Felicia, Jackson and Elizabeth are in Partnership Sharing Profits and Losses in the ratio of 5:3:2 respectively. According to the Partnership Agreement, Partners Capital Accounts attract an interest of 20% per annum. While any Drawings by a Partner also attract 10% interest per annum.

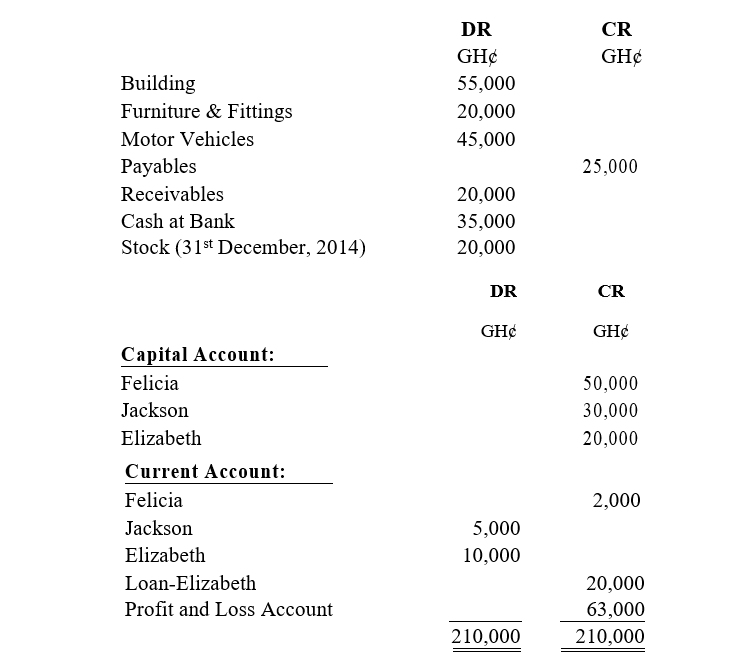

The following understated Trial Balance has been extracted after the preparation of the Profit and Loss Account for the period ending 31st December, 2014.

The following entries have not been recorded in the books.

(i) Salary of GH¢5,000 was paid to Elizabeth during the period.

(ii) Felicia personally paid General Expenses of GH¢2,500 on behalf of the

Partnership.

(iii) Cash Drawings made by partners: Felicia GH¢500, Jackson GH¢1,500 and

Elizabeth GH¢1,200.

(iv) Interest on loan – Elizabeth – GH¢2,000.

(v) Jackson took goods worth of GH¢2,000 for personal use.

(vi) Interest on Capital Account. All Capital Accounts were to remain fixed.

You are required to prepare:

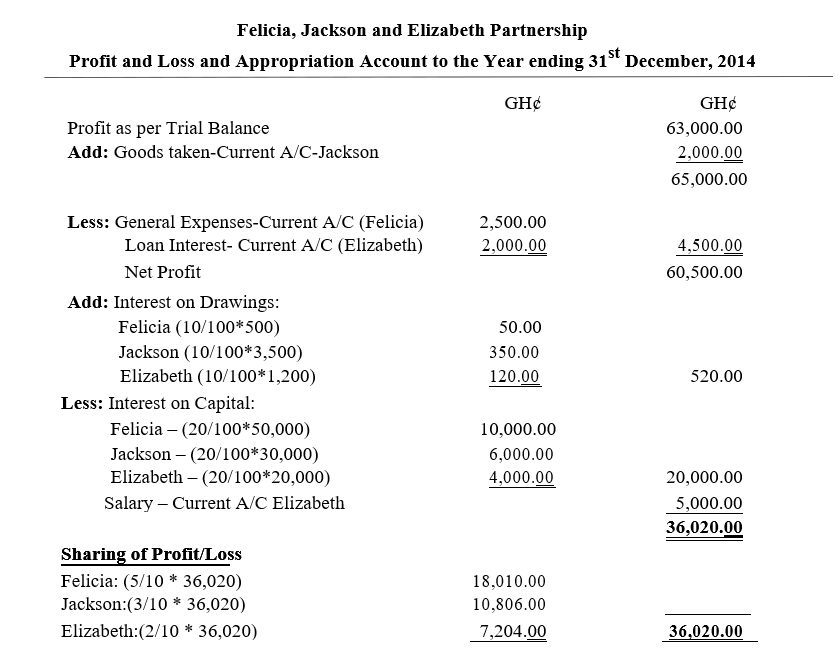

i. Profit or Loss and Appropriation Account. (7 marks)

