Nov 2019 Q1

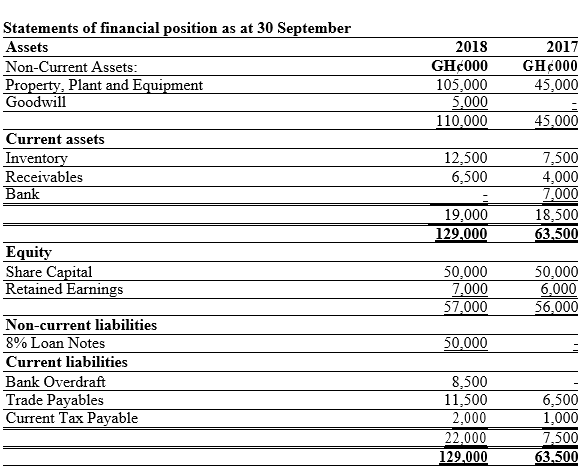

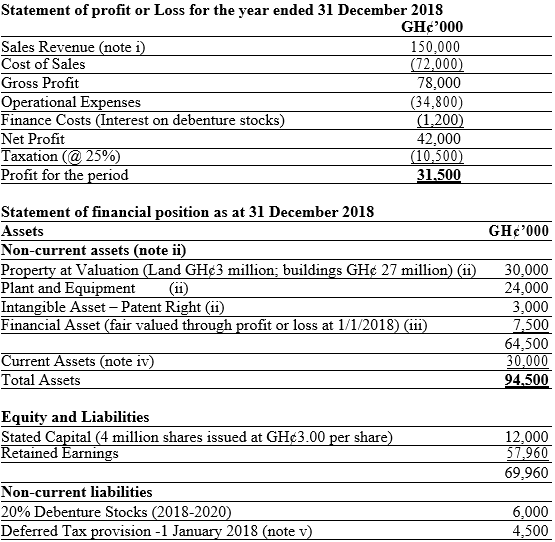

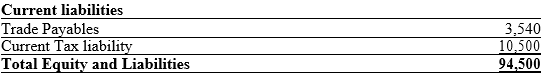

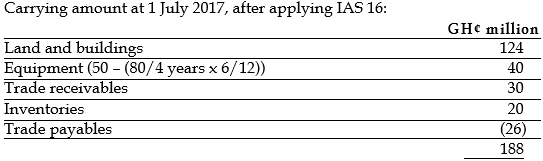

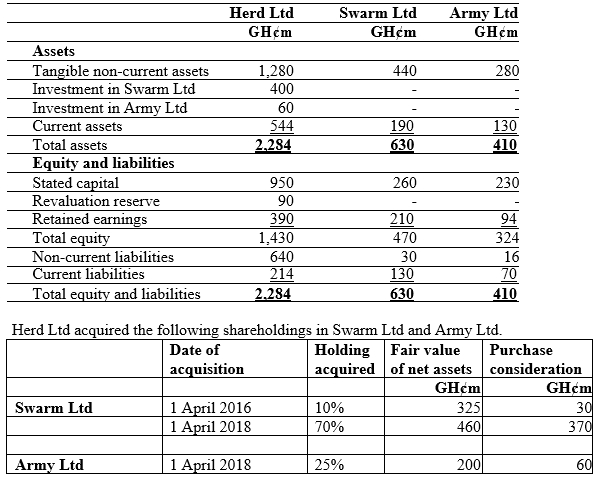

The following statements of financial position are as at 31 March 2019:

You are also provided with the following information which will be relevant to the consolidated financial statements of Herd Ltd.

