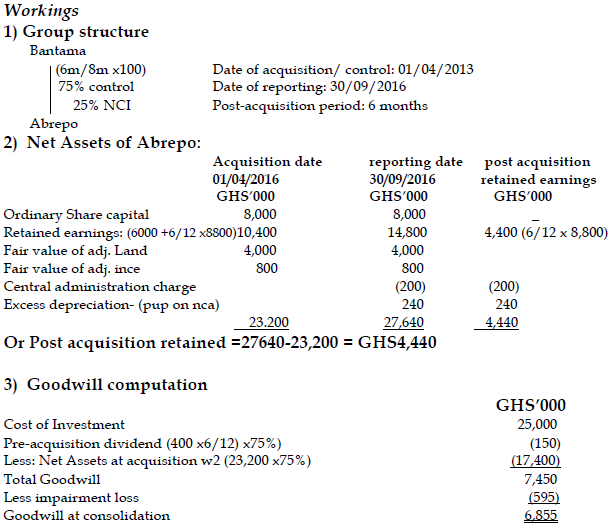

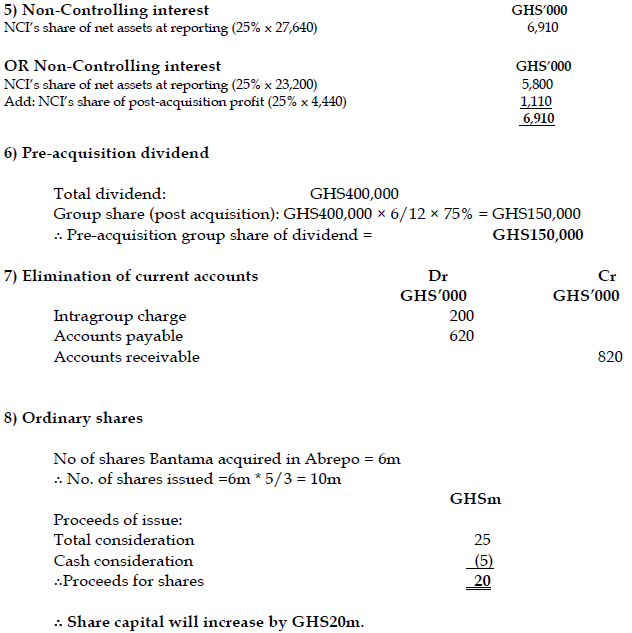

a) Bantama Ltd acquired six million of Abrepo Ltd’s ordinary shares on 1 April 2016 for an agreed consideration of GH¢25 million. The consideration was settled by a share exchange of five new shares in Bantama Ltd for every three shares acquired in Abrepo Ltd, and a cash payment of GH¢5 million. The cash transaction has been recorded, but the share exchange has not been recorded.

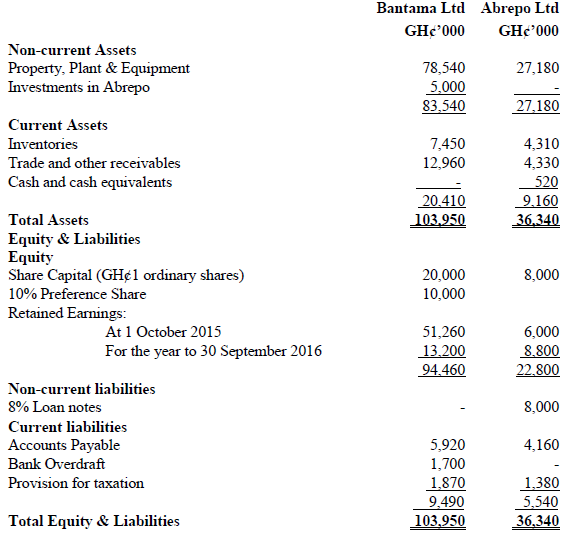

The draft statements of financial position of the two companies as at 30 September 2016 are:

Additional information

i) The fair value of Abrepo Ltd’s land at the date of acquisition was GH¢4 million in excess of its carrying value. Abrepo Ltd’s financial statements contain a note of a contingent asset for an insurance claim of GH¢800,000 relating to some inventory that was damaged by a flood on 5 March 2016. The insurance company is disputing the claim. Bantama Ltd has taken legal advice on the claim and believes that it is highly likely that the insurance company will settle it in full in the near future.

