Gbewaa Ghana Ltd has issued 10 million shares with a market value of GH¢5 per share. The equity beta of the company is 1.2. The current yield of short-term government debt is 14% per annum, and the equity risk premium is approximately 5% per annum. The debt finance of Gbewaa Ghana Ltd consists of bonds with a book value of GH¢10,000,000. These bonds pay interest at 18% per annum, and the par value and market value of each bond is GH¢100. The company’s tax rate is 25%.

Required:

Calculate Gbewaa Ghana Ltd’s Weighted Average Cost of Capital. (9 marks)

View Solution

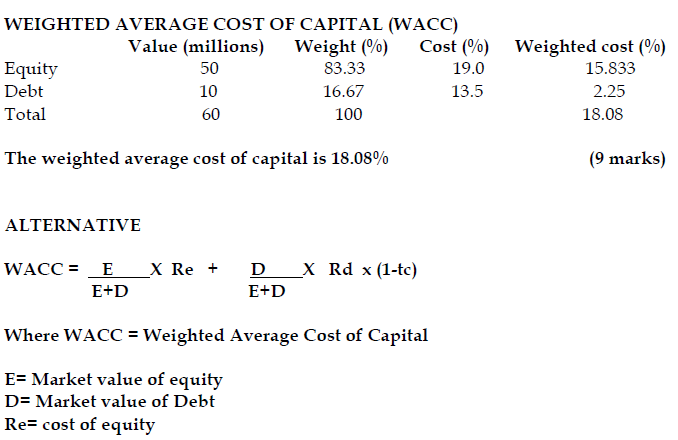

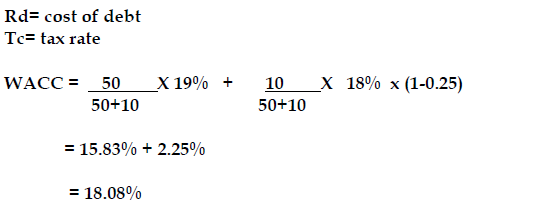

Cost of Equity =14% + 5% = 19%. (Risk free + equity risk premium)

The company’s bonds are trading at par and before tax cost of debt is the same as the interest rate on the bonds which is 18%

After tax cost of debt = 18% x (1- 0.25) = 13.5%

Market value of equity = 10 million x 5 = 50 million

Market value of debt is equal to its par value of 10 million