May 2021 Q5

SEEN MATERIAL

INTRODUCTION

Savior Box Limited (SBL), a private limited liability company, was established in 1974 by James Mensah, a Chemist, who had spotted the opportunity to distribute Over the Counter (OTC) drugs in his local area. James had no ambition to extend the business, seeing it as a means of making enough money to enjoy life with his family. When James retired, his son Edwin Mensah who has been associated with the business since childhood, took over. Edwin has known most of the staff, suppliers and local customers for much of his life.

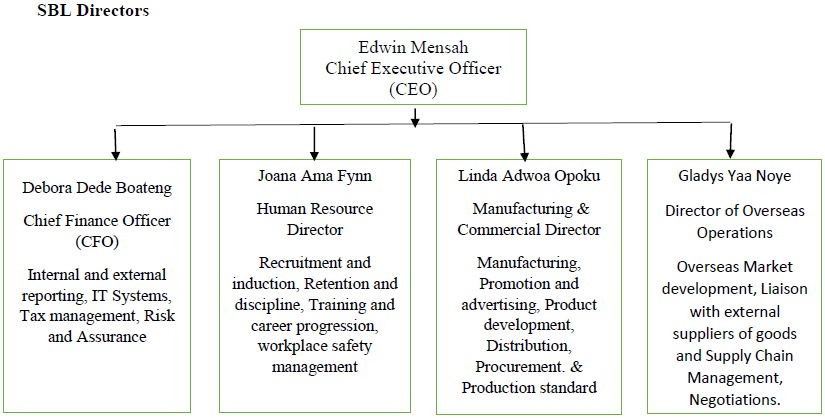

In the last ten years Edwin took over, the business has grown into a pharmaceutical empire with manufacturing, retailing & wholesale distribution and export. It still focuses on pharmaceutical products but now supply companies across the whole of West Africa and beyond. In recent years, he has appointed six directors, including his father, to help him run the increasingly complex organisation after retirement as a non-executive director.

SBL’s BOARD OF DIRECTORS

James Mensah, Non-Executive Chairman

James is a retired business executive who established SBL and worked for many years before his retirement. James was appointed in 2018.

Edwin Mensah, Chief Executive Officer

Until he took over from his father in 2010, Edwin was in charge of the retail and wholesale distribution division of SBL.

Debora Dede Boateng, Chief Financial Officer

Debora was a Senior Accountant with a large commercial food chain before she was appointed to SBL’s Board. She is a qualified accountant. Debora was appointed in 2018.

Gladys Yaa Noye, Director of Overseas Operations

Gladys is a qualified Pharmacist and a Chartered Marketer with specialisation in pharmaceutical products, marketing and distribution. She has worked in several countries with extensive overseas experience. Gladys was appointed Director in 2018.

Linda Adwoa Opoku, Manufacturing & Commercial Director

Linda has held several senior positions in major quoted companies, including Director of Human Resources in one of SBL’s competitors. Linda joined SBL’s Board in 2018.

Joana Ama Fynn, Human Resource Director

Joana trained and practised as a human resource manager in a large production company before joining SBL as a senior HR Manager in 2014. She was promoted to HR Director in 2018.

The Directors of SBL are having sleepless nights and wondering the best solution over the following issues, which they only provided as insight from the latest board minutes summarised below for reason of confidentiality:

- Board remit and effectiveness

- Evolutionary (not revolutionary) change

- The digital opportunity

- Greater need for hands-on pharma experience

- Winning in emerging market

Edwin is aware that the business world is changing rapidly around him, and he needs to be updating the culture, structure and technology used in the business. His decision to appoint the directors two years ago has resulted in a different approach to business and change in the business culture but unfortunately not improving the bottom line, profit. Edwin and the directors agreed at an earlier board meeting that some sort of strategic review was needed. Since none of them had any experience in structuring such an exercise, they decided to obtain an expert to help from outside the business. Blessed Consulting agreed and sent Bismark Guy to dedicate four months on a full time basis for the assignment effective February 2021.

Bismark Guy joined a large West Africa bank after graduation from University as a trainee Accountant. During his first eighteen months with the company, he completed his Institute of Chartered Accountant Ghana (ICAG) examination and, having worked on a variety of projects, was able to gain the experience necessary to award him the designation CA. Having qualified, Bismark was keen to develop his expertise in a wide range of businesses and so left the bank to join a management consultancy firm. Blessed Consulting is based in a country in West Africa but with clients all over the world. His work centred around short project re-imaging in a variety of industries. He advised on best fit organisational structure, governance, improvement to planning and control processes, and was often involved in implementing organisational restructuring (re-imaging).

