May 2021 Q5

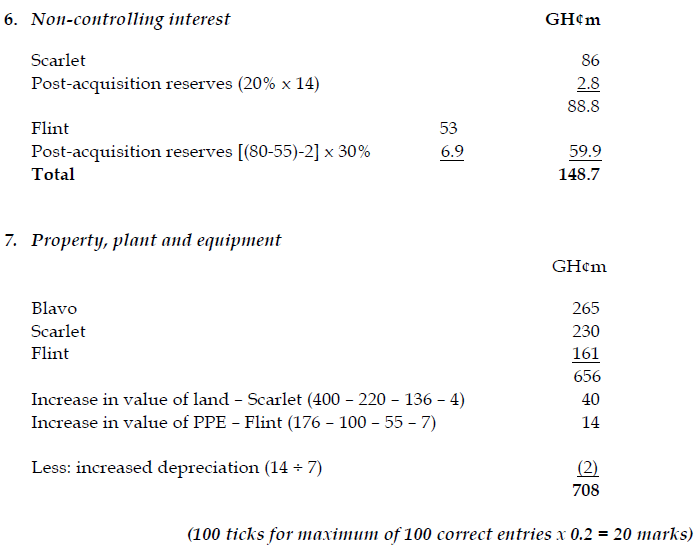

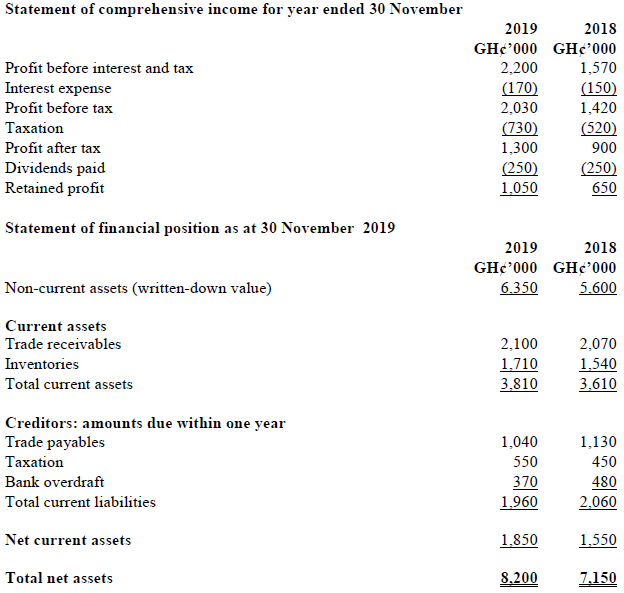

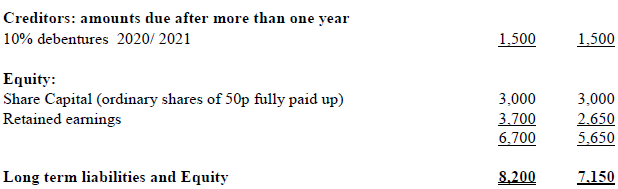

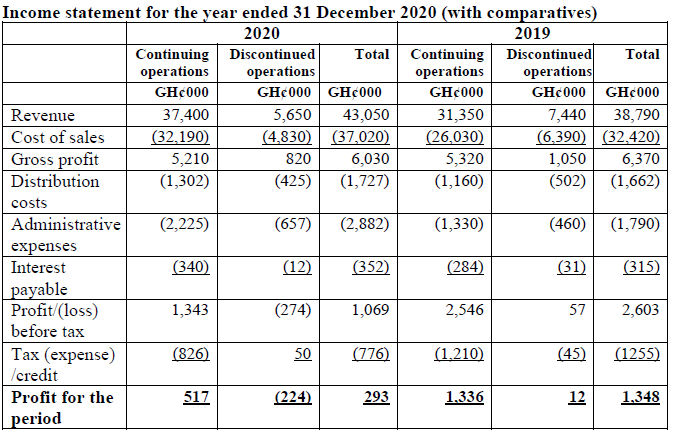

Shop First Ltd operates supermarket chains across the sixteen (16) regions of Ghana. The firm has been in commercial operation for more than two decades, growing its operations through an effective supply chain and financial management. However, in the last few years, keen competition and worsening general economic performance have steadied the consistent growths experienced over the years, resulting in the entity disposing off part of its operations. Below are the financial statements of Shop First Ltd:

