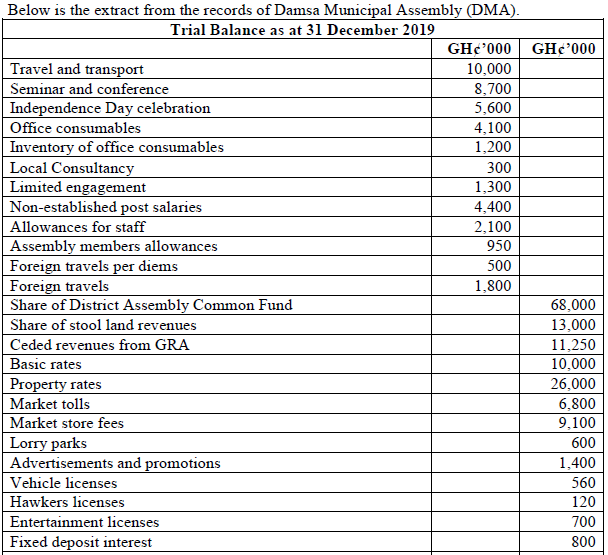

Additional Information:

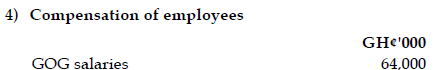

i) The central government has a constitutional responsibility to pay all established post salaries of the Assembly from the Consolidated Fund. The established post salaries paid by the central government on behalf of the assembly for 2019 amounted to GH¢64,000,000. This payment has not reflected in the books of DMA.

ii) Office consumables in respect of stationery and other items bought for GH¢ 1,800,000 remained unused during the year. The current replacement cost of the inventories is GH¢1,050,000. Meanwhile, the net realisable value of the inventories is estimated at GH¢1,400,000. No market exists for unused office consumables and other items.

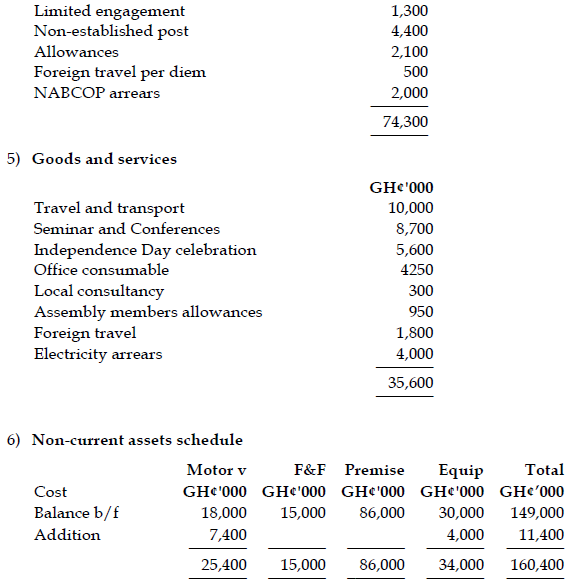

iii) Consumption of fixed capital is to be charged as follows:

Assets Estimated useful life

Motor vehicles 5 years

Furniture and fittings 5 years

Premises 10 years

Equipment 8 years

iv) During the year, the following assets were acquired and outright payments made for them: Motor Vehicle GH¢7,000,000; Equipment GH¢ 4,000,000. These have been accounted for.

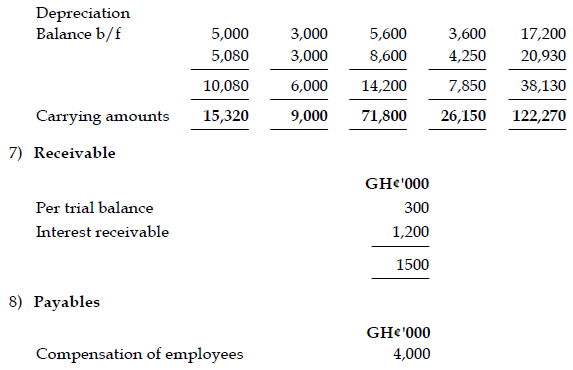

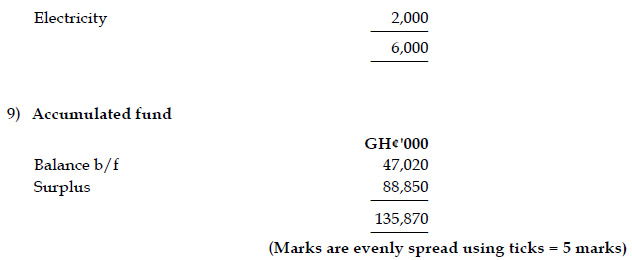

v) DMA could not pay the electricity bill for the last quarter of 2019. This was brought to its attention by the Electricity Company Ltd. of Ghana. The amount involved is GH¢4,000,000.

vi) The government has assigned some young graduates to DMA as part of the Nation Builders Corp programme to support the Assembly in revenue mobilisation. The allowances amounting to GH¢2,000,000 due them from DMA for the last month of the year was outstanding. DMA promises to pay them by the end of the first quarter of 2020.

vii) Fixed deposit attracts interest of 20% per annum and some interest is due as at 31 December 2019.

viii) The market store fees received was for two years: 2019-2020.

ix) During the year, the chiefs and people of the Assembly donated a new vehicle valued at GH¢400,000 to the DMA. No record was made in the books.

x) Extract of the 2019 Budget of the DMA is as follows:

