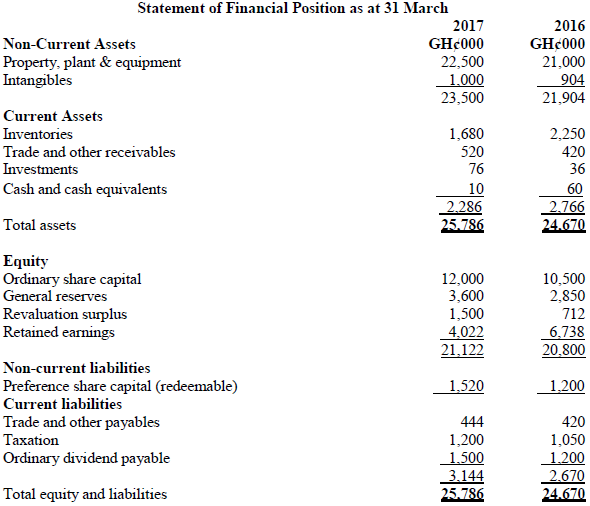

Fadama Ltd is a listed manufacturing company that plans to increase its production capacity. Below are the most recent financial statements of the company.

You have been provided with the following additional information in relation to Fadama Ltdʼs trading performance for the years ended on the stated dates:

Required:

Write a report to the Chief Executive Officer of Fadama Ltd, concisely analysing the profitability and working capital management of the firm. Your report should be supported with appropriate ratios. (15 marks)

View Solution

REPORT

To : Chief Executive Officer

From : Consultant

Date : 31/03/2017

Subject : Profitability and Working capital management of Fadama Ltd for the year ending March 2017.

As requested, I have analyzed the profitability and working capital management of Fadama Ltd. My analysis is based on the Statement of financial Position, and the additional information given. A number of key measures have been calculated and these are set out in the attached Appendix.

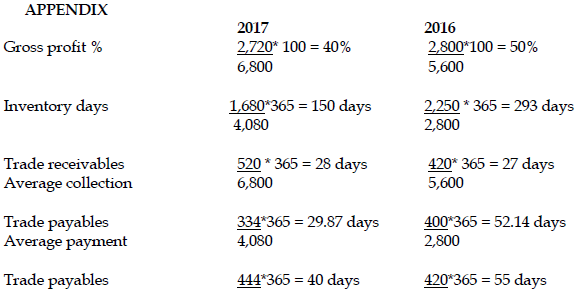

Profitability

Sales have increased by 21% and cost of sales has risen by 46%, resulting in a fall of 3% in the gross profit. This could be explained by a strategy of lowering sales prices to boost volumes. If so, it did not succeed, either in terms of gross profit amount, or gross margin. However, operating costs have increased by just GH¢44,000 or 6% – much less than the percentage increase in revenue. As a result, the ratio of expenses as a percentage of revenue has fallen from 12.75% to 11.1%.

Working capital management

- Cash, including the short term investments, has reduced by GH¢10,000, a fall of 10%. However this is not material in the context of the large sums invested in non-current assets and paid out as dividends. Operating cash flow is healthy.

- A big improvement is evident in the inventory day’s ratio from 2016 to 2017. However it would seem reasonable to expect further improvement, as 6 months is rather a long time to be carrying inventory. Efficient production services must be introduced with effective marketing, selling and distribution of products.

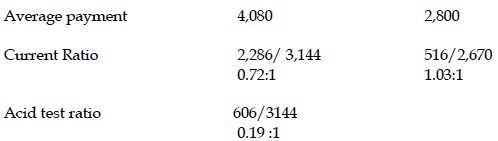

- Trade receivables and payables are reasonable consistent, with a significant improvement noteworthy in the case of the payables days.

- Current ratios seem rather weak, however a cessation of dividends would be a simple way to boost cash flow should an emergency present.

Conclusion

Fadama Ltd’s profit margins can be improved by deliberately reducing the operating expenses for the year, intensive sales and marketing strategies to boost sales revenue. There are no apparent short-term liquidity problems but Fadama Ltd should find solution to reducing inventory days as this will reduce cost of holding inventory. The firm should also consider cessation of payment of dividends to improve liquidity.