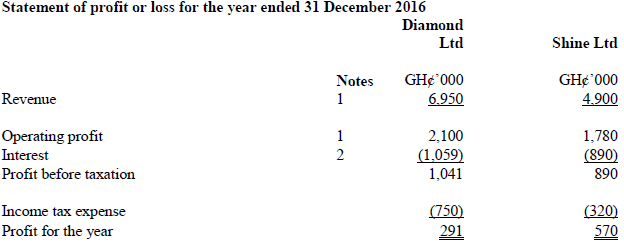

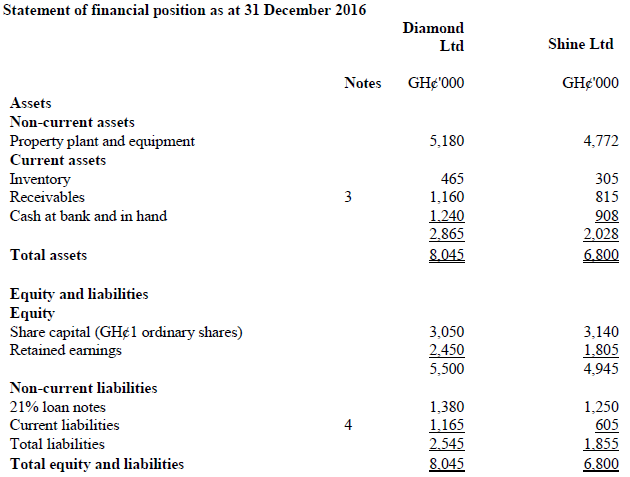

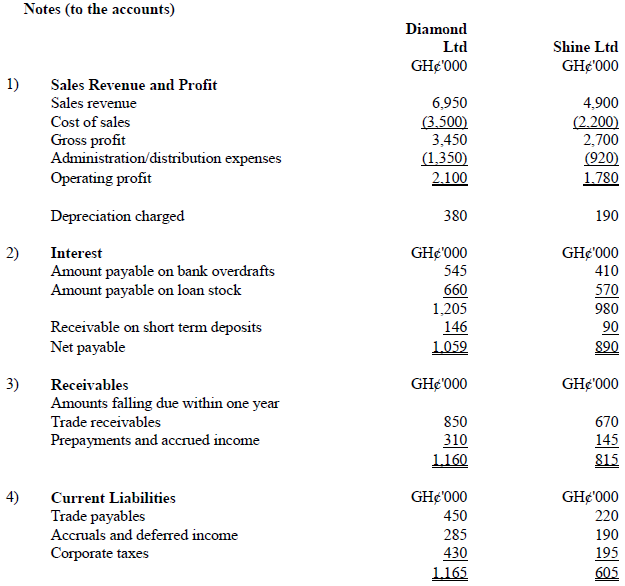

The following information has been extracted from the recently published accounts of Diamond Ltd and Shine Ltd.

![]()

Required:

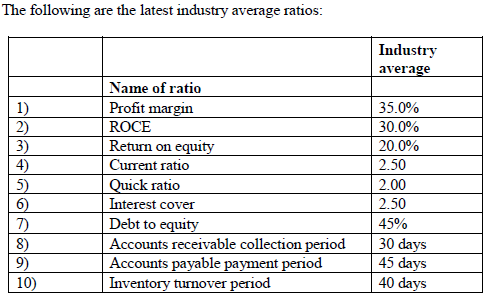

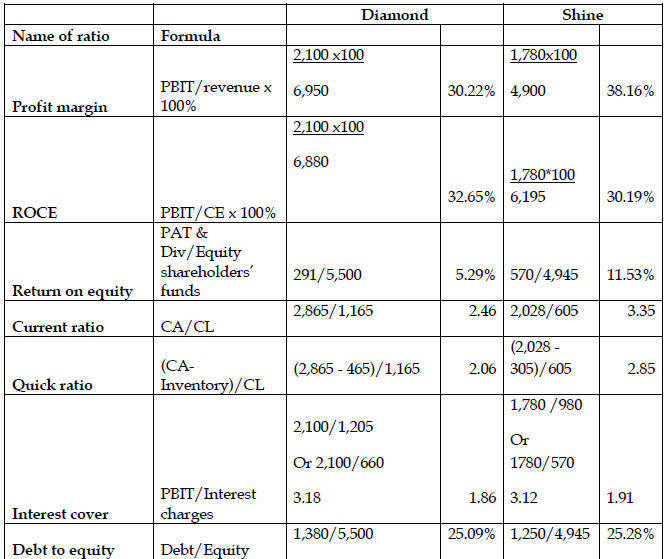

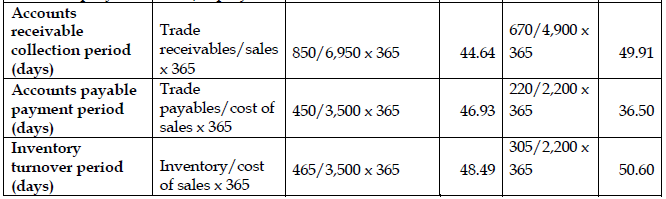

a) Calculate comparable ratios (to two decimal place where appropriate) for the two companies. All calculations must be clearly shown.

View Solution

(6 marks spread evenly using ticks)

b) As the Financial Controller of Shine Ltd, write a report to the Managing Director analyzing the performance of your company, comparing the results against that of Diamonds Ltd (a key competitor) and against the industry average using the following measures:

- Profitability

- Liquidity

- Gearing

- Efficiency.

View Solution

Report to the Managing Director

To : Managing Director

From : Financial Controller

Subject : Analysis of performance for the year 2015

This report should be read in conjunction with the appendix attached which shows the relevant ratios. (1 mark)

Profitability

Profit margin is one of the key indicators used to evaluate a company’s performance as this margin calculates a company’s net income as a percentage of the company’s sales. Several factors directly contribute to the change in a company’s net profit margin. A high profit margin shows that a company can convert sales into profits. The net profit margin also considers all of the costs associated with the sale of the products. Profit margin was better than that of our competitor Diamond Ltd as well as the industry average. This suggest that if we increase sales, there will be more profits for the company.

Return on Capital Employed is very useful for companies that require large amounts of capital to facilitate production, otherwise known as capital-intensive industries. Return on capital employed was bit lower than that of Diamond just approximating the industry average .Options available to the company to improve on its return on capital employed (ROCE) ratio include reducing costs, increasing sales, and paying off debt or restructuring financing.

Return on equity (ROE) is a measure of profitability that calculates how many Ghana cedis of profit a company generates with each Ghana cedi of shareholders’ equity. ROE compared to the industry average of 20% was quite lower. This is bad even though it’s significantly higher than that of Diamond. Return on equity can be improved if asset turnover, financial leverage and profit margins are properly managed by the company. (2 marks)

Liquidity

The current and quick ratios performed better than the industry and that of Diamond. The higher the current ratio, the more capable the company is of paying its obligations, as it has a larger proportion of asset value relative to the value of its liabilities. This suggests that Shine has no short term liquidity challenges and should have no difficulty in paying short term debts as they fall due. (2 marks)

Gearing

Gearing focuses on the capital structure of the business – that means the proportion of finance that is provided by debt relative to the finance provided by equity (or shareholders). However, it focuses on the long-term financial stability of a business. Our interest cover although slightly below the industry average it is marginally higher than that of Diamond. This also shows the company’s ability to adequately settle interest charges.

The debt to equity ratio compares favourably with Diamond and is significantly lower than industry average. The higher the level of borrowing (gearing) the higher are the risks to a business, since the payment of interest and repayment of debts are not “optional” in the same way as dividends. However, gearing can be a financially sound part of Shine’s capital structure particularly if the business has strong, predictable cash flows. (2 marks)

Efficiency

Average collection period is worse off than both Diamond’s and the industry average. Our longer credit days is yet to translate into higher sales for us compared to Diamond. More effort is required at the Credit Control Unit to reduce the collection period.

Although we collect from our debtors latter than Diamond and industry, we pay our suppliers earlier than both. We need to negotiate better credit terms form our suppliers to match the industry norm. The inventory days on hand is higher than industry and Diamond’s. There is the possibility of having some obsolete items in store. This high level of inventory has been financed by increased overdraft which may reduce if the inventory levels can be managed down. (2 marks)

Signed: Financial Controller.