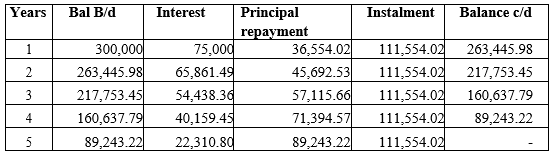

Dinpa Supermarket is considering acquiring a loan of GH₵300,000 from Abrempong Bank Ltd. The loan is payable in five equal annual instalments at an interest rate of 25%. Dinpa Ltd has consulted you to determine their annual repayment amount and the interest thereon.

Required:

i. Prepare a repayment schedule for Dinpa indicating clearly the interest payment and the principal repayment. (8 marks)

View Solution

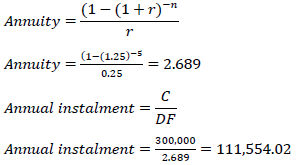

Loan Amount (C) 300,000

Interest rate (r) 25%

No. of years (n) 5

Annuity (DF) 2.68928 or 2.689

Annual Instalment 111,554.02

ii. State THREE (3) advantages of a term loan over an overdraft facility. (3 marks)

View Solution

- Interest charged is not predictable, as it depends on a variable interest rate and on the amount overdrawn on each day of the charging period.

- The lender may not grant the entire amount requested, as changing financial situation of the business will be taken into consideration.

- Overdrafts are repayable on demand, which may occur at a time when management are not ready.

- Company may be forced to convert a hardcore overdraft into a loan term which can affect capital structure especially where the preference for overdraft was for managing the capital structure.

- Management will need to spend time strictly monitoring their accounts to ensure they operate within the overdraft limit.

- Time will need to be spent preparing management accounts and monitoring compliance with covenants