View Solution

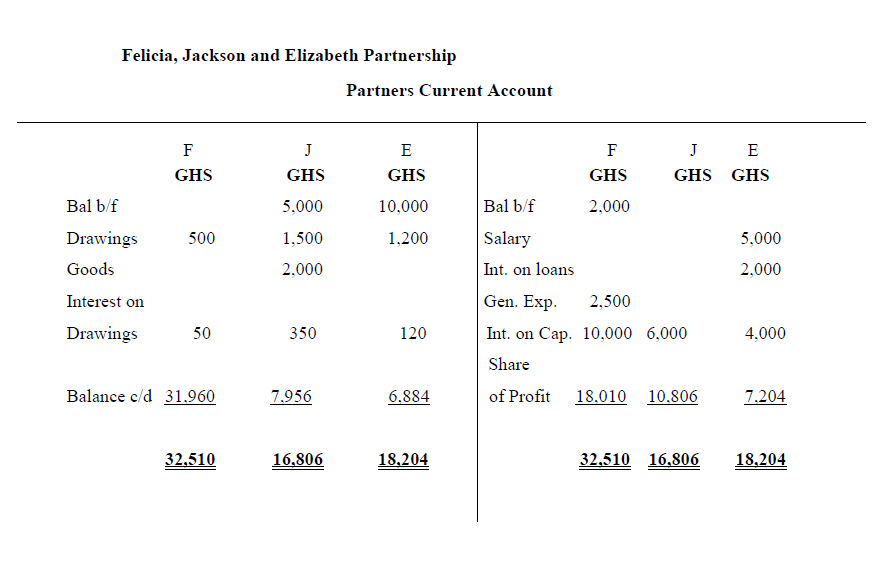

ii. Partners’ Current Account. (3 marks)

View Solution

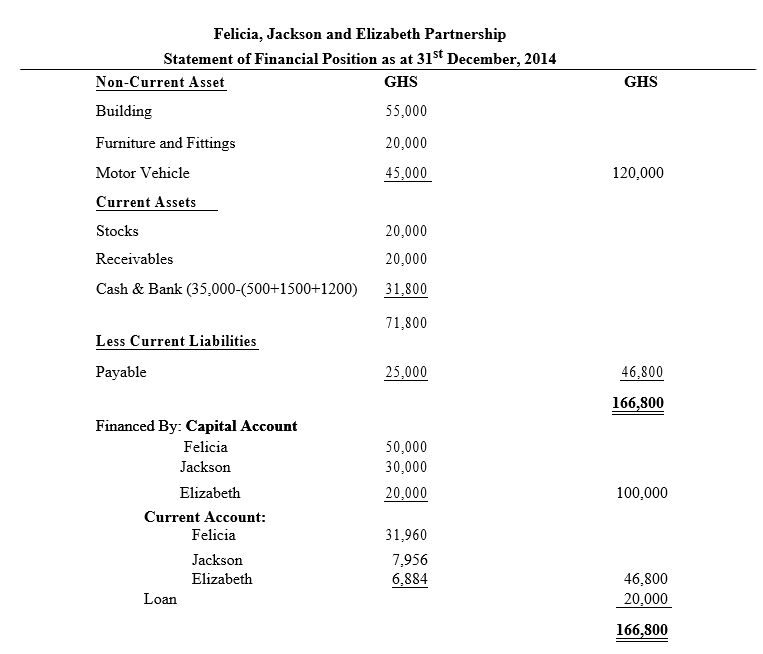

iii. Statement of Financial Position as at 31st December, 2014. (5 marks)

View Solution