Additional information

i) At a class meeting of key shareholders and debentures held on 30 June 2020, a decision was taken to sell the entire operations of one of the firm’s major retail shops as a response to teething operational difficulties that started in the early part of the current period. Operations, however, continued until 30 September 2020, when the sale transaction finally closed and proceeds received. Results from these operations for the current period are separately shown in the above income statement. Loss on sale of the operations amounting to GH¢217,000 has been included within administrative expenses.

ii) On 31 December 2020, there was litigation and claim amounting to GH¢2.05 million against the company by a supplier whose contract was terminated as part of the closure process. Its legal counsel has advised the company that it has a good defence against the claim. Accordingly, no provision has been made in respect of the potential liability in these financial statements.

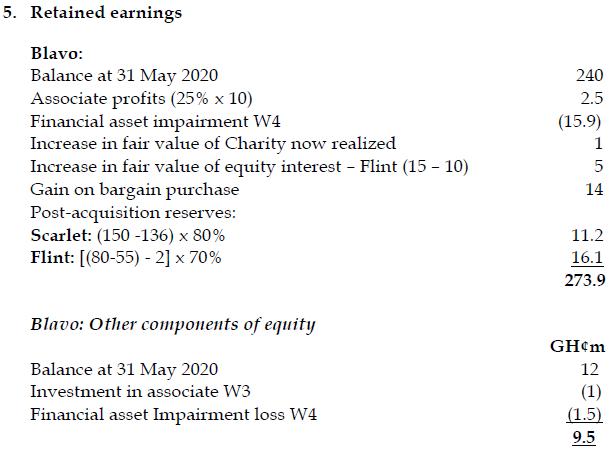

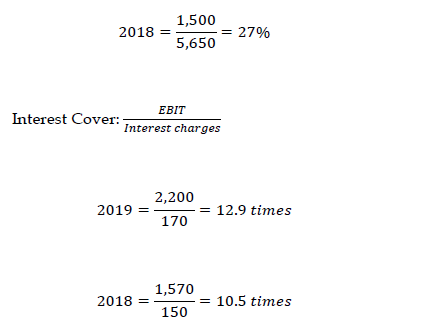

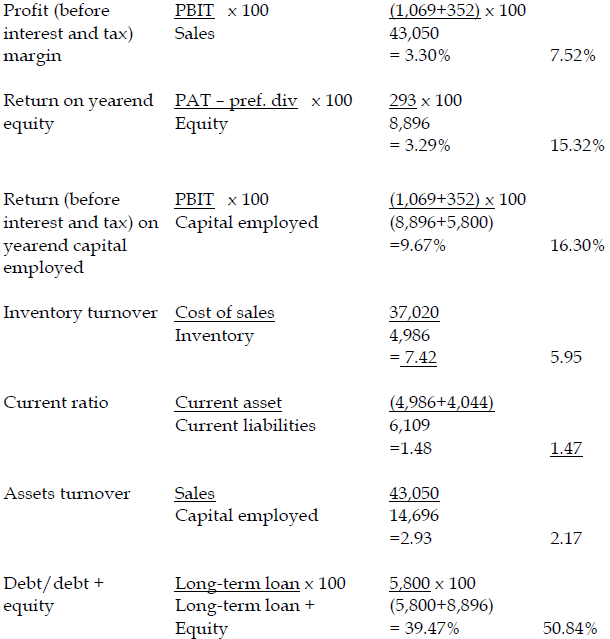

iii) The following ratios have been computed based on the 2019 financial statements of Shop First Ltd

Gross profit margin 16.42%

Profit (before interest and tax) margin 6.71%

Return on equity 15.32%

Return on capital employed 16.30%

Inventory turnover 5.95

Current ratio 1.47

Assets turnover 2.17

Debt/debt+equity ratio 50.84%

Required:

Write a report to the Board of Directors analysing the financial performance and position of Shop First Ltd, drawing their attention to the effects (or potential effects) of the discontinued operations and the contingencies on overall performance. (20 marks)

View Solution

. Report

To : Board of Directors of Shop First Plc

From : Accountant

Date : 10 January, 2021

Subject : Analysis of the financial performance and position of Shop First Plc

Following the discussion we had on the above subject matter, this report is submitted for your perusal. The report looks at profitability, working capital management and gearing of the company for the year ended 31 December 2020, as against its comparative period. This report should be read with the attached appendix.

