In accordance with IFRS 5: Non-current Assets Held for Sale and Discontinued Operations, an entity shall classify a non-current asset (or disposal group) as held for sale if its carrying amount will be recovered principally through a sale transaction rather than through continuing use.

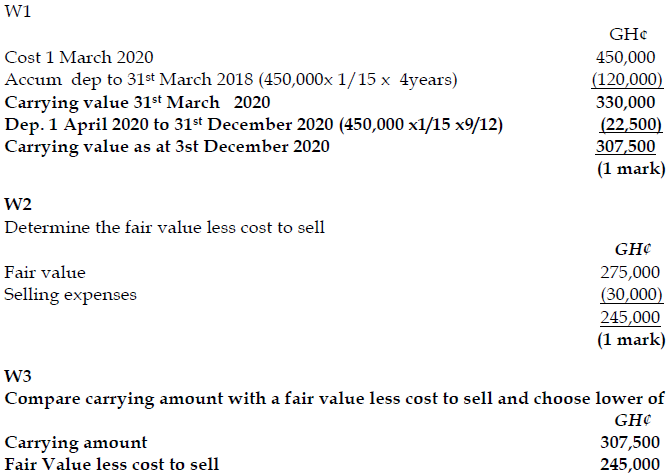

On 1 April 2016, Gologo Ltd purchased an equipment at a cost of GH¢450,000. It is being depreciated on a straight line basis over its useful economic life of 15 years. The reporting date of Gologo Ltd is 31 March. At 31 December 2020, the equipment was no longer needed by the entity. It was decided that the asset should be sold, and a buyer was being sought. The asset is advertised for sale at a price of GH¢275,000, which was a reasonable reflection of its fair value. It is anticipated that a transportation cost of GH¢30,000 will be incurred to deliver the item to the buyer. The sale is expected to occur within one year.

Required:

i) Explain the ‘disposal group concept’ under IFRS 5. (2 marks)

View Solution

A group of assets to be disposed of, by sale or otherwise, together as a group in a single transaction, and liabilities directly associated with those assets that will be transferred in the transaction. The group includes goodwill acquired in a business combination if the group is a cash-generating unit to which goodwill has been allocated in accordance with IAS 36 Impairment of Assets or if it is an operation within such a cash-generating unit.

ii) Demonstrate how to account for the above transaction on 31 March 2021 in accordance with IFRS 5. (4 marks)

View Solution

Since the Fair value is lower, the asset should be measured at GH¢245,000 (W3) in the statement of financial position. (1 mark)

Since the Fair value is lower, the asset should be measured at GH¢245,000. Need for impairment loss of (GH¢307,500-245,000) = GH¢62,500

Dr Cost of sales 62,500

Cr NCA held for sale 62,500

(1 mark)