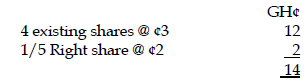

b) The Moorgate Company has issued 100,000 GH¢1 par equity shares which are at present selling for GH¢3.00 per share. It has also issued 50,000 warrants, each entitling the holder to buy one equity share. The warrants are protected against dilution. The company has plans to issue rights to purchase one new equity share at a price of GH¢2 per share for every four shares.

Required:

i) Calculate the theoretical ex rights price of Moorgate’s equity shares. (4 marks)

View Solution

![]()

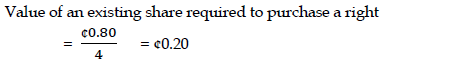

ii) Calculate the theoretical value of a Moorgate right, before the shares sell ex rights. (3 marks)

View Solution

Value of a right = Theoretical ex-right prices – rights prices

. = ¢2.80 – ¢2.0 = ¢0.80

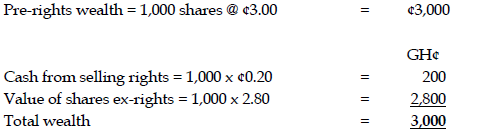

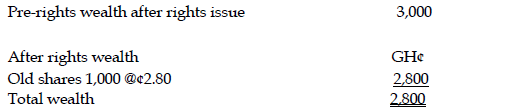

c) The chairman of the company receives a phone call from an angry shareholder who owns 1,000 shares. The shareholder argues that he will suffer a loss in his personal wealth due to this rights issue, because the new shares are being offered at a price lower than the current market value.

The chairman assures him that his wealth will not be reduced because of the rights issue, as long as the shareholder takes appropriate action.

Required:

Prepare a statement showing the effects of the right issue on this particular shareholder’s wealth, assuming:

i) He sells all the rights. (3 marks)

View Solution

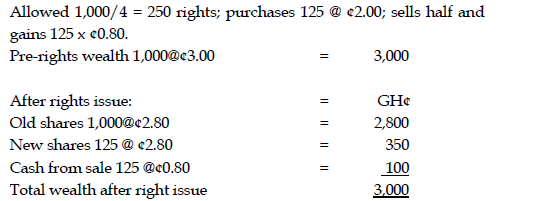

ii) He exercises one half of the rights and sells the other. (3 marks)

View Solution

iii) He does nothing. (2 marks)

View Solution

It is only if the shareholder does nothing that his wealth position will be reduced. As long as all the rights are either sold or exercised his wealth position will be unchanged. This is not surprising because the theoretical ex-rights price has been calculated as a weighted average of the old price and the price of the right.