Hukportie Ltd is a manufacturer of product “Okwada” which is sold for GH¢5 per unit. Variable costs of production are currently GH¢3 per unit, and fixed costs excluding depreciation is GH¢350,000. The current machine which was purchased for GH¢120,000 has a written down value of GH¢20,000 and a resale value of GH¢12,000. This can however be used for the next four years.

A new machine is available which would cost GH¢90,000. This could be used to make product “Okwada” for a variable cost of only GH¢2.50 per unit. Fixed costs, however, would increase by GH¢7,500 per annum as a direct consequence of purchasing the machine. The machine would have an expected life of 4 years and a resale value after that time of GH¢8,000. Sales of product Okwada are estimated to be 75,000 units per annum. Hukportie limited expects to earn at least 12% per annum from its investments. Taxation and depreciation should be ignored.

Required:

Advise whether Hukportie Ltd should purchase the new machine. (10 marks)

View Solution

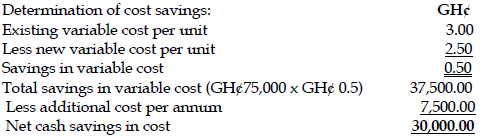

The net investment should be 78,000. This is because the receipt on disposal of old asset should be deducted from the cost of the new machine.

The resale value of the machine is GH¢ 8,000.

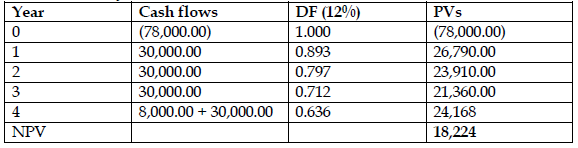

Candidates can use annuity due formula to determine the NPV

Using Annuity Due, NPV is obtained as:

= – Co + C x AF + C/ (1+ r) 𝑛

= – 78,000 .00 + 30,000.00 x 3.038 + 8,000.00 / (1.12) 4

= – 78,000.00 + 91,140.00 + 5,084.14

= 18,224.14

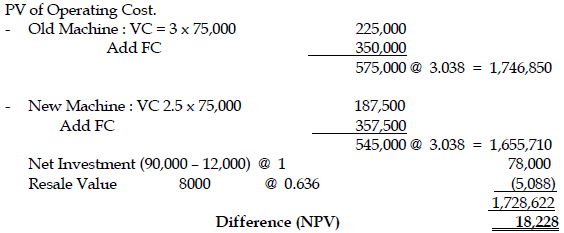

ALTERNATIVE SOLUTION 1:

ALTERNATIVE SOLUTION 2:

Decision:

The NPV is positive and so the project is expected to earn more than 12% per annum and is therefore acceptable.