Bismark enjoyed the opportunity to work on a project that involved reviewing a whole business rather than just one department’s system. During his time with SBL, he carried out a thorough review of the resources, the business development cycle, past business performance, and the business environment in which the company was operating. Recognising that the strategic process ought to be oriented to the future rather than the past, he spent some time talking to the directors, employees and external key stakeholders, including industry competitors.

BISMARK’S INTERNAL REVIEW NOTE OF SBL

SBL is the biggest pharmaceutical company in Ghana. The company is driven by a mission to provide a full range of quality pharmaceutical products at affordable prices and be the preferred supplier in Ghana. With many years of experience in the Pharmaceutical Industry operating as a manufacturer, retailer, and exporter to West Africa’s sub-region.

SBL is a wholly-owned Ghanaian private company.It was founded by Mr. James Mensah as a family business. SBL has made giant strides since the retirement of the founder James Mensah in 2010 and has grown from a single retail outlet into a thriving business entity with its own office complex as headquarters in Ghana, retail & wholesale shops and warehouse facilities across West Africa. SBL also owns a manufacturing plant located in Ghana.

Edwin’s deep insight, knowledge, and experience in the pharmaceutical industry have enabled SBL to continue providing quality and affordable pharmaceutical products to meet everyone’s health needs in Ghana and beyond. SBL has consolidated its position as the biggest distributor of pharmaceutical products with a vast distribution network across Ghana and West Africa’s sub-region. SBL has the largest retail chain of shops, with an ultra-modern pharmacy set up to bring products closer to customers, coupled with perceived exceptional customer service.

Besides the manufacturing of quality and affordable medicine, SBL also has the most prominent Agency representation for multinational pharmaceutical and consumer brands, enabling them to offer the widest range of pharmaceutical and consumer products in Ghana and the sub-region of West Africa.

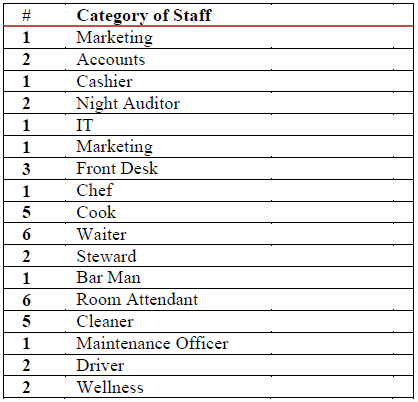

SBL is made up of three main divisions- Manufacturing, Retailing & Wholesale Distribution and Exports. SBL goes beyond the offering of quality and affordable medicine to offer quality customer service. All SBL staff are trained to put the customer’s needs first with the view of exceeding the expectations of customers. SBL has a staff strength of 500 with 54% in the manufacturing division and the remaining 46% in the other divisions at the end of 2020.

Vision

SBL’s vision is to be a leading pharmaceutical company in Ghana and to become a significant global player by providing high quality, affordable and innovative solutions in medicine and treatment.

Mission

SBL’s mission is to be a globally admired pharmaceutical company, providing excellent quality products to its customers and people worldwide. To dedicate itself for humanity’s quest for longer, healthier, happier lives through innovation.

Corporate Objectives

- Source products and raw materials from reputable organisations that will help the company offer top quality products at affordable prices.

- Engage in continuous improvement of customer service and internal processes through research and development.

- Make SBL products more available and accessible to all its stakeholders.

- Be among the largest indigenous African pharmaceutical companies by 2030.

- Treat the planet with respect.

Core Values:

- Transparency: Honest with their clients when examining the needs of the market with precision to meet all their customers’ needs, provide the highest levels of quality for the company’s services in the field of customer service.

- Integrity: Have a high level of ethics and integrity in the provision of everything they do, promote the principles and work ethics among the company’s employees.

- Quality: Have a passion for excellence in quality products and services in every aspect of their business. Innovation and new features and constantly creating value for customers and employees through teamwork at the company.

- Respect: Have a good feeling of pride and high regard for all employees, attract top talent, and maintain a good continuity relationship.

