Mensah and Asamoah have been in partnership for several years. Up to 30th September 2015 the partnership agreement stated that there should be no partners’ salaries and partners should not receive any interest on capital put into the business. It was agreed that profit and losses were shared equally between Mensah and Asamoah.

Asamoah made a loan to the partnership during the year ended 31st May 2015 and no repayments have been made.

From 1st October 2015, the partners decided to change the partnership agreement and the terms were as follows.

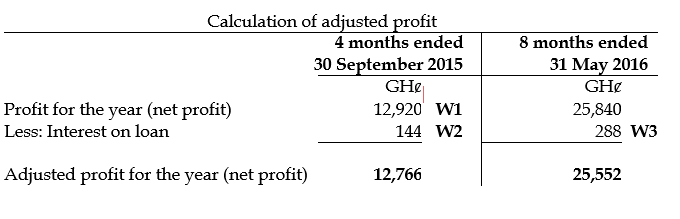

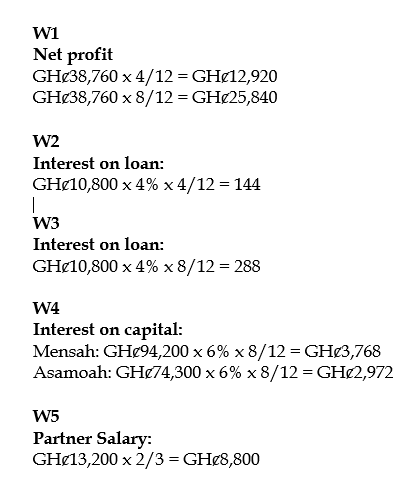

(i) Interest on the partner’s loan account is to be 4% per annum.

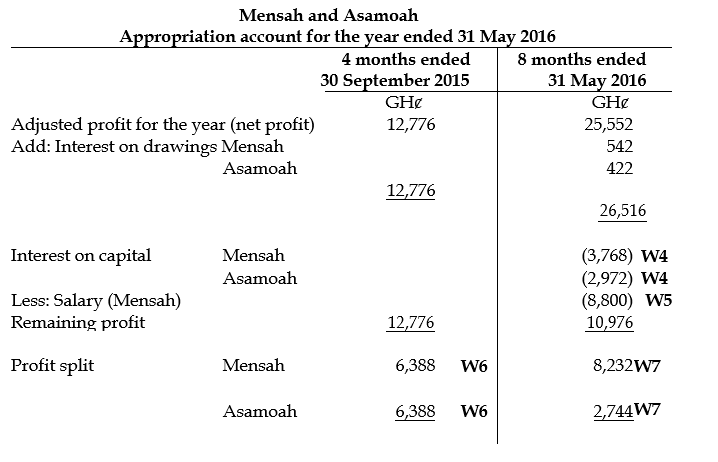

(ii) Interest on partners’ capital accounts is to be 6% per annum.

(iii) Interest on partners’ total drawings is to be charged at 3% per annum. (For the period 1st October 2015 to 31st May 2016, interest on drawings were: Mensah GHȼ542; Asamoah GHȼ422).

(iv) Mensah’s partnership salary is to be GHȼ13,200 per annum.

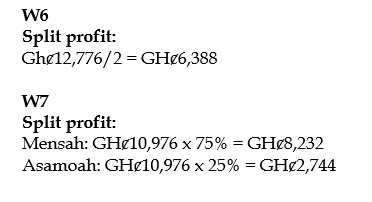

(v) Profits and losses will be split between Mensah and Asamoah in the proportion 3:1 respectively.

(vi) No account has been taken of the interest on Asamoah’s loan. The draft profit for the year ended 31st May 2016 was GHȼ38,760. Profits were accrued evenly before allowing for loan interest.

vii) The following balances were extracted from the books of account for the year ended 31st May 2016.

Required:

Prepare the partners’ appropriation account for the year ended 31st May 2016, showing clearly the appropriation of profit for the periods:

i) 1st June 2015 – 30th September 2015 and

ii) 1st October 2015 – 31st May 2016. (11 marks)

View Solution