Spacefon Ltd (Spacefon) in its quest to gain dominance in the telecommunication industry, bought an 80% holding in the equity of Buzz and 40% of the equity shares of Kasapa Ltd (Kasapa) on 1 July 2017. The purchase price of the investment of Buzz Ltd (Buzz) was agreed at GH¢4,400 million, of which GH¢1,600 million was paid in cash. The remaining balance was paid by issuing 800 million equity shares each of GH¢1 nominal value to the seller at their then fair value of GH¢3.50 each. The 20% non-controlling interest in Buzz had a fair value of GH¢900 million at that date. Buzz’s net assets had a fair value of GH¢4,700 million on 1 July 2017. Spacefon applies the fair value method to calculate goodwill on acquisition.

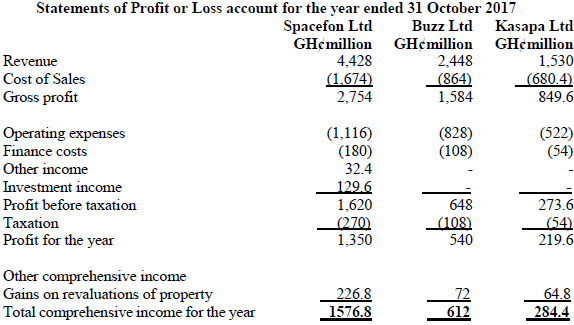

The following statements of comprehensive income relate to Spacefon and its investee companies, Buzz and Kasapa.

The following additional information is provided:

i) Included in the fair value of Buzz’s net assets on the acquisition date was some machinery owned by Buzz but carried at GH¢90 million below its fair value. The revised fair value was not incorporated into the books of Buzz as Buzz has not adopted a policy of revaluing machinery assets. The useful economic life of this machinery at the acquisition date was estimated to be six years.

ii) During the post-acquisition period, Buzz sold goods to Spacefon for GH¢50 million. These goods were sold by Buzz at a profit of 30 pesewas per every GH¢1 on sales price and 40% of the goods remained in the inventory of Spacefon at 31 October 2017.

iii) Since acquiring its investment in Buzz, Spacefon has managed the administration of the entire group. Spacefon invoiced Buzz GH¢4 million for its share of these costs. Spacefon recorded this transaction within “other income”, and Buzz within “operating expenses”.

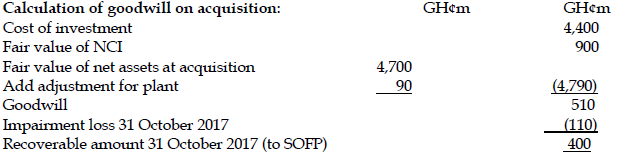

iv) The goodwill of Buzz was reviewed for impairment at 31 October 2017 and was found to have a recoverable amount of GH¢400 million. There was no impairment of the investment in Kasapa.

v) On 1 October 2017, Spacefon sold some land to Kasapa for GH¢12 million, recording a profit of GH¢8 million. This profit is included within “other income” in the books of Spacefon.

(Note: All calculations may be taken to the nearest GH¢0.01 million and assume all expenses and gains accrue evenly throughout the year unless otherwise instructed.)

Required:

a) Calculate the goodwill arising on the acquisition of Buzz by Spacefon, and the goodwill amount that should appear in the consolidated Statement of Financial Position of Spacefon as at 31 October 2017. (3 marks)

View Solution

Note;

The recoverable amount of goodwill is given as GH¢400m. Hence goodwill must be reported at that amount. The difference between goodwill at acquisition (GH¢m510) and its recoverable amount (GH¢400m) is impairment loss GH¢110m).

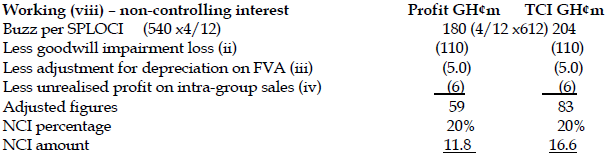

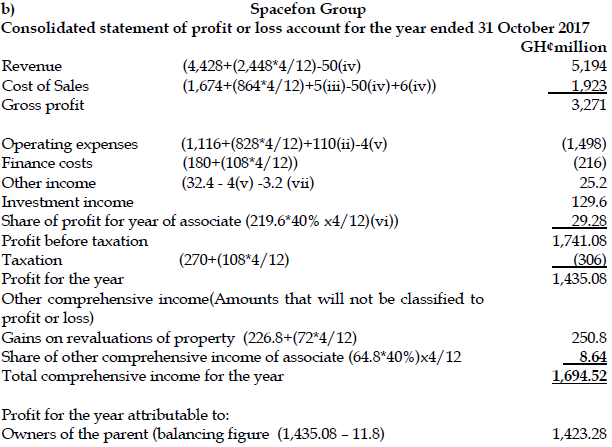

b) Prepare a Consolidated Statement of Profit or Loss account for Spacefon Group for year ended 31 October 2017 in accordance with IFRS. (17 marks)

View Solution

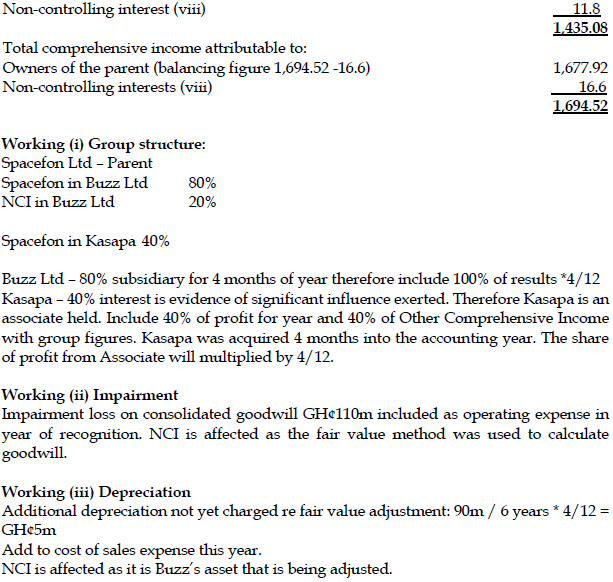

Working (iv) Provision for Unrealised Profit

Eliminate intra-group sales and purchases (GH¢25m) in full from group revenue and group cost of sales.

Unrealised profit provision required = 50m * 30/100 * 2/5 = GH¢6m

[Dr Cost of sales, Cr Inventory in SOFP]

NCI is affected as Buzz was the internal selling company that recorded the gain.

Working (v) Intragroup income and expenses

Eliminate intragroup income and expenses GH¢4m from other income and operating expenses.

Working (vi)

Share of associate’s profit for year 219.6 * 4/12 * 40% = GH¢29.28m

Share of associate’s OCI 64.8 * 4/12* 40% = GH¢8.64 m

Working (vii) Sale of Land

This is a transaction between parent and associate. We should eliminate 40% of the profit earned on the transaction.

GH¢8m * 40% = GH¢3.2m. This should be eliminated from the “other income” heading (though it would be acceptable to show it as a deduction from “Share of results from associate”). It should NOT be time apportioned.