. GH¢’000

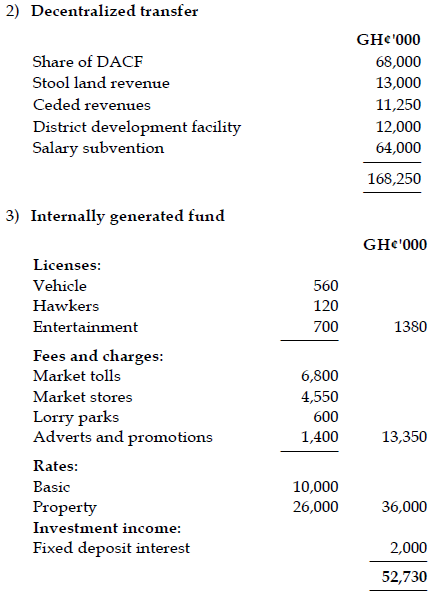

Decentralised transfer 185,000

Compensation of employees 74,300

Goods and Services 35,600

Other expenses 1,700

Internally Generated Funds 102,000

Donations and grants 1,000

Required:

Prepare in accordance with the IPSAS and the Public Financial Management Act, 2016 (Act 921):

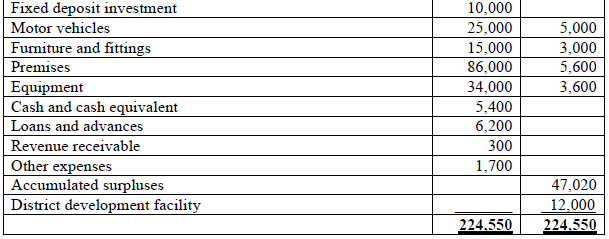

a) Statement of Financial Performance for the year ended 31 December 2019. (5 marks)

View Solution

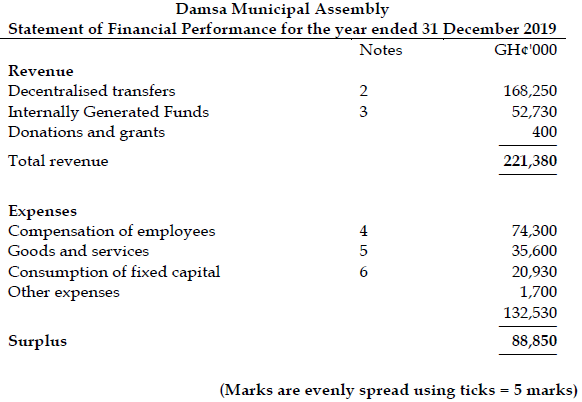

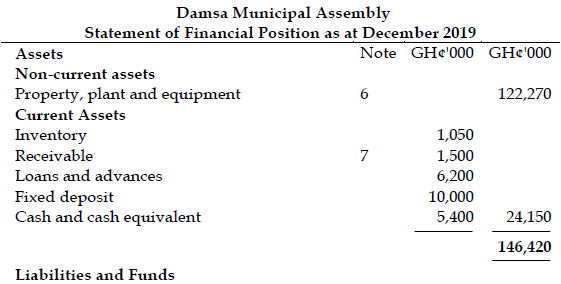

b) Statement of Financial Position as at 31 December 2019. (5 marks)

View Solution

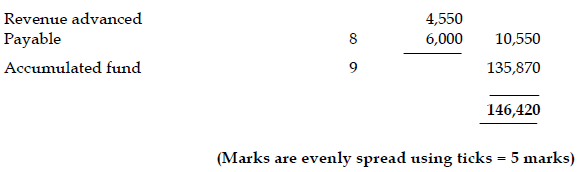

c) Statement of Budget Information in Comparison with Actuals for the year ended 31 December 2019. (5 marks)

View Solution

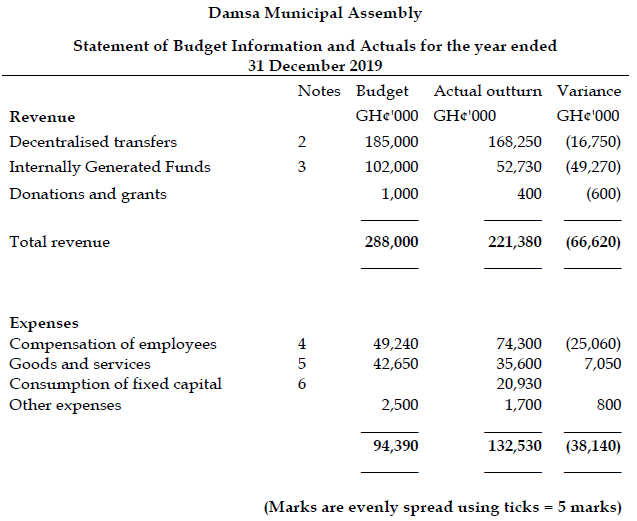

d) Notes to the financial statements. (5 marks)

View Solution

1) Accounting policies

Relevant accounting policies applied to the preparation of the financial statements include the following

- Basis of accounting. The financial statements have been prepared on accrual basis where transactions and events are recognised as and when they occur.

- Cost measurement. Assets are measured on historical cost basis except for motor vehicle donated to the assembly which was measured and recognized at fair value.

- Consumption of fixed assets. Consumption of fixed assets are charges using the straight-line basis. The estimated useful life of the assets are as follows:

. Assets Estimated useful life

Motor vehicle 5 years

Furniture and fittings 5 years

Premises 10 years

Equipment 8 years - Valuation of inventory. Inventory of office consumable was valued at lower of cost and current replacement cost in compliance with IPSAS 12: inventory

- Compliance with IPSAS and PFM Act. The financial statements have been prepared in conformity with the IPSAS and the Public Financial Management Act 2016.