IPSAS 17 – Property, Plant and Equipment provides guidance on the recognition, measurement, and derecognition of fixed assets.

Required:

Outline THREE main principles of IPSAS – 17 for the recognition, measurement and derecogniiton of property, plant and equipment. (3 marks)

View Solution

IPSAS 17 – Property, Plant and Equipment provides guidance on the recognition, measurement and derecognition of fixed assets. The main principles are summarises below:

- Recognition:

The cost of an item of property, plant and equipment is recognised as an asset if it meets the following conditions:

*It is probable that future economic benefits or service potential associated with the item will flow to the MDA

*The cost or fair value of the item can be measured reliably. - Measurement:

*An item of property, plant and equipment that qualifies for recognition as an asset shall be measured at its cost.

*The cost of PPE comprises:

a. Its purchase price including import duties and non-refundable purchase taxes, after deducting trade discounts and rebates

b. Any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management

c. The initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located.

*If an asset is acquired through a non-exchange transaction, its cost shall be measured at its fair value at the date of its acquisition. A non-exchange transaction is one in which an entity receives resources and provides no or nominal consideration in return. - Measurement after Recognition:

An MDA shall choose either the cost model or the revaluation model as its accounting policy and shall consistently apply that policy to an entire class of property, plant and equipment.

*Cost model. The asset is carried at cost less accumulated depreciation and impairment

*Revaluation Model. The asset is carried at a revalued amount, being its fair value at the date of revaluation less subsequent depreciation, provided that fair value can be measured reliably. Under the revaluation model, revaluations should be carried out regularly, so that the carrying amount of an asset does not differ materially from its fair value at the balance sheet date. If an item is revalued, the entire class of assets to which that asset belongs should be revalued. - Derecognition:

The carrying amount of an asset shall be derecognized (written off) if:

*The asset is disposed of;

*No future economic benefits are expected to be accrued to the MDA from the use or disposal of the asset - Disclosure:

For each class of property, plant and equipment, an MDA must disclose the following:

*Basis for measuring carrying amount;

*Depreciation method(s) used;

*Useful lives or depreciation rates;

*Gross carrying amount and accumulated depreciation and impairment losses;

*Reconciliation of the carrying amount at the beginning and the end of the period showing;

*Additions;

*Disposals;

*Acquisitions through business combinations;

*Revaluation increases;

*Impairment losses;

*Reversals of impairment losses; - Depreciation:

Depreciation is the decline in the value of a fixed asset over an accounting period because of normal usage, physical deterioration due to wear and tear and age.

The estimated decline in the value of a fixed asset is allocated to the accounting periods over which the relevant asset is expected to be in use.

The primary objective of depreciation is to match the cost of fixed asset, which typically have a useful life of more than one year, to the revenues derived from the use of that asset by the MDA.

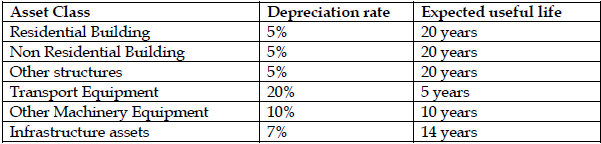

MDAs shall apply the straight-line method of depreciation and the depreciation rates advised by the Controller and Accountant General. This method of depreciation allocates the cost of an asset less its present value evenly over the expected useful life of the asset.

The rates currently in use are as follows: