Santo has three product lines: P1, P2 and P3. Since its inception, the company has been using a single direct labour cost percentage to assign overhead costs to products.

Despite P3 being a relatively new product line, it is attracting additional business. However, increasing overhead costs has resulted in loss-making in recent times. P2 particularly has been a significant product line since its inception. However, it has lost a considerable market share due to an increase in overhead cost in recent times and consequent increase in price per unit. Management is, therefore, convinced that the costing system needs some review.

A team led by the management accountant was put together to develop an improved system of costing based on activities. The team spent several weeks collecting data for the different activities and products.

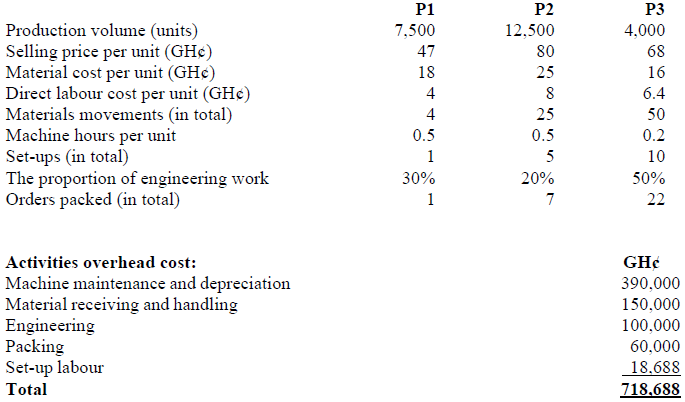

Below is data on Santo’s three product lines and overhead costs for the current accounting period:

Required:

Identify for each overhead activity, an appropriate cost driver from the information supplied, and then calculate the product unit costs using a system that assigns overheads based on the use of activities. (10 marks)

View Solution

ABC workings:

1. Receiving and handling materials cost

Total cost = GH¢150,000

Cost driver = Number of materials movements

Number of materials movements = 4 + 25 + 50 = 79 movements Cost per material movement = GH¢150,000/79 = GH¢1,898.73.

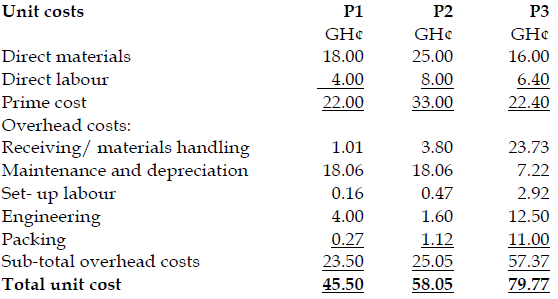

Cost per unit of P1 = (GH¢1,898.73 × 4)/7,500 = GH¢1.01 per product unit

Cost per unit of P2 = (GH¢1,898.73 × 25)/12,500 = GH¢3.80 per product unit

Cost per unit of P3 = (GH¢1,898.73 × 50)/4,000 = GH¢23.73 per product unit.

2. Maintenance and depreciation cost

Total cost = GH¢390,000

Cost driver = Number of machine hours

Number of machine hours = (0.5 × 7,500) + (0.5 × 12,500) + (0.2 × 4.000) = 10,800

Cost per machine hour = GH¢390,000/10,800 = GH¢36.11 per machine hour.

Cost per unit of P1 = GH¢36.11 × 0.5 = GH¢18.06 per product unit.

Cost per unit of P2 = GH¢36.11 × 0.5 = GH¢18.06 per product unit.

Cost per unit of P3 = GH¢36.11 × 0.2 = GH¢7.22 per product unit.

3. Set-up labour cost

Total cost = GH¢18,688

Cost driver = Number of set- ups

Number of set-ups 1 + 5 + 10 = 16

Cost per set-up = GH¢18,688/16= GH¢1,168 per set-up

Cost per unit of P1 = (GH¢1,168 × 1)/7,500 = GH¢0.16 per product unit

Cost per unit of P2 = (GH¢1,168 × 5)/12,500 = GH¢0.47 per product unit

Cost per unit of P3 = (GH¢ 1,168 × 10)/4,000 = GH¢2.92 per product unit.

4. Engineering cost

Total cost =GH¢100,000

Cost driver: Based on the proportion of engineering work.

Cost per unit of P1 = (GH¢100,000 × 30%)/7,500 =GH¢4.00 per product unit Cost per unit of P2 = (GH¢100,000 × 20%)/12,500 =GH¢1.60 per product unit Cost per unit of P3 = (GH¢100,000 × 50%)/4,000 =GH¢12.50 per product unit.

5. Packing cost

Total cost =GH¢60,000

Cost driver = Number of orders packed

Number of orders packed = 1 + 7 + 22 = 30

Cost per order =GH¢60,000/30 =GH¢2,000

Cost per unit of P1 = (GH¢2,000 × 1)/7,500 =GH¢0.27 per product unit

Cost per unit of P2 = (GH¢2,000 × 7)/12,500 =GH¢1.12 per product unit

Cost per unit of P3 = (GH¢2,000 × 22)/4,000 =GH¢11.00 per product unit