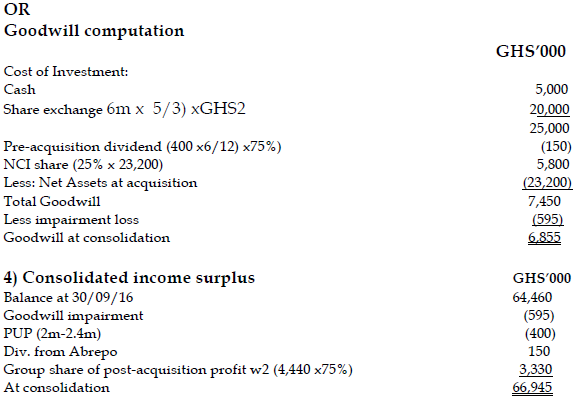

ii) At the date of acquisition Bantama Ltd sold an item of plant that had cost GH¢2 million to Abrepo Ltd for GH¢2.4 million. Bantama Ltd has charged depreciation of GH¢240,000 on this plant since it was acquired.

iii) Bantama Ltd’s current account debit balance of GH¢820,000 with Abrepo Ltd does not agree with the corresponding balance in Abrepo Ltd’s books. Investigations revealed that on 26 September 2016, Bantama Ltd charged Abrepo Ltd GH¢200,000 for its share of central administration costs. Abrepo Ltd has not yet recorded this invoice. Intercompany current accounts are included in accounts receivable or payable as appropriate.

iv) Abrepo Ltd paid a dividend of GH¢400,000 on 30 September 2016. The profit and dividend of Abrepo Ltd are deemed to accrue evenly throughout the year. Abrepo Ltd’s retained earnings of GH¢8.8 million for the year to 30 September 2016 as shown in its statement of financial position is after the deduction of the dividend. Bantama Ltd’s policy is to credit to income only those dividends received from post-acquisition profits. Bantama Ltd has not yet accounted for the dividend from Abrepo Ltd. The cheque has been received but not banked.

v) At the year-end an impairment review was carried out on the consolidated goodwill arising on the acquisition of Abrepo Ltd, and an impairment loss of GH¢595,000 was identified. No adjustment has yet been made for this. It is group policy to value non-controlling interest at acquisition at its proportionate share of the fair value of the subsidiary’s identifiable net assets.

Required:

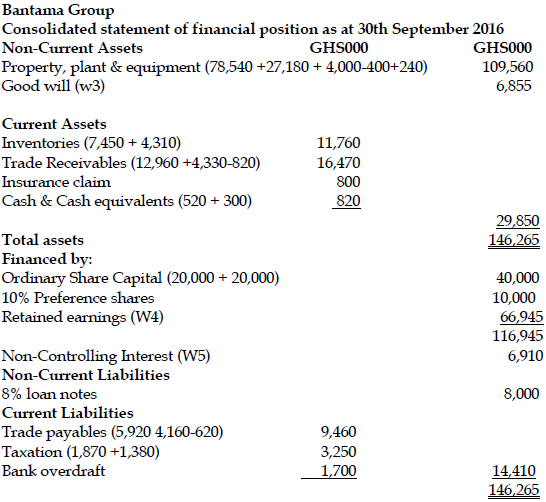

Prepare the consolidated statement of financial position of Bantama Ltd group as at 30 September 2016. (17 marks)

View Solution

b) IFRS 10 Consolidated Financial Statements outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls.

Required:

Explain and justify how IFRS 10 Consolidated Financial Statements determines elements of control of an investor over investee.

(3 marks)

View Solution

An investor controls an investee if and only if the investor has all of the following elements:

- power over the investee, i.e. the investor has existing rights that give it the ability to direct the relevant activities (the activities that significantly affect the investee’s returns)

- exposure, or rights, to variable returns from its involvement with the investee.

- the ability to use its power over the investee to affect the amount of the investor’s returns.