Profitability

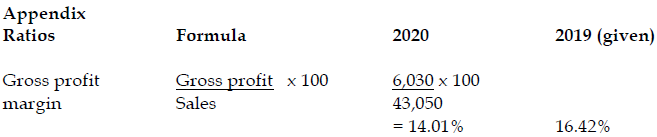

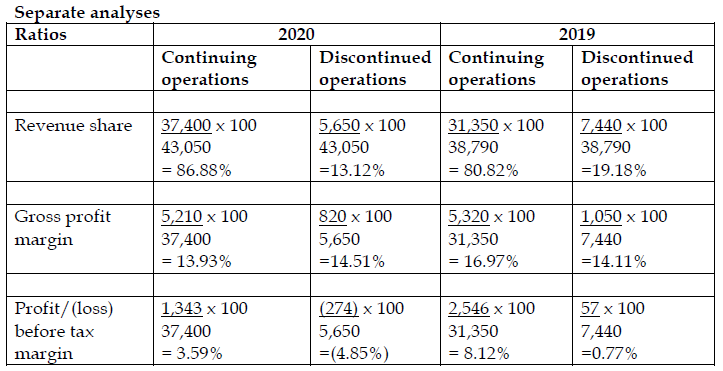

There has been a fractional improvement in revenue in 2020 over 2019. This steady rise in revenue resulted largely due to discontinuation of the retail shop. The sold shop contributed 13.12% of the total revenue generated in 2020 against 19.18% in 2019. The company could however not keep its operational costs in line with the revenue changes as all the profitability measures have dropped in 2020. Management did poorly in controlling both direct trading costs and overheads as gross profit margin as well as net profit margin has fallen. A separate analysis carried out on margins between continuing and discontinued operations reveals that while the stopped operations may have significantly contributed to the poor operating margins especially because of the disposal loss recorded this part of the entity operated on better gross margins than the rest of the company. Hence, the company is likely not become any better after the sale of the operations if cost controls are not significantly tightened for the remaining operations.

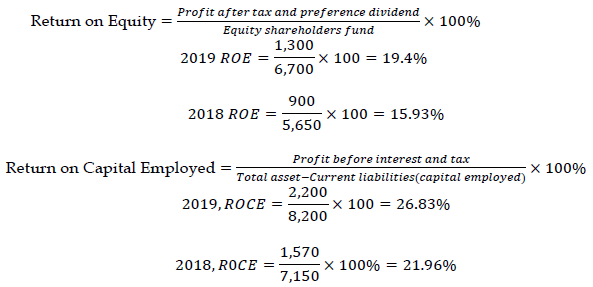

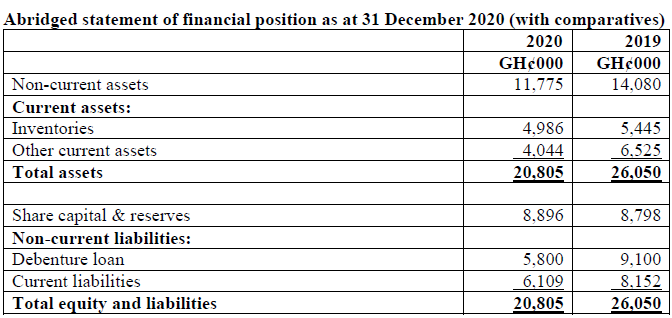

The low margins have had hugely negative impact on returns made for providers of capital in 2020. Both ROCE and return on equity have slipped considerably even though the company has seen some noticeable improvements in net asset and inventory turnovers. Asset turnover shows that the firm turned its resources roughly three times into sales this year as against little over two times in 2019. Thus, the decline in profitability can be clearly attributed to high operating cost levels.

