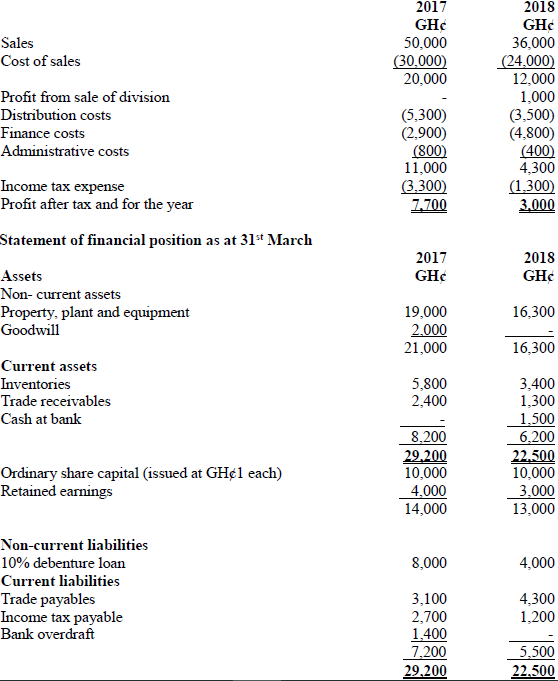

Zangi Ltd is a private company in Ghana and extracts from its most recent financial statements are provided below:

Statement of profit or loss for the year ended 31 March

Required:

a) Calculate the following ratios using the information in the financial statements above.

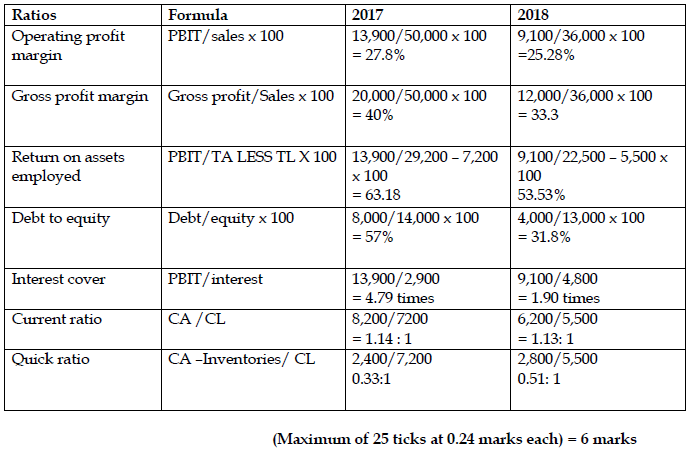

i) Operating profit margin

ii) Gross profit margin

iii) Return on assets employed

iv) Debt to equity

v) Interest cover

vi) Current ratio

vii) Quick ratio

(6 marks)

View Solution

b) Comment on the profitability, liquidity and gearing of the company for the two year periods based on the ratios computed above and advice management where appropriate. (9 marks)

View Solution

Profitability

The gross profit margin has dropped by 2.5% from 2017 levels possibly due to the reduction in sale revenue by 28%. Although the cost of sales has also reduced by 20%, this is not proportionate to the sales figure resulting in lower gross margin. Similarly, the operating margin has also declined from 23.6% in 2017 to 13.06% in 2018 levels. This can be attributable to a marginal increased in distribution expenses the fallen gross margin. On the positive side, administrative expense appears to have been managed well. The return on capital employed which measures the efficiency and effectiveness of management utilizing capital contributed in generating operating profit was higher at 63.18 % but has deteriorated in 2018 to only 53.53%. This could be attributable to the overall decline in profit margins and fallen sales levels.

Recommendation: Management must work to increase sale levels as soon as practicable by increasing advertising campaigns and diversifying its product offerings in order to improve profit margins. (3 marks)

Gearing

Gearing measures, the proportion of a company’s capital in debts and the associated risks this brings to firms. In 2017, the gearing was high at 57%. However, this has been reduced to 31.8%. Management has paid half of the loan off by the end of 2018 which currently stands at GH¢4,000. Interest cover means the number of times that the operating profit can pay the finance off without challenges. The lower the ratio, the more the company is burdened by debt expense. In 2017, it was 4.79 times but in 2018 it has slightly reduced to about 1.90 times. The company’s ability to meet its finance costs may be questionable in 2018. The company at the moment does not appear to be highly geared. (3 marks)

Liquidity

Liquidity measures the ability of an entity to meet its short-term obligation as and when it falls due. In relation to Zangi Ltd, the current ratio appears to suggest that the company is liquid. However, the quick ratios suggest otherwise, that the company is not liquid as a significant proportion of the current assets are locked up in inventories. Although it’s not explicitly clear the industry in which the company is operating, the quick ratios are still not good enough and needs to be improved. Indeed, the improvement seems to have started already as the quick ratio was only 0.33: 1 in 2017 to its current levels of 0.51:1. This trends needs to continue in the next years to come as that is the surest way Zangi Ltd can sustain its operation in the foreseeable future.

(3 marks)