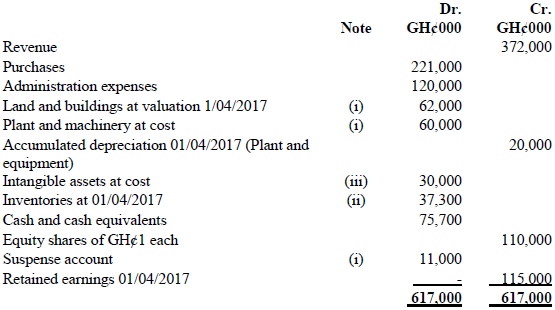

The following trial balance was extracted from the books of Frafraha Ltd (Frafraha) on 31 March 2018.

The following notes may be relevant:

i) Frafraha applies the revaluation model of IAS 16 Property, Plant & Equipment to its land and buildings. A revaluation took place on 31 March 2017 and resulted in the fair value of GH¢62 million shown above. This figure included GH¢22 million in respect of land. The buildings were deemed to have a 40-year useful economic life remaining at that date. No depreciation has yet been charged for the accounting period ended on 31 March 2018. All depreciation is charged to cost of sales. On 31 March 2018, a further revaluation took place which revealed a fair value of GH¢24 million for the land, and GH¢41 million for the buildings. This is to be recorded in the books in accordance with the accounting policy of Frafraha.

Plant & equipment is being depreciated at 25% per annum straight line from the date of purchase to the date of sale. On 1 October 2017, a piece of plant was purchased at a cost of GH¢12 million. This replaced another piece of plant which had cost GH¢8 million some years ago and was fully depreciated prior to 31 March 2017. A trade-in allowance of GH¢1 million was received for the old plant. The only entries made to record this transaction were to credit cash and debit suspense with the net payment of GH¢11 million. No other item of plant was more than three years old at 1 April 2017.

ii) The inventories figure in the trial balance is the opening inventories balance measured on the first-in first-out (FIFO) basis. Due to a change in Frafraha’s business, the company decided to change its accounting policy with respect to inventories to a weighted average basis, as follows:

. 31 March 2016 31 March 2017

GH¢’000 GH¢’000

FIFO 33,200 37,300

Weighted average 30,300 34,100

Closing inventories at 31 March 2018, measured under the weighted average basis, amounted to GH¢41.2 million.

iii) Intangible assets consist of capitalised development costs of GH¢30 million. These relate to products in development at 1 April 2017. No revenue has yet been earned from any of these products. They are all expected to be successful once ready for market, with the exception of one project. The amount previously capitalised in respect of this project was GH¢6 million. However, adverse developments have led to the decision to abandon the project as it was unlikely to be successful in the marketplace. During the year further expenditure was incurred on other qualifying projects and was charged to administration expenses. The amounts are as follows:

- Prototype development costs GH¢3 million.

- Marketing research to determine the optimal selling strategy GH¢1 million.

- Basic research which may lead to future projects GH¢4 million.

iv) Frafraha commenced construction of a new warehouse on 1 May 2017.The building was completed and available for use on 30 November 2017. The cost of construction amounted to GH¢9 million, funded out of general borrowings, which comprise two bank loans as follows:

- GH¢4 million of bank loan finance at 6% interest.

- GH¢6 million of bank loan finance at 4.5% interest.

All interest costs have been expensed in the year to 31 March 2018 but no other entries has been passed in respect of this. Ignore any depreciation in relation to the new warehouse.

v) Corporate tax for the year is estimated at GH¢0.25 million.

Required:

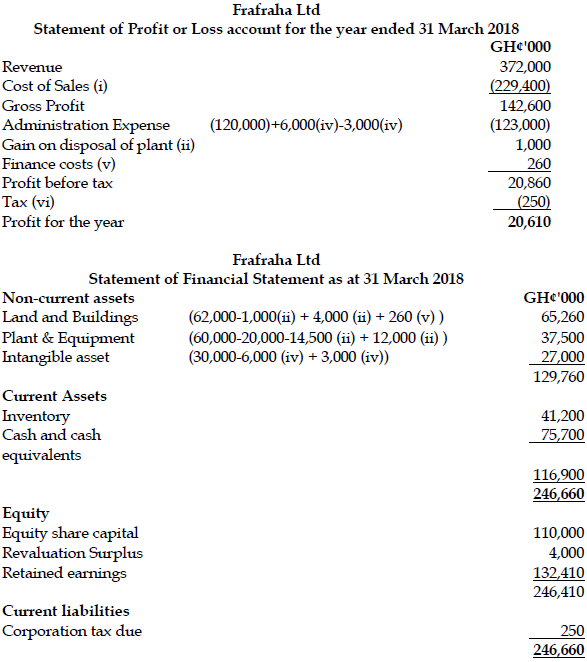

Prepare, in a form suitable for publication to the shareholders of Frafraha Ltd the Statement of Profit or Loss for the year ended 31 March 2018 and Statement of Financial Position as at 31 March 2018. (20 marks)