Working capital management

Overall, working capital has been effectively managed by Shop First Plc. With current ratio of 1.48 in 2020, Shop First Plc’s current assets provide a good cover for its short-term obligations. And this ratio is slightly up from 1.47 it had back in 2019. Current ratio measures how well a firm is positioned to apply current assets to pay off current liabilities when they mature. The current ratio of 1.48 implies that the company maintains GH¢1.48 of current assets to pay every GH¢1 of current debt owed. As a cushion, Shop First achieves a good inventory turnover rate and records a clear improvement over last year. This should reduce any fear of liquidity concerns. On inventory turnover of 7.42 (as against 5.95 in 2019), the company is able to empty its warehouse 7.5 times on average within 2020, as against approximately 6 times back in 2019. The strong liquidity situation is further helped by Shop First Plc being a retail firm which makes it more likely that it would convert resources into liquid assets at an accelerated rate. However, were the contingent liability to crystallize any time soon, it would have a damaging effect on liquidity by bringing it down below 2019’s level.

Gearing

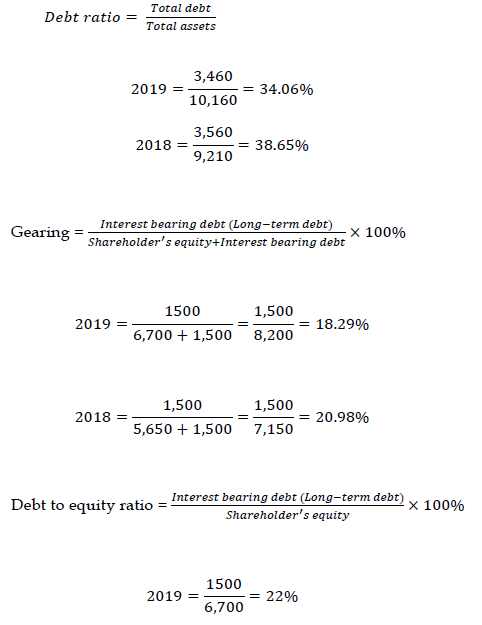

This measures the extent to which the firm finances its operations with funds provided by external parties. Under this section, investors and lenders determine how much risk the firm exposes them to. The proportion of debts in the total long-term capital has seen a decline, as shown by its capital gearing ratio. While little more than half of the total resources in 2019 was provided by lenders, around six percent of total funds came from within for 2020. The reduction in debt used implies that the firm is facing lower financial risk now, and the company is looking healthy. But if profitability concerns are not overturned sooner than later, keeping even minimal level of gearing may be unsustainable.

Conclusion

The analysis above has revealed that Shop First Plc’ profitability has worsened and operational costs seem out of control. However, liquidity, efficiency and gearing levels do not raise any concerns. Management are therefore entreated to institute investigation into unearthing how best it can put costs under check and consolidate its strong position.

I am available to provide any further clarification, if so needed. Thank you

(Signed)

Accountant

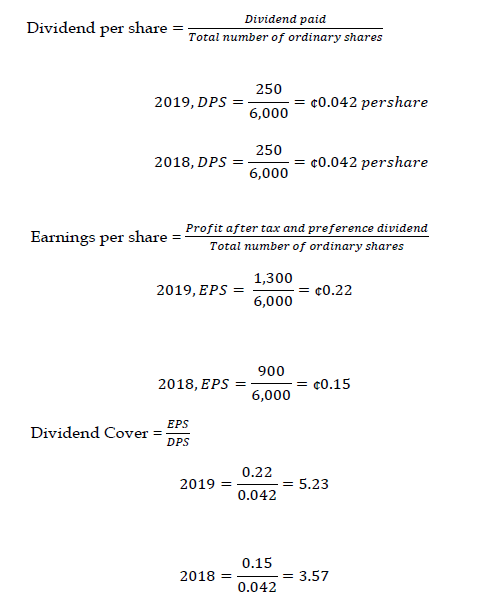

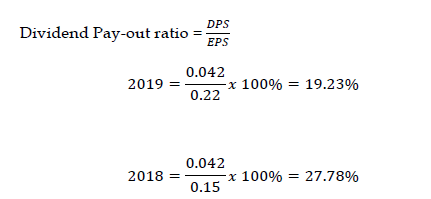

Computation of 2020 ratios; 10 x 1 mark = 10 marks

Report on the analysis = 6 marks

Comment on the effects of the discontinued operations = 4 marks