Nov 2017 Q3 b(ii)

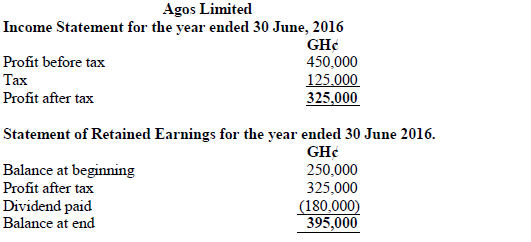

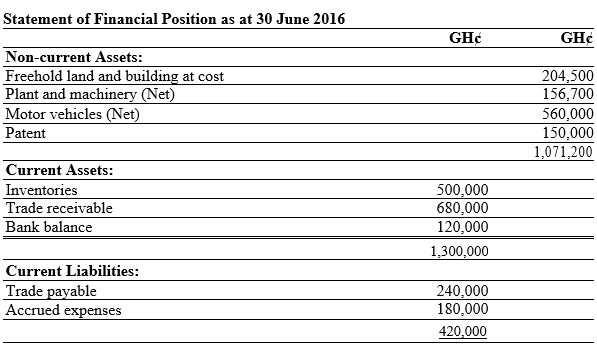

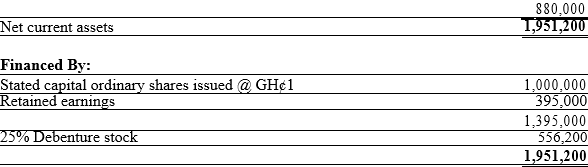

Santader Limited intends to take over Agos Limited. The financial statements of Agos Limited for the year ended 30 June 2016 are as follows:

Additional Information:

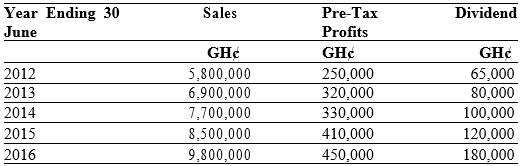

i) Turnover, profits before tax and dividend of Agos Limited over the past 5 years were as follows:

ii) The patent represents a license to produce and sell a special product. This product is expected to generate a pre-tax profit of GH¢12,000 per annum in perpetuity.

iii) The discount rate of Agos Limited is 10% per annum.

iv) Nhyira Limited, a major competitor of Agos Limited, is listed on the Stock Exchange and has a P/E ratio of 8 and a dividend yield of 10%.

v) Nhyira Limited expects a return of 11% of the net assets.

Required:

Note:

1. You may assume that it is about 10% more risky investing in unlisted entity than investing in listed entity.

2. Unless otherwise deemed inappropriate, the current year’s financial statements (appropriately adjusted) may form the basis of the valuation.

ii) Estimate the value per share of Agos Limited as at 30 June, 2016 using the Dividend valuation method: (4 marks)

View Solution

Value of business = Dividend / Dividend Yield

Using the current year’s dividend (GH¢180,000)

Value of business = GH¢180,000/0.10

. = GH¢1,800,000 x 0.90

. = GH¢1,620,000

Using the average dividends over the 5 years (65+80+100+120+180)/5 = GH¢109,000

Value of business = GH¢109,000/0.10

. = GH¢1,090,000 x 0.90

. = GH¢981,000

Therefore, the value lies between GH¢1,620,000 and GH¢981,000 inclusive.