View Solution

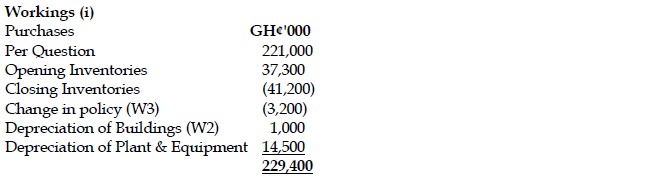

Working (ii) / note (i)

Depreciation on buildings for the year needs to be provided for. Amount (62 – 22) / 40 years * 1 year = GH¢1 million

Dr Cost of sales 1.0

Cr Accumulated depreciation – buildings 1.0

Revaluation of land and buildings takes place on 31 March 2018 AFTER depreciation for the year has been charged. Land shows a gain of (24-22) GH¢2 million. Buildings shows a gain of (41 – 39) GH¢2 million. Total gain GH¢4 million.

Dr Land & buildings 3.0

Dr Accumulated depreciation – buildings 1.0

Cr Revaluation surplus 4.0

Tutorial note:

Revaluation gains and losses are calculated by deducting the carrying amount at the date of revaluation from the revalued amount. The accounting entry is to eliminate any accumulated depreciation accrued at the date of revaluation and adjust the asset account to equal the revalued amount.

Plant

The new plant is depreciated for 6 months from the date of purchase to the reporting date. The amount of this depreciation is GH¢12 million * 25% * 6/12 = GH¢1.5 million

The remaining plant falls into two categories. First, the plant traded in, costing GH¢8 million, was fully depreciated at the beginning of the period. Hence no depreciation remains to be charged on this plant. Second, the balance of the plant, GH¢52 million, is depreciated for a full year as none of it is more than three years old. This means there is at least a full year remaining in its useful economic life. Depreciation amount GH¢52 million * 25% = GH¢13 million.

Record depreciation on plant & equipment (1.5 + 13 = GH¢14.5 million):

Dr Cost of sales 14.5

Cr Accumulated depreciation – plant & equipment 14.5

The new plant has not yet been capitalised into the plant account. Also, the old plant shows a gain on disposal on GH¢1 million as it was fully depreciated, yet generated economic benefit on disposal of GH¢1 million.

Record new plant correctly, eliminate suspense account, and record gain on disposal of old plant:

Dr Plant & equipment 12.0

Cr Profit or loss (gain on disposal) 1.0

Cr Suspense 11.0

Working (iii)

Change of Policy

. 31 March 2016 31 March 2017

GH¢’000 GH¢’000

FIFO 33,200 37,300

Weighted average 30,300 34,100

Decrease under Weighted Average (2,900) (3,200)

Working (iv)

GH¢6 million needs to be written off with respect to the project that is no longer expected to be successful. This judgment means that the IAS 38 criteria for capitalisation are not met in respect of this project. Eliminate GH¢6 million from intangible assets:

Dr Administration expenses 6.0

Cr Intangible assets 6.0

Among the further expenses, the GH¢3 million for prototype development should be capitalised. The other amounts are correctly charged to administration expenses.

Capitalise GH¢3 million to intangible assets:

Dr Intangible assets 3.0

Cr Administration expenses 3.0

Working (v)

Borrowing cost

IAS 23 Borrowing costs provides that borrowing costs that are directly attributable to the acquisition or construction of a ‘qualifying asset’ form part of the cost of that asset. The amount of borrowing costs that should be capitalised is calculated by reference to the weighted average borrowing costs of general borrowing. Interest rate to use is:

![]()

Borrowing costs to be capitalised are: GH¢9m x 5% x 7/12 = GH¢0.26m (approximately GH¢0.3m)

. GH¢m GH¢m

Dr NCA (PPE) 0.26

Cr SPLOCI (Interest Expense) 0.26

Working (vi)

Accrue for corporation tax due:

Dr Profit or loss- taxation 0.25m

Cr Taxation due 0.25m

(60 ticks @ 0.333 marks = 20 marks)