- Teamwork: Encourage cooperation, advice and promote the spirit of teamwork. The company employees are familiar with the policy of total commitment to quality which will reflect the spirit necessarily when they are doing business.

SBL’s DEVELOPMENT AND GROWTH STRATEGY

In line with its vision, mission and corporate objective, SBL operates three divisions of Manufacturing, Retailing & Wholesale Distribution and Export to ensure efficient and effective operations. The divisions are headed by managers who provided goods and services to other divisions of the same organisation using transfer pricing. This ensures that SBL achieves goal congruence for the entity while not losing sight of each division’s autonomy.

Manufacturing Division

It was established six years ago to maintain a high standard of quality in manufacturing pharmaceutical products. Through the manufacturing division, SBL is able to meet the health needs of all segments of the market with affordable medicine. The manufacturing division of SBL started operation in the year, late 2015. The manufacturing plant is located in the Heavy Industrial area along the coast of Ghana to ensure access to cheap but skilled labour and easy logistics and supply chain management.

Following the report submitted by the consultant, the division noted that the plant is obsolete and not competitive, resulting in higher production cost and an increase in wastage. Additionally, the plant has higher setup cost with spare part not readily available on the local market to support its smooth operation. The plant was procured from a far Eastern country with no back up after-sales service support.

Product range and plant capacity

Currently, there are four product range in their plant, capable of producing on an annual basis and in a single shift the following dosage forms and their quantities as indicated below:

- Capsules – 37 million units: Optimal production capacity 84 million units annually.

- Liquids – 6 million units: Optimal production capacity 24 million units annually.

- Powders – 15 million units: optimal capacity 60 million units annually.

- Tablets – 450 million units: Optimal capacity 2 billion units annually.

Most of the product range are tropical medicine which is SBL’s competitive advantage. SBL’s manufacturing division produces about Two hundred (200) different Finished Pharmaceutical Products for the Ghanaian, West African and Africa markets.

SBL has initiated an ongoing investment program to build a new and fully Good Manufacturing Practice (GMP) compliant facility to complement their current output generation effort. This facility, upon completion, shall increase output generation by about 300 percent with a readily available market to absorb the products.

Quality Policy is also in place with a summary highlighted below:

- Produce safe, efficacious and affordable pharmaceuticals delivered as per agreed quality, agreed quantity and agreed time.

- Satisfy regulatory, statutory and current Good Manufacturing Practice requirements.

- Recruit qualified and experienced personnel and continuously develop their competence.

- Establish and implement quality objectives at all levels of the organisation.

- Institute and maintain a company-wide quality culture.

SBL is also committed to conducting its manufacturing processes to protect the health and safety of its employees, visitors, contractors, stakeholders, and the public. The aim is to remove or reduce the risks to the health, safety and welfare of all employees, contractors and visitors, and anyone else who may be affected by its operations.

Summary of industry best manufacturing practices standard committed below:

- Provide a safe working environment and safe systems of work.

- Ensure the plant and equipment are in a safe condition.

- Provide facilities for the welfare of all employees.

- Provide information, instruction, training and supervision that is reasonably necessary to ensure that each employee is safe from injury and risks to health.

- Have a commitment to consult and co-operate with workers in all matters relating to health and safety in the workplace.

- Commit to improving performance through effective safety management continually.

Retailing and Wholesale Distribution

SBL provides a full range of quality pharmaceutical products at affordable prices to all their customers. This philosophy allows them to contribute to the health needs of everyone in society. They are the largest pharmaceutical retailing and wholesale distribution company in Ghana, with their extensive distribution channels and warehouse facilities nationwide. Additionally, their fleet of over 160 trucks, vans and cars ensure that their products reach every corner of the country. This vital function is performed by its strong team of Medical and Sales Representatives. They work round the clock to ensure the delivery of quality and affordable medicines to every customer at a competitive price.

SBL uses prequalified independent pharmaceutical distributors, retail pharmacies, and chemical sellers to augment its warehouses, wholesales, and retails (pharmacies) to reach its customers/consumers. Government medical stores, hospitals, clinics and private health facilities are key partners to their business value chain.

The planned expansion programme is on course to add new wholesales and pharmacies to the network. Their objective is to get closer to the customer, thereby reducing the cost of doing business and increasing the bottom-line profit.

