Your firm is the external auditor of The Ceramicz Company, and you recently attended the year-end inventory count at the company’s warehouse. The company manufactures high quality tableware (plates, cups and saucers etc.) and it maintains an integrated computerised system that shows the inventory held at any point in time.

At the year-end inventory count, reports showing the various categories of inventories (but not the quantities) are printed off the system and the quantities of inventories actually counted are inserted annually by the counters. Later the quantities are compared with those per the computer system.

The count instructions were received by both you and the counters the day before the count was due to take place. The instructions consisted of the following five points:

1. Counters must arrive at 8 am on the morning of the count.

2. They will work in teams of two people.

3. Each team will be assigned a specific area of the warehouse to count. They will receive inventory sheets listing the products to be found in their area.

4. The inventory sheets are pre-numbered.

5. Once the counters have finished the inventory count, the inventory sheets must be handed to the warehouse manager.

Your notes from the attendance at the count include the following observations:

Many areas in which the count took place were untidy and inventory was sometimes difficult to find because it was not in the allocated area. The same categories of inventories were sometimes found in several different areas and some inventory was incorrectly labelled. The count was conducted in a hurry in order to close the warehouse before a public holiday and there were insufficient counters to conduct the count properly in the time available. The issue and receipt of inventory sheets (on which the quantities were recorded by counters) was not properly controlled. It was difficult to reconcile the inventory quantities recorded at the count to the computerised records and some significant differences remain outstanding. Although no finished goods were dispatched during the inventory count, a large delivery of raw materials was received into the warehouse.

Required:

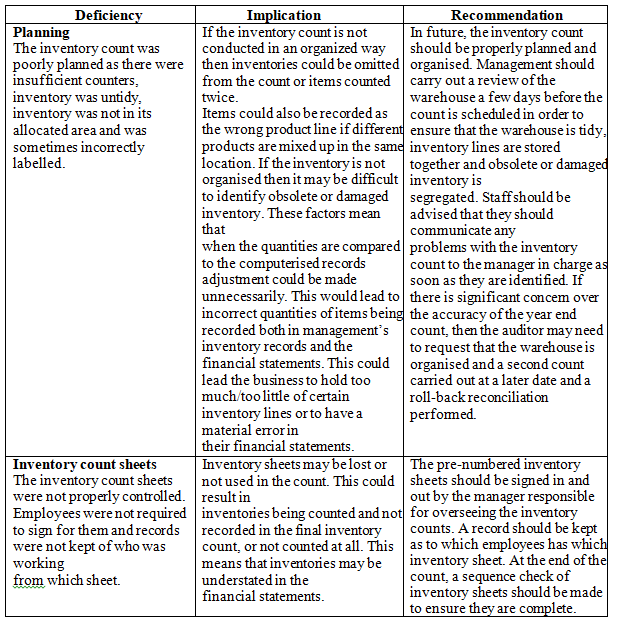

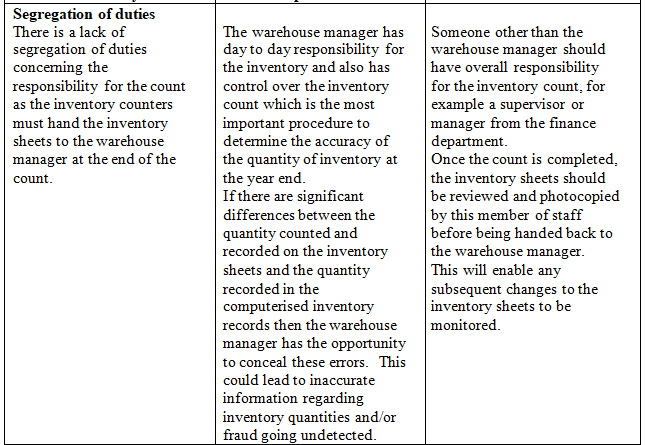

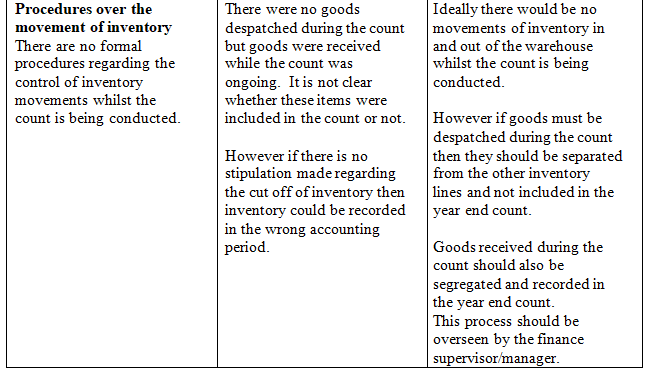

a) For the inventory count conducted by the Ceramicz Company:

i. Identify and explain FOUR (4) deficiencies in the count.

ii. Explain the possible implication of each deficiency and

iii. Provide a recommendation to address each deficiency.

(12 marks)

View Solution

b) Describe the audit procedures that auditor should perform at the year end to confirm each of the following:

(i) The existence of inventory (2 marks)

View Solution

Observe the inventory count in order to determine whether the inventory exists. Enquire of management whether any inventory is held for third parties.

Obtain a copy of the completed inventory sheets. Select a sample of items and physically verify that the products listed on the inventory sheets are in the warehouse.

For the raw materials delivered on the day of the count, discuss with management whether these goods relate to the year being audited, or whether they are to be included in the post year end period. Trace these items through to the final inventory figures to ensure they have been recorded in the correct accounting period.

(ii) The completeness of inventory (3 marks)

View Solution

For a sample of product lines in the warehouse, verify that they have been included on the inventory sheets and that the quantity is accurately recorded.

Perform a sequence check of all inventory sheets to ensure that they have all been resumed to the warehouse manager at the end of the inventory count, so that all product lines are included in the year-end inventory quantity.

Enquire of management whether there are any items of inventory held off site which have not been included in the inventory sheets.

(iii) The valuation of inventory. (3 marks)

View Solution

For a sample of finished goods sold post year end, compare the sales price to the current price list or catalogue in order to check items are being sold at a price which is greater than the item’s cost.

For a sample of items classified as work in progress at the year end, ask management how they have determined the percentage completion at the year end. Recalculate the costs incurred to date. Compare this to the future selling price of the completed item less the costs to complete in order to determine the net realisable value of the item. Trace through the final valuation of the item to the financial statements.

Review the inventory movement records to identify any particularly slow moving inventory lines. Discuss the saleability of these items with management and enquire whether any provision has been made in order to write the item down to its net realisable value (also check whether damaged inventory identified by Cermaicz Company during the count has been written down to its net realisable value).