Kumbungu Group owns a number of freehold properties throughout Northern Region. Three of these properties are rented out under annual contracts, the details of which are as follows:

Property Life Cost Value at 31/12/2017 Value at 31/12/2018

GH¢’000 GH¢’000 GH¢’000

1 50 years 200 275 225

2 40 years 180 240 210

3 15 years 150 175 180

All three properties were acquired on 1 January 2017, and their valuation is based on their age at the date of the valuation. Property 1 is let to a subsidiary (60% ownership) of Kumbungu on normal commercial terms, while Property 2 and Property 3 are let on normal commercial terms to companies that are not related to Kumbungu.

Kumbungu adopts the fair value model of accounting for investment properties in accordance with lAS 40: Investment Properties and the benchmark treatment for owner-occupied properties in accordance with lAS 16: Property, Plant and Equipment. Annual depreciation, where appropriate, is based on the carrying value of assets at the beginning of the relevant accounting period.

Required:

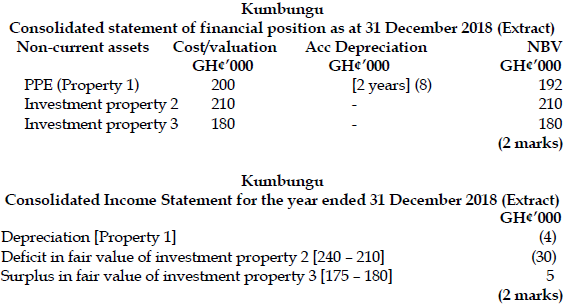

Prepare extracts for the consolidated income statement of Kumbungu for the year ended 31 December 2018 and the consolidated statement of financial position as at that date in respect of the above properties. (5 marks)

View Solution

Property 1 is let to another group entity. From a group perspective, this property is not an investment property, as defined by IAS 40, and must therefore be accounted for in accordance with IAS 16. Properties 2 and 3 are investment properties and are accounted for in accordance with the fair value model of measurement set out in IAS 40. (1 mark)