Export

SBL continue to extend their vast distribution network to provide quality and affordable medicines to other parts of West Africa and the rest of Africa. This is in line with their vision to be among the top ten indigenous African pharmaceutical companies.

Well planned export activities commenced within SBL since the establishment of the manufacturing plant in 2015. Before forming the Exports Division, they had already embarked on several prospective activities in West African countries. The cumulative effect of those activities is the leverage SBL has gained in some West African countries initiated by Edwin after his father’s retirement.

SBL exports have mainly been pharmaceutical products manufactured locally in Ghana. They opened their first wholly-owned subsidiary in Freetown, the capital of Sierra Leone, in September 2017 known as GOOD HEALTH Pharma Limited. In addition, they also operate through accredited distributors in the under listed countries:

- Gambia-PK Pharmaceuticals, formerly OJAY Pharmacy

- Liberia-BEST Pharmacy and PAA Pharmacy Ltd

SBL is also gaining a foothold in the Nigerian market and has completed the registration of some of its brands in that country. Fortunately, Nigeria and Ghana Company laws are similar following the adoption of the ECOWAS market integration treaty. Plans are therefore afoot to establish a subsidiary of SBL in Nigeria. In addition to the above efforts to grow its distribution network across Africa, SBL has started making efforts to operate in Benin and Burkina Faso but their challenge is language and stringent French law.

To gain visibility and aid its mission to provide quality and affordable medicine to other parts of Africa, they participate in international trade exhibitions in several African countries, including South Africa, Morocco, Egypt, and Kenya.

With the results achieved so far, they are confident that SBL is poised to increase its reach and impact in West Africa and beyond. There are plans to enter other Africa countries in the near future, with the test market ongoing. They derive fulfilment from their growing capacity to bring quality and affordable medicines to other African countries.

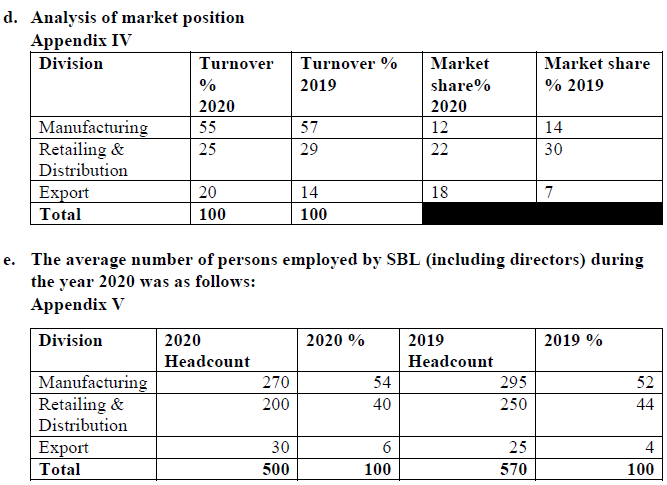

MARKET POSITION REPORT

SBL is suffering due to the fragmented nature of the markets. Growth rates in most of the divisions served have fallen steadily over the last three years due to external competition from overseas rivals, and SBL is now facing a series of market that is stagnant or in decline. While SBL is still profitable due to substantial market shares, it is unreasonable to expect the situation to continue indefinitely. Zero growth is forecast in the SBL current market for the next four years due to overseas rival aggressive market penetration in Ghana and West Africa.

Over the last ten years, SBL has established itself as the market leader in manufacturing, retailing and wholesale distribution, but this has been hard work. The export has a lot of choices and strong market bargaining power. Margins are reasonable for the export division with growth potential but struggling to compete with the new entrant’s rivals. This sector is encouraging, but the business model is not supporting leveraging the potential for growth since only 6% of the staff effort is directed toward this part of the business. Manufacturing is still causing major problems due to price competition from overseas rivals, making SBL a small fish in a big pond.

COMPETITORS ANALYSIS

Key Companies to Watch

YELLOW PLC

YELLOW PLC is the second-largest local manufacturer in the private sector and the second-largest supplier to the public sector in West Africa. It is among the few companies to supply a wide range of generic antiretrovirals (ARVs), including the triple therapy combination, to the public sector through a highly competitive tender system. Besides operating in Sub-Saharan Africa, the company has more recently ventured into the Indian market for an alternative supply source of cheaper generic drugs and expanding its geographic footprint.

