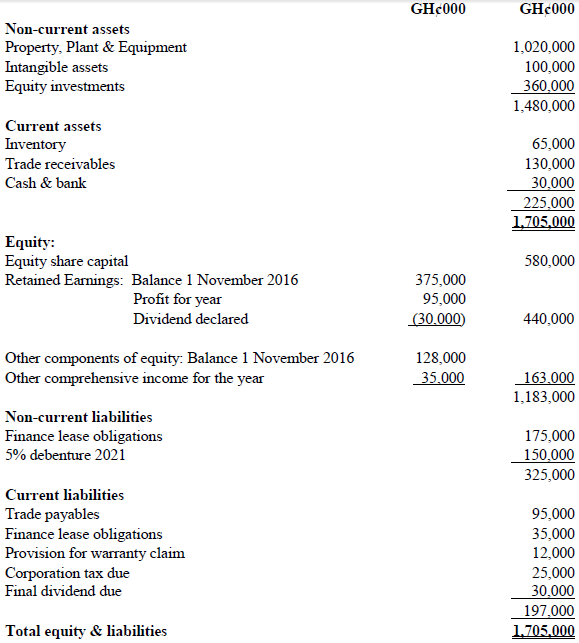

Okushe Ltd, a listed textile manufacturing company prepared this draft statement of financial position as at 31 October 2017. On subsequent examination of the books and records, the Finance Director prepared a list of issues which she believes may require amendments to the draft statement presented.

Okushe Ltd

Statement of Financial Position as at 31 October, 2017

The following notes are relevant:

i) Property, Plant and Equipment are carried after charging depreciation for the year. On 31 October 2017, a piece of property, carried at GH¢130 million, was revalued to GH¢110 million. This revaluation has not been accounted for. The revaluation reserve (included with other components of equity) had a balance of GH¢12 million due to previous revaluations of this property.

A sale agreement was entered into during October 2017 to sell some of the plant. The plant sold had a carrying value of GH¢45 million at the date of sale, it was sold for an agreed price of GH¢39 million. No cash has yet been received in respect of this sale, as a 30 day credit period was agreed with the purchaser. No entry has been made to record this transaction.

ii) The equity investments had a fair value of GH¢380 million at 31 October 2017, which has not yet been incorporated into the financial statements. Okushe has taken a decision to take all fair value gains and losses on equity investments to “other comprehensive income” as permitted by IFRS 9 – Financial Instruments.

iii) The 5% debenture was issued on 1 November 2016 for cash proceeds of GH¢150 million, and was correctly recorded. The redemption terms of this debenture are such that the effective rate of interest to maturity was 6.5%. The only other entry made in respect of the debenture was the payment of GH¢7.5 million interest on the due date 31 October 2017.

iv) Okushe Ltd offers a 12-month warranty on all goods sold to retail customers. A provision is maintained for the expected cost of honouring this warranty. This has not been updated as at 31 October 2017. Okushe sold 40,000 units of its relevant product during the year, all of which qualify for warranty. It expects that 10% of these would need minor repairs at an average cost of GH¢500 each, and 3% would need major repairs at a cost of GH¢10,000 each. All costs are expected to be incurred within 12 months.

(Ignore the taxation effects of any adjustments you make)

Required:

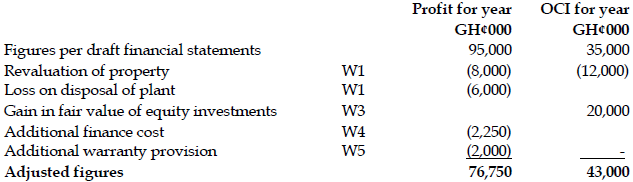

a) Prepare a schedule showing any corrections required to the profit and other comprehensive income for the year.

View Solution

Schedule of changes to profit and OCI for the year

(8 marks evenly spread using ticks)

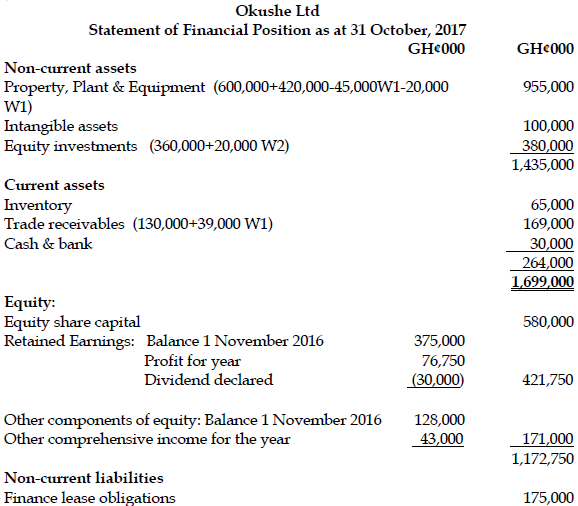

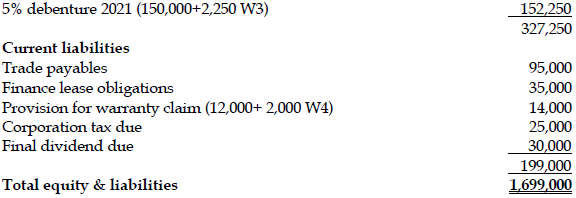

b) Redraft the Statement of Financial Position at 31 October 2017 taking the above into account.

View Solution

(12 marks evenly spread using Ticks)

Workings for a & b

W1 – Property, Plant & Equipment

This piece of property should be revalued downwards by GH¢20 million (130-110). A downward revaluation in an IAS 16 (Property Plant & Equipment) asset should be charged to the revaluation reserve (and OCI) to the extent that a balance exists in that reserve relating to the same asset. Here, this amount is GH¢12 million. Any further revaluation loss should be charged to profit or loss. The extra GH¢8 million of loss should be so charged.

The Plant & Equipment transaction should be recorded as a sale as the agreement has been made, and all significant economic risks and rewards associated with the plant have been transferred to the new owner. Hence a loss on disposal of GH¢6 million (39-45) will be recorded in profit or loss. GH¢45 million will be derecognized from PPE, and a receivable of GH¢39 million recorded in current assets.

W2 – Equity Investments

Under IFRS 9, equity investments should be classified as “Fair Value” financial instruments, and remeasured to fair value at each reporting date. Any resulting gains or losses are taken to profit or loss unless the entity makes an irrevocable election to take them to OCI. The decision has been made by Okushe, hence the gain in value of GH¢20 million (380 – 360) should be taken to OCI as well as being reflected in the carrying value of the equity investments.

W3 – Debenture

Under IFRS 9 the amortised cost method is appropriate for this liability as there is no evidence to suggest the company is treating the liability as a trading instrument. Hence the annual finance charge should reflect the effective rate to maturity rather than the coupon rate. The correct finance cost should therefore be GH¢150m *6.5% = GH¢9.75 million instead of the recorded GH¢7.5 million. The additional GH¢2.25 million (9.75 – 7.5) should be charged as a finance cost to profit or loss and accrued as an additional non-current liability.

W4 – Warranty provision

The current liability for warranty provision needs to be updated at each reporting date to reflect best estimates available at that date. At 31 October 2017 best estimates suggest a provision of GH¢14 million is required, calculated as follows:

GH¢

Minor repairs: (4,000 * GH¢500) = 2 million

Major repairs: (1,200 * GH¢10,000) = 12 million

14 million

As the existing provision is recorded at GH¢12 million, an additional charge of GH¢2 million must be made to bring the provision up to the required GH¢14 million. This should be charged to profit or loss, and added to the existing provision.