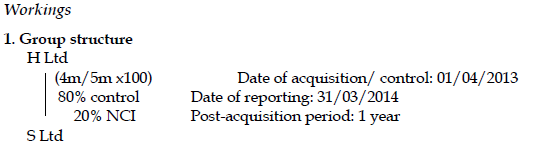

On 1st April 2014, H Plc. acquired four million of the ordinary shares of S Ltd, paying GH¢4.50 each. At the same time, H Plc also purchased, GH¢500,000 of S Ltd 10% redeemable preference shares. At the acquisition date, the retained earnings of S Ltd were GH¢8,400,000.

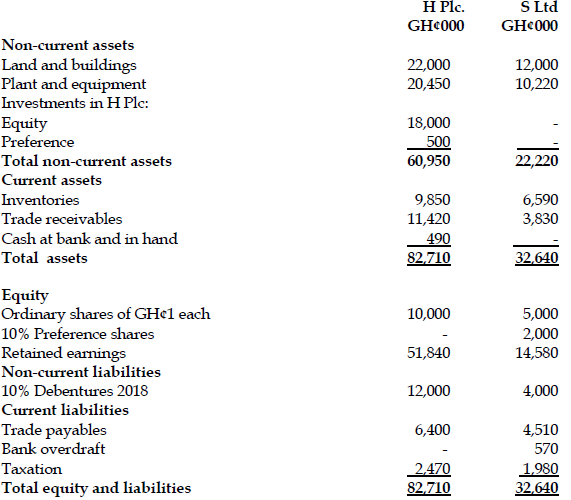

Reproduced below are the draft statements of financial positions of the two companies at 31st March 2015:

Extracts from the statement of profit or loss of S Ltd, before intra group adjustments, for the year to 31st March 2015 are:

The following information is relevant.

i) Included in the land and buildings of S Ltd is a large area of development land at cost of GH¢5 million. Its fair value at the date S Ltd was acquired was GH¢7 million and by 31st March 2015 this had risen to GH¢8.5 million. The group valuation policy for development land is that it should be carried at fair value and not depreciated.

ii) Also at the date of acquisition of S Ltd, S Ltd plant and equipment included plant that had a fair value of GH¢4 million in excess of its carrying value. This plant had a remaining life of 5 years. The group calculates depreciation on a straight-line basis. The fair value of the other net assets of S Ltd approximated to their carrying values.

iii) During the year, S Ltd sold goods to H Plc. for GH¢1.8 million. S Ltd adds a 20% mark-up on cost to all its sales. Goods with a transfer price of GH¢450,000 were included in the inventory of H Plc. at 31st March 2015.The balance on the current accounts of the H Plc and S Ltd was GH¢240,000 on 31st March 2015.

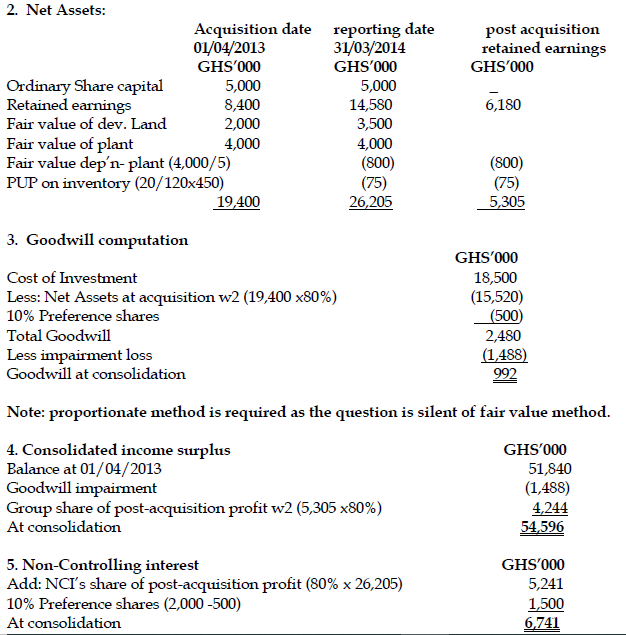

iv) An impairment test carried out at 31st March 2015 showed that the consolidated goodwill was impaired by GH¢1,488,000.

v) S Ltd had paid its preference dividends in full and ordinary dividends of GH¢500,000.

Required:

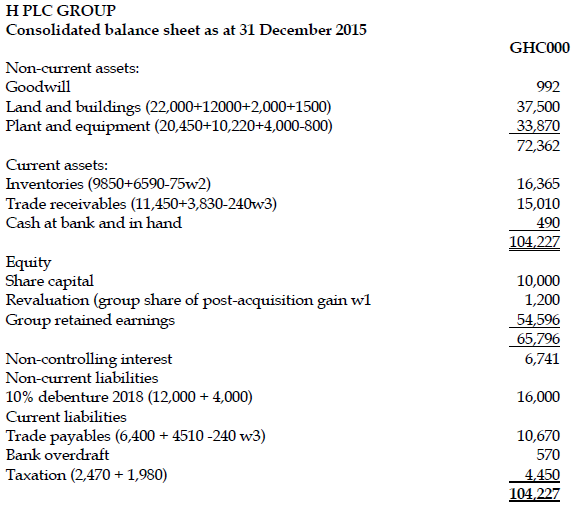

a) Prepare the consolidated statement of financial position of H Plc. as at 31st March 2015. (14 marks)

View Solution

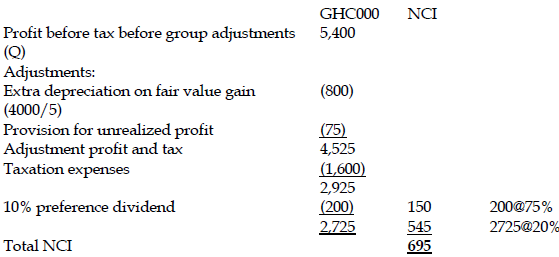

b) Calculate the non-controlling interest in the adjusted profit of S Ltd for the year to 31st March 2015. (3 marks)

View Solution

The profits after tax are GHC2,925, but the preference dividends would have been paid, as distributable profits exist. The ordinary NCI is 20% of the retention.