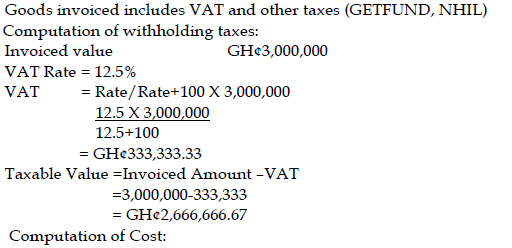

The following unstructured invoice has been forwarded to Adamu Ltd from Asigra Ltd, a standard rated supplier:

Goods invoiced (VAT inclusive) GH¢3,000,000

The above transactions relate to payment for goods in January 2019.

Required:

i) Compute the withholding tax payable by Adamu Ltd. (2 marks)

View Solution

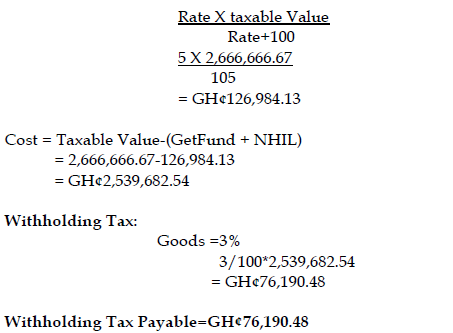

ii) Compute the penalty payable, assuming Adamu Ltd filed the withholding tax return 12 days after the due date? (3 marks)

View Solution

Penalty for filing 12 days late

GH¢500+ (GH¢10x12days)

=GH¢620