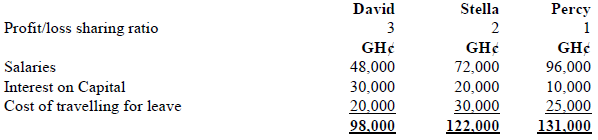

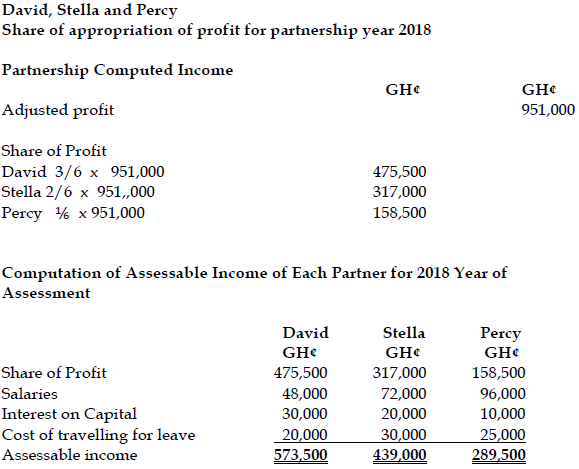

During the year ended 31 December, 2018 the partnership of David, Stella and Percy reported an adjusted profit of GH¢951,000 before charging partners salaries, interest on capital and cost of travelling for leave.

Required:

Compute the assessable income for each partner. (7 marks)

View Solution

(In accordance with section 52(7) of the Income Tax Act (Act 896), benefits paid to partners are added back)

(7 marks evenly spread using ticks)