GREEN PLC

GREEN PLC, one of the leading pharmaceutical companies in China, is one of the leading exporters of generics to West Africa. The company’s product range includes vitamins, antibiotics, analgesics, cardiovascular, respiratory, and cerebrovascular medicines. The company focuses primarily on the public sector and has recently won several tenders in teaching hospitals in Ghana.

RED LTD

RED Ltd, a subsidiary of Health Professional PLC., is one of the leading pharmaceutical distributors in Nigeria, handling about 30% of pharmaceuticals sold and distributed across the country. Entering Ghana a couple of years ago, RED Ltd is growing steadily in the Ghanaian pharmaceutical industry. Given the recently formed alliance with BOSTER Logistics (June 2020), the company plans to expand its coverage and further strengthen its distribution network.

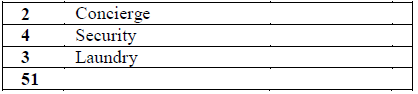

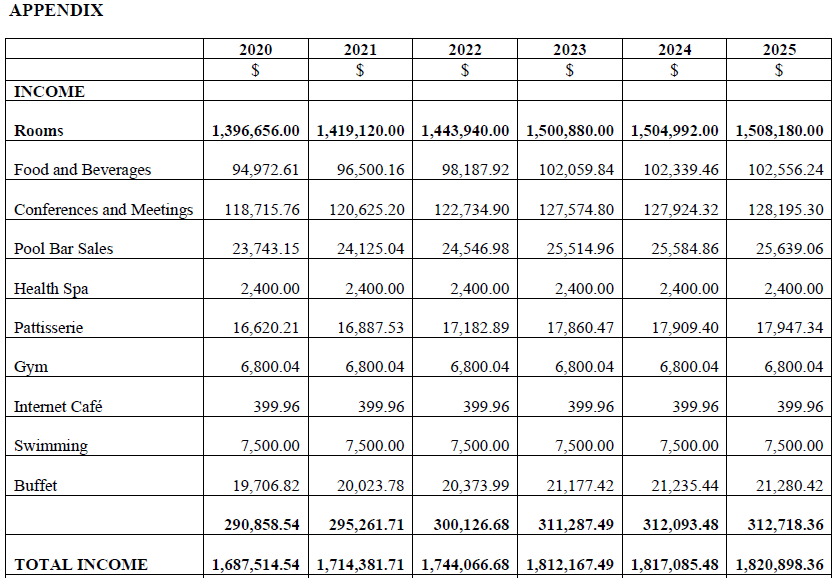

SBL FINANCIAL STATEMENTS

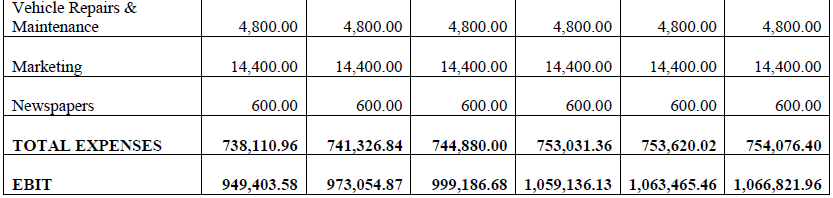

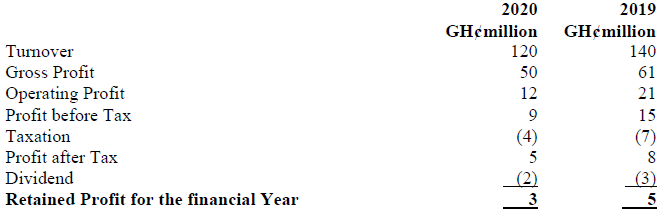

Summary Statement of Financial Performance for the year ended 31 December 2020

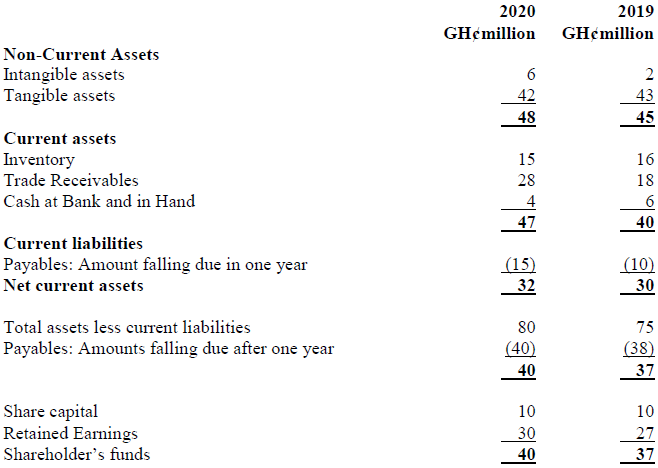

Statement of Financial Position as at 31 December 2020

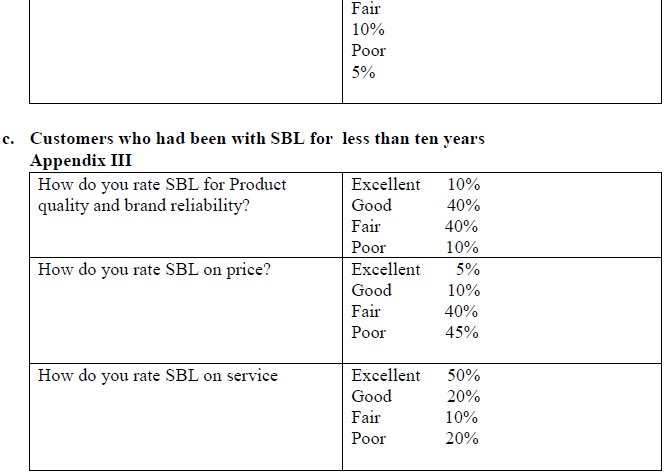

ANALYSIS OF TURNOVER BY PRODUCT GROUP AND AREA

BISMARK EXTERNAL REVIEW NOTE: PHARMACEUTICAL INDUSTRY IN GHANA

Executive Summary

In 2020, the pharmaceutical industry in Ghana was valued at GH¢1.15 billion. It is expected to witness a compound annual growth rate (CAGR) of 21.4% and generate a revenue of GH¢2.06 billion by the end of 2023.

SBL accounted for 5.65% of the total Ghanaian pharmaceutical industry’s revenue in 2020 because of its large size, while others accounted for the remaining 94.35%. The pharmaceutical industry in Ghana is fragmented. In 2020, the generic pharmaceutical segment represented the highest revenue share of 51%, while the branded pharmaceutical segment represented the least. The over-the-counter (OTC) pharmaceutical segment is considerably large in Ghana, constituting 59.34% of the total pharmaceutical industry, attributable to a large number of local manufacturers, particularly in the anti-infectives, analgesics, and multivitamins product segments.

