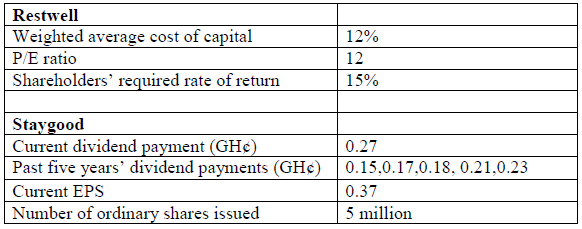

Restwell Ltd (Restwell), a hotel and leisure company is currently considering taking over a smaller private limited liability company, Staygood Ltd (Staygood). The board of Restwell is in the process of making a bid for Staygood but first needs to place a value on the company. Restwell has gathered the following data:

The required rate of return of the shareholders of Staygood is 20% higher than that of Restwell due to the higher level of risk associated with Staygood. Restwell estimates that cash flows at the end of the first year will be GH¢2.5 million and these will grow at an annual rate of 5%. Restwell also expects to raise GH¢5 million in two years’ time by selling off hotels of Staygood that are surplus to its needs.

Required:

Estimate values for Staygood using the following valuation methods:

i) Price/earnings ratio valuation. (6 marks)

View Solution

Calculation of the value of Staygood using P/E ratios:

Staygood’s share price = 12 x 37p = GH¢4.44 (3 marks)

Note:

Any candidate who uses an adjusted P/E ratio in a 30% range should be given full credit.

We will assume that the market will expect Restwell to achieve a level of return on Staygood comparable to that which it makes on its own assets. Hence:

Total market value = 5m x GH¢4.44 = GH¢22.2m (3 marks)

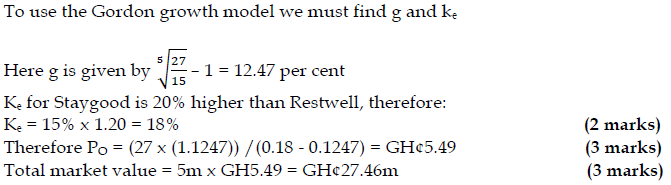

ii) Gordon growth model. (8 marks)

View Solution

iii) Discounted cash flow valuation. (6 marks)

View Solution

Using future cash flows and discounting these to infinity using Restwell’s WACC as a discount rate:

Present value = (GH¢2.5m / (0.12-0.05)) + (5/1.122) = GH¢39.7m