PQ Ltd had, among others the following balances in the books at 1st January 2015.

Debit (GHȼ) Credit (GHȼ)

Machinery at cost 750,000

Machinery accumulated depreciation 301,000

Motor vehicles at cost 1,000,500

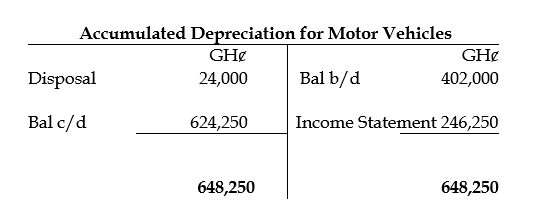

Motor vehicles accumulated depreciation 402,000

The following information relate to the non-current assets for the financial year ended 31st December 2015.

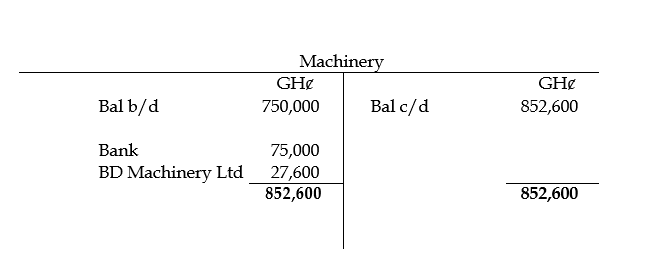

a) On 1st July 2015 PQ Ltd purchased machinery at a cost price of GHȼ75,000, paying by cheque.

b) On 1st December 2015 PQ Ltd purchased machinery at a cost price of GHȼ27,600, on credit from BD Machinery Ltd.

c) No disposals of machinery took place during the year ended 31st December 2015.

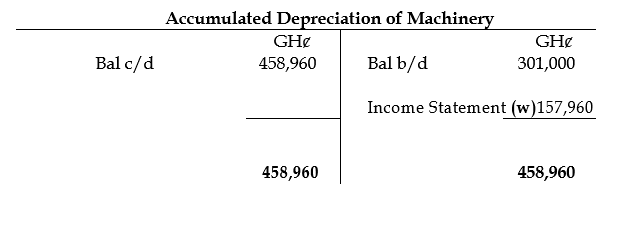

d) Machinery is depreciated at 20% per annum using the straight line method, the rate being charged for each proportion of the year the machinery is owned. No allowance is made for any residual value. All machinery held at 31st December 2015 had been purchased within the previous four years.

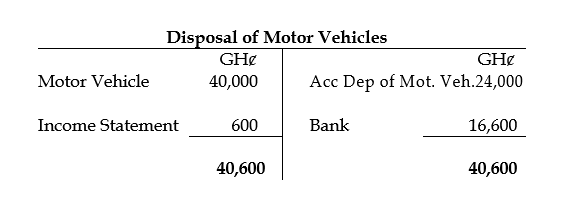

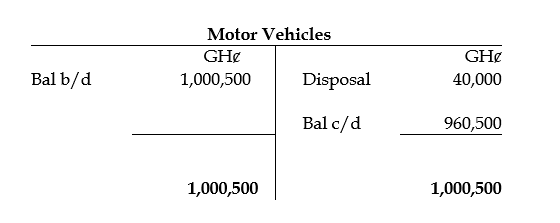

e) On 30th June 2015 motor vehicles which originally cost GHȼ40,000 and with a net book value of GHȼ16,000 at the date of sale, were sold at a profit of GHȼ600. The disposal receipt was paid into the bank account.

f) No purchases of motor vehicles took place during the year ended 31st December 2015.

g) Motor vehicles are depreciated at 25% per annum using the straight line method, the rate being charged for each proportion of the year the motor vehicles are owned. No allowance is made for any residual value. All motor vehicles held at 31st December 2015 had been purchased within the previous three years.

Required:

Prepare the following ledger accounts of PQ Ltd for the year ended 31st December 2015, where appropriate showing the balance carried down to the next financial year. Dates are not required.

a) Machinery. (4 marks)

View Solution

b) Accumulated Depreciation of Machinery. (4 marks)

View Solution

Working (w)

750,000 x 20% + 75,000 x 20% x 6/12 + 27,600 x 20% x 1/12 = 157,960

c) Motor vehicles. (4 marks)

View Solution

d) Accumulated Depreciation of Motor vehicles. (4 marks)

View Solution

e) Disposal of Motor Vehicles. (4 marks)

View Solution