In 2020, the anti-infectives therapeutic segment accounted for the highest revenue share of 30.02% of the total pharmaceutical industry in Ghana. It is expected to witness a high CAGR from 2021 to 2024 and remain the largest therapeutic segment during the forecast period. Although the oncology therapeutic segment accounted for the smallest revenue share in 2020, it is expected to be the fastest-growing segment during the forecast period, given the increasing awareness about cancer in Ghana.

The recent achievement of 84% National Health Insurance Scheme (NHIS) coverage in Ghana in 2020 is expected to result in high growth of the pharmaceutical industry, particularly the prescription pharmaceutical (generic and branded) segment, because of easy accessibility and affordability of medicines. The judicious efforts of the Food and Drugs Authority (FDA) in Ghana to control parallel trading and imports of counterfeit drugs are expected to contribute to the growth of Ghana’s legitimate pharmaceutical industry. Furthermore, the government is also encouraging the local production of essential medicines to improve capacity utilisation and reduce imports.

Market Segment

The Ghanaian pharmaceutical industry can be broadly divided into three main segments: branded, generic, and over-the-counter (OTC) pharmaceuticals. Branded pharmaceuticals include research and patented prescription drugs sold by innovator companies, particularly multinationals, through local distributors in Ghana. Generic pharmaceuticals include prescription drugs produced and imported into Ghana by generic companies from India and China and sold through local distributors. OTC pharmaceuticals include drugs sold directly to consumers without a healthcare professional’s prescription by local pharmacists and chemists.

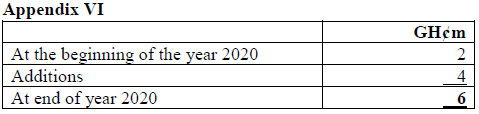

f. Intangible Assets: research and development cost

Intangible assets relate to the development of new products. Since the products are not yet on the market, no amortisation has been recorded.

