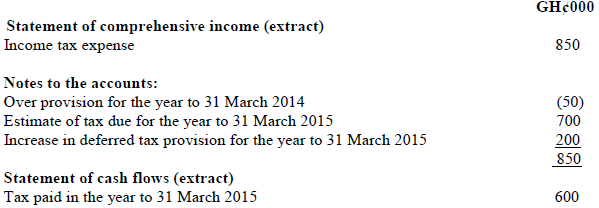

The draft financial statements for the year ended 31 March 2015 for Kobby Ltd include the following:

Required:

i) Explain how deferred tax arises. (2 marks)

View Solution

Deferred tax is the estimated future tax consequences of transactions and events that have been recognized in the financial statements of the current and previous periods. Deferred tax arises due to the temporary differences between the accounting profit and the taxable profit. The temporary differences cause the carrying value of some items in the statement of financial position to be different from their tax base (the amount recognized for tax calculation).

ii) Identify the most likely reason for the increase of GH¢200,000 in the deferred tax provision for the year to 31 March 2015. (2 marks)

View Solution

Kobby Ltd’s statement of comprehensive income shows an increase in deferred tax, this suggests that temporary differences in the year to 31/3/2015. The main reason was probably an increase in non-current assets causing the tax depreciation to increase more than the accounting depreciation for the year to 31/3/2015, thus causing the increase of GH¢200,000 in deferred tax provision.

iii) Explain what the over provision of GH¢50,000 in the income statement represents. (2 marks)

View Solution

Current tax is the estimated amount of corporate income tax payable on the taxable profits of the entity for the period. The amount of current tax is accrued in the financial statements and carried forward as a current liability to the next accounting period when it will be paid. When the tax is paid there will usually be a difference between the amount paid and the amount accrued. If the amount paid is less than the amount accrued there will be an over provision of income tax. The amount over provided will be an adjustment to the income tax expense in the following period. In Kobby Ltd, the current tax estimate for year to 31 March 2014 was GH¢650,000, the statement of cash flows shows that GH¢600,000 was paid in the following period leaving a balance of GH¢50,000 over provided.