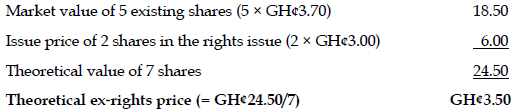

A company with 20 million shares in issue announces a 2 for 5 rights issue at a price of GH¢3 per share. The market price of the existing shares before the rights issue is GH¢3.70.

Required:

i) What is the theoretical ex-right price? (3 marks)

View Solution

ii) What is the theoretical value of the rights? (3 marks)

View Solution

In theory, the holder of five shares in the company in the previous example could buy two new shares in the rights issue for GH¢3 each, and these two shares will be expected to rise in value to GH¢3.50, a gain of GH¢0.50 for each new share or GH¢1.00 in total for the five existing shares.

We can therefore say that the theoretical value of the rights is:

GH¢0.50 for each new share issued, or

GH¢0.20 (GH¢1.00/5 shares) for each current share held.