ADDITIONAL INFORMATION

Final Bismark Note for SBL Directors discussion

The note below was obtained as part of Bismark’s engagement with Directors of SBL’s competitors in other to help SBL formulate a sustainable growth strategy. The West Africa region currently enjoys a stable political, legal and economic system. Recent attempts to improve the economy have been largely successful, with inflation projected between 5% – 10% in the past two years. Business taxation is likely to remain at an average of 40%. Government payment shall continue to be the main challenge with the associated negative impact on the businesses’ cash flow since it is the industry’s largest customer.

Summary of Chief Executives Officers (CEO’s) Perspective

- Pharmaceutical companies must understand the similarities and differences in market optimisation strategies to ensure maximum profit and product accessibility by patients.

- GREEN PLC and RED Ltd are the leading Multinational Companies (MNCs) in Ghana because of their decentralised decision-making system and strategic relationship with stakeholders.

- Public tenders are attractive target segments for large revenues and long-term commitment, especially MNCs and foreign market participants.

- Urban centres are expected to be responsible for about 75% of Ghana’s growth over the next 15 years. Thus the regional capital contributed 64% of Ghana’s overall share of the market in 2020.

- Government procurement through competitive tenders is the cheapest despite the process bottlenecks but contributes significantly to the Pharmaceutical Industry’s bottom line.

- Government is the main contributor to the industry’s cash flow problems due to delays in payments after supplies to central medical stores.

Summary of Chief Finance Officer’s (CFO’s) Predictions

- Branded pharmaceuticals are expected to adopt a differential pricing strategy specific to patient segments and geographies in West Africa to make treatment affordable to a large group of patients, thereby significantly expanding their customer base.

- Foreign traders in West Africa are expected to bolster their distribution channels by engaging in strategic partnerships with trustworthy local stakeholders.

- Given the immense growth potential and business opportunities, it is expected that companies would invest significantly in their marketing capabilities, patient awareness programmes, and treatment support services to enhance brand loyalty.

SECTION B

5) Bismark’s four months consultancy service contract was running out of time with so much yet to be done. He then contracted you as a Consultancy Business Support Advisor to summarise his work to enable him meet with the Directors of SBL. He provided you with the following format to use to ensure that all issues reviewed are covered:

i. Title page

ii. Table of contents

iii. Introduction

iv. Executive Summary

v. Body of the report

- Business environment analysis

- Industry background

- Competitor analysis

- Market Analysis

- Operations analysis

- Management Summary

- Financial Performance

vi. Conclusions and recommendations (20 marks)

View Solution

i. Title page

The title page is there to attract readers to the report and assist them in finding the report later. The following should be covered:

- Title (any sub-titles) should distinguish the report and ensure it is easily identifiable from others.

- Author since the report is for internal use only

- Degree of confidentiality

- Date (1 mark)

ii. Table of contents

The table of contents is a list of all the sections that are included in the report (in the same order in which they appear plus relevant page numbers, for example

SBL internal review summary report

SBL external review with a focus on the pharmaceutical industry in Ghana

SBL competitor analysis with an emphasis on directors and Chief Finance Officers perspectives and predictions (2 mark)

iii. Introduction

The introduction prepares the reader (Bismark Guy) for the report itself by reminding him of what he already knows for example why the report has been written and the question that the report answers by

Make the subject of the report clear, i.e. support of Bismark Guy extract notes summary.

State the purpose of the report, i.e. to be presented to SBL directors (1 mark)

iv. Executive Summary

The benefit of including an executive summary is for senior management with little time to go through or read. Therefore, a concise, clear, and well written executive summary should include the following:

- What the report is about

- What the problems are

- The conclusions the writer arrived at

- What the writer recommendation

The skill in writing the executive summary is to give the overall picture without including too many details. (4 marks)

v. Body of the report

The body of the report heading provided by the Bismark. The headings are essential ‘signposts’ that allow Bismark to navigate to the relevant details of the report in a logical fashion to further investigate when he read the executive summary:

- Business environment analysis- Brief SWOT analysis:

* Strength: business employs a high skill and dedicated staff

* Weakness: Obsolete plant with no after sales service producing well below capacity, challenging start time etc.