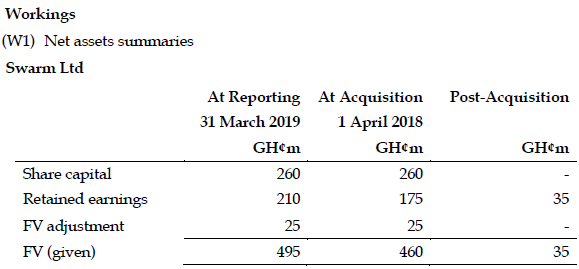

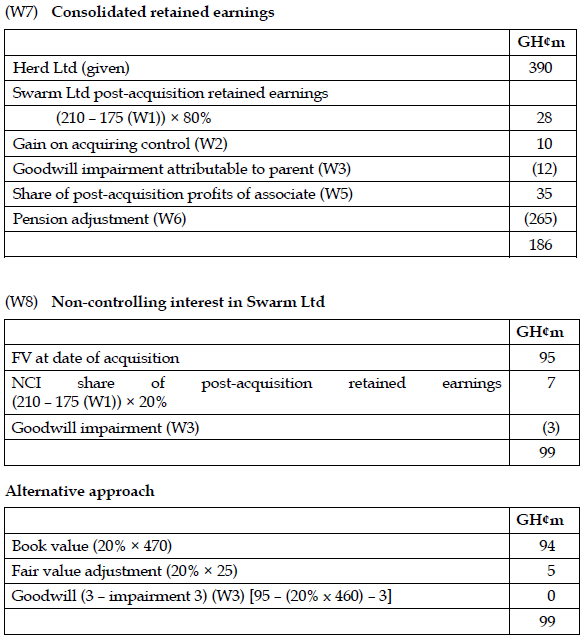

i) At 1 April 2016, the carrying value of the net assets of Swarm Ltd was the same as their fair value, GH¢325 million.

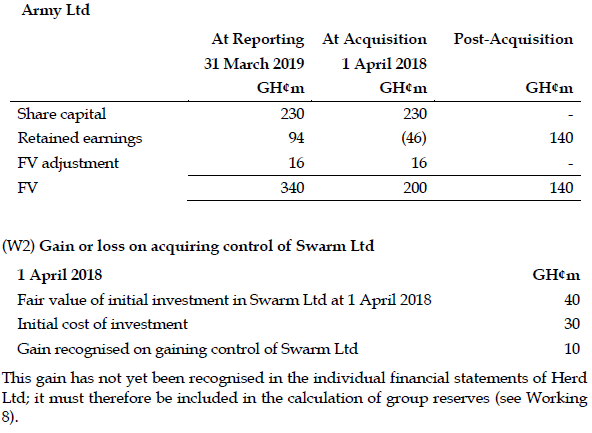

ii) The estimated fair value of the initial investment in 10% of the shares of Swarm Ltd was GH¢40 million at 31 March 2018.

iii) Herd Ltd wishes to use the full fair value method of accounting for the acquisition of Swarm Ltd. At 1 April 2018 the estimated value of the non-controlling interests was GH¢95 million.

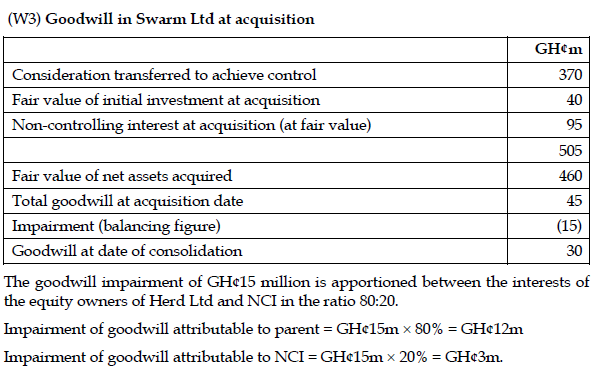

iv) The difference between the carrying amount of Swarm Ltd’s net assets and their fair value at the date of acquisition was due to land valued at cost which on 1 April 2018 had a fair value of GH¢25 million in excess of its carrying value. There has been no subsequent significant change in that value.

v) At 1 April 2017 the fair value of Army Ltd’s land was GH¢16 million in excess of its carrying value. There has been no subsequent significant change in that value.

vi) Goodwill arising on acquisition is tested for impairment at each year end. The recoverable amount of goodwill in Swarm Ltd at 31 March 2019 was GH¢30 million.

vii) There has been no impairment of the investment in Army Ltd.

