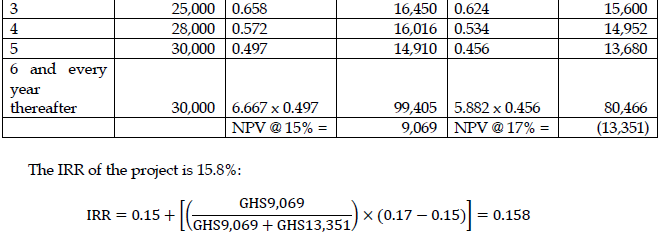

ABC Ltd is considering five projects for the coming financial year. Four of the projects have undergone financial appraisal (see the table below).

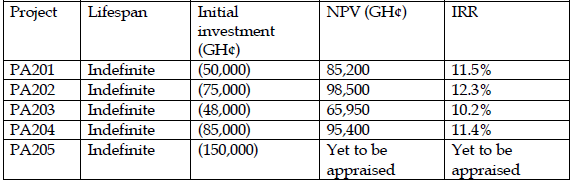

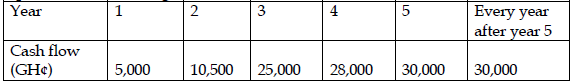

Project PA205 entails an immediate capital investment of GH¢150,000 and will produce the following annual net cash flows in real terms:

Expected general rate of inflation is 15% and the company’s money required rate of return is 25%.

Required:

a) Appraise Project PA205 using the NPV criteria. (4 marks)

View Solution

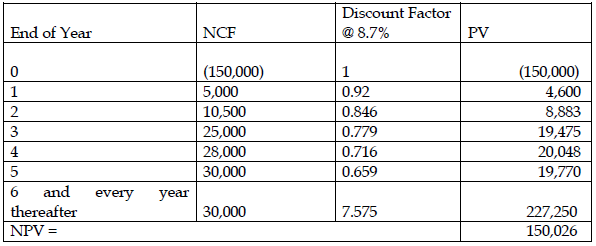

NPV can be computed by discounting the real cash flows with the company’s real rate of return. Discounting the project real cash flows with the real rate of return produces an NPV of GHS152,666:

Comment: Since the NPV of the project is positive, the value of the firm will increase when the project is implemented. The project should therefore be accepted for implementation.

Workings:

1. Discount rate

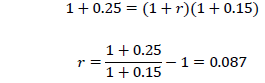

The real rate of return is estimated using the Fisher’s equation as under: 1+𝑖=(1+𝑟)(1+ℎ)

Nominal rate, i = 25%

Inflation rate, h = 15%

Therefore, the real rate of return is 8.7%

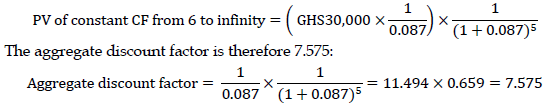

2. Discount factor for equal cash flows occurring every year from year 6 to infinity.

The equal annual cash flow of GHS30,000 from year 6 to infinity is first discounted as a perpetuity to obtain the terminal value at end of year 5: Terminal value of constant CF from 6 to infinity= GHS30,000×(1/0.087)

The terminal value is then discounted as a single amount to obtain the PV at time zero:

NB: Some candidates may round the real rate of return to 9% so as to read discount factors from interest factor tables (if provided). In this case, the NPV would be GHS138,715. Full credit should be awarded to candidates who answer the question in this manner.

b) Assess the sensitivity of Project PA205 to the discount rate. (4 marks)

View Solution

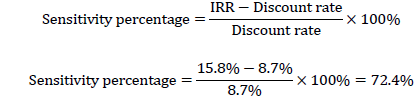

The sensitivity of the project’s NPV to the discount rate can be estimated as the percentage change in the discount rate needed to reduce NPV to zero.

That is the discount rate will have to increase by 72.4% for the NPV to reduce to zero. The high percentage increase required in the discount rate for the NPV to drop to zero implies Project PA205 is less sensitive to variation in the discount rate.

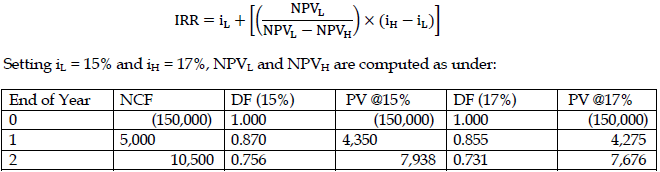

The IRR is calculated by trial and error as under: