Kwame after his National Service and with no hope of securing a job in the formal sector has decided to run a taxi service. The following forecast has been made for the operation of a service between Abisim and Sunyani.

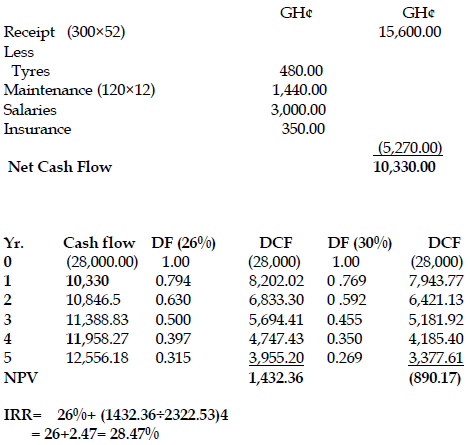

i) Revenue totaling GH¢300 a week for 52 weeks in a year. This is net of fuel and other variable costs.

ii) Tyres; four pieces for a year at GH¢120 per unit.

iii) Maintenance and servicing; GH¢120 per month.

iv) Salaries GH¢3,000 per year

v) Insurance GH¢350 per year

The net cash flow will increase at 5% per annum for the next five years due to inflation. The cost of the vehicle is estimated at GH¢28,000. The project appears quite profitable based on the NPV criteria using the Government policy rate of 26%. However the banks are offering rates far higher than the policy rate.

Required:

You are to calculate the break-even rate for the project. (10 marks)

View Solution

The guiding rate is the internal rate of return. Any borrowing rate greater than that, will render the venture unprofitable.

Calculation of cash flow