Nov 2020 Q4 b.

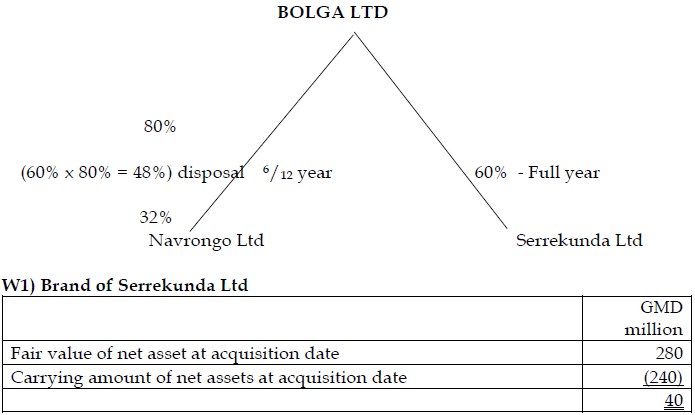

Under IFRS 3: Business Combinations, the identifiable assets, liabilities and contingent liabilities of subsidiaries are therefore required to be brought into the consolidated financial statements at their fair value rather than their book value. The difference between fair values and book values is a consolidation adjustment made only for the purposes of the consolidated financial statements.

Required:

Explain the justification for undertaking fair value exercise when a parent acquires a controlling stake in a subsidiary company. (5 marks)

View Solution

Fair value of assets and liabilities acquired

Assets and liabilities in an entity’s own financial statements are often not stated at their fair value, for example, where the entity’s accounting policy is to use the cost model for assets. If the subsidiary’s financial statements are not adjusted to their fair values, where, for example, an asset’s value has risen since purchase, goodwill would be overstated (as it would include the increase in value of the asset).

Consolidated accounts are prepared from the perspective of the group, rather than from the perspectives of the individual companies. The book values of the subsidiary’s assets and liabilities are largely irrelevant, because the consolidated accounts must reflect their cost to the group (i.e. to the parent), not their original cost to the subsidiary. The cost to the group is their fair value at the date of acquisition.

Purchased goodwill is the difference between the value of an acquired entity and the aggregate of the fair values of that entity’s identifiable assets and liabilities. If fair values are not used, the value of goodwill will be meaningless.