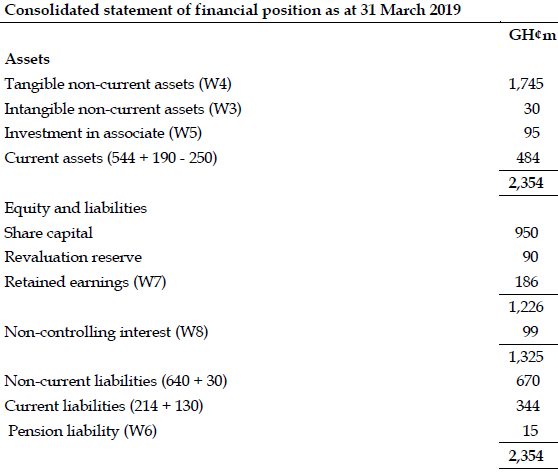

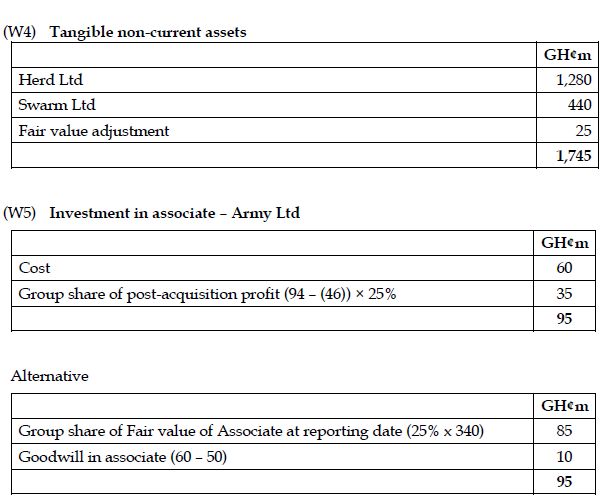

viii) During the year, the Directors of Herd Ltd decided to form a defined benefit pension scheme for its employees. The company contributed cash to it of GH¢250 million but the only accounting entry for this has been to include it in receivables at 31 March 2019.

At 31 March 2019 the following details relate to the pension scheme:

. GH¢m

Present value of obligation 317

Fair value of plan assets 302

Required:

Prepare the consolidated statement of financial position of the Herd Ltd group as at 31 March 2019. (20 marks)

View Solution

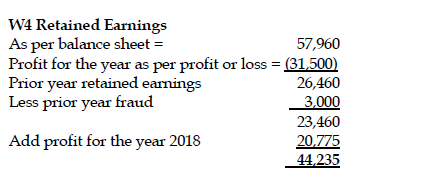

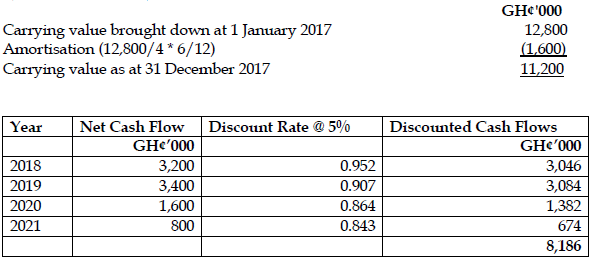

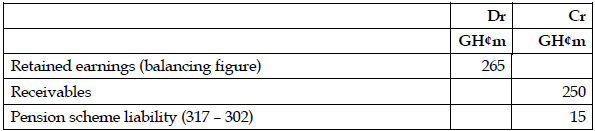

(W6) Pension

The amount paid to set the pension must be removed from receivables, and the net pension liability must be recognised in the statement of financial position.

The double entry to achieve this is as follows:

Tutorial note: The amount recognised in retained earnings is made up of the return on plan assets, interest, current service cost and actuarial gain or loss. If the answer required the preparation of a consolidated statement of profit or loss and other comprehensive income, these amounts would have to be identified separately. This would not be needed when preparing a statement of financial position (and in any case, the necessary information was not provided in the question).

(20 marks evenly spread using ticks)