Sabir Company is considering whether to invest in a project whose details are as follows.

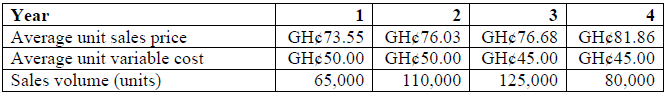

The project will involve the purchase of equipment costing GH¢2,000,000. The equipment will be used to produce a range of products for which the following estimates have been made.

Incremental fixed costs are GH¢1,200,000 per annum. The sales prices allow for expected price increases over the period. However, cost estimates are based on current costs, and do not allow for expected inflation in costs. Inflation is expected to be 3% per year for variable costs and 4% per year for fixed costs. The incremental fixed costs are all cash expenditure items. Tax on profits is at the rate of 30%, and tax is payable in the same year in which the liability arises.

Sabir Company uses a four-year project appraisal period, but it is expected that the equipment will continue to be operational and in use for several years after the end of the first four-year period.

The company’s cost of capital for investment appraisal purposes is 10%. Capital projects are expected to pay back within two years on a non-discounted basis and within three years on a discounted basis. Tax allowable depreciation will be available on the equipment at the rate of 25% per year on a reducing balance basis. Any balancing allowance or balancing charge is not attributed to a project unless the asset is actually disposed of at the end of the project period.

Required:

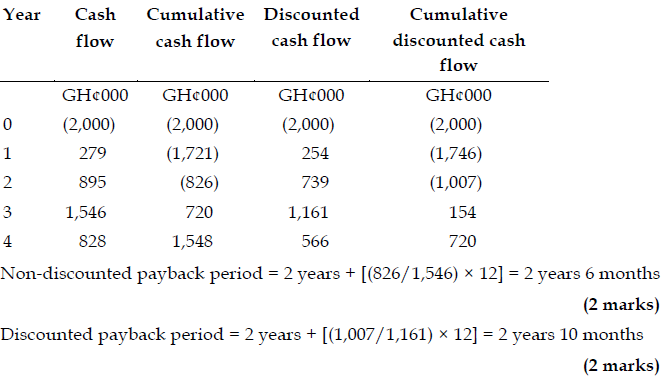

To the nearest month, calculate the non-discounted payback period and the discounted payback period (4 marks)

View Solution