* Opportunity: Huge demand for the business products overseas with potential to increase export market share in West Africa and beyond

* Threat: A large number of new competitors forming strategic alliances to dominate and government procurement and payment delays - Industry background- pharmaceutical industry which provides both product and service

- Competitor analysis- who are the main competitors?

- Market Analysis- Size, segmentation and potential growth and challenges

- Operations analysis- operations challenges

- Management Summary- who the management personnel are and their background.

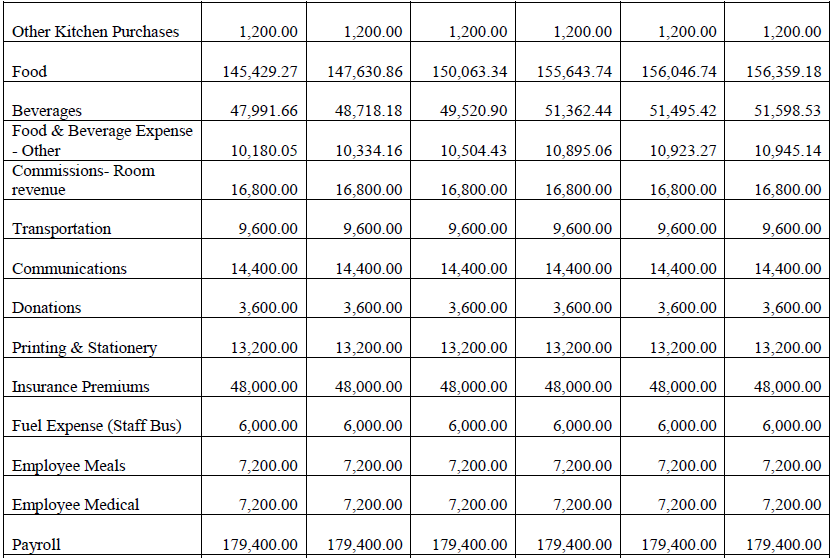

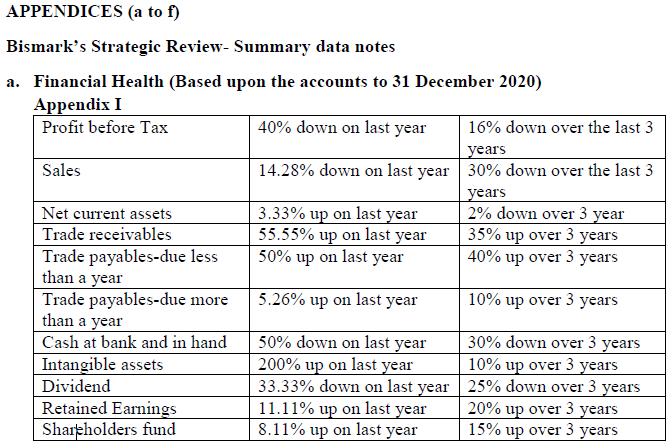

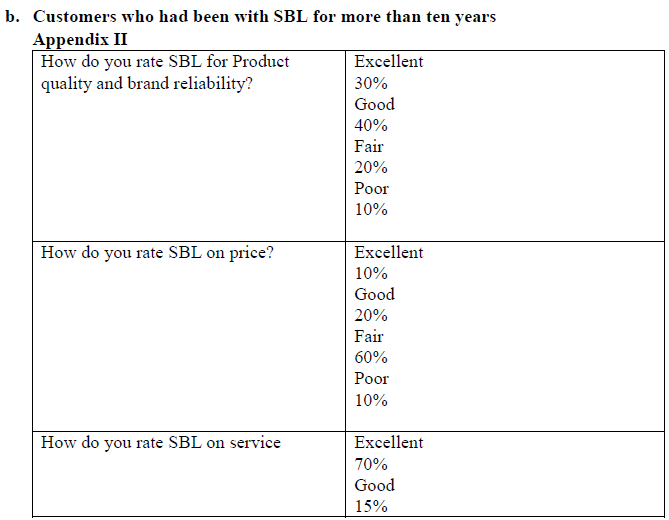

- Financial Performance – Summary of financial information, income statement, statement of financial position and highlight performance challenges based on the ratios provided in the case study appendices. (9 marks)

vi. Conclusions and recommendations

- Do the conclusion and recommendations follow logically from the rest of the report (draw out the main points of the report and present a considered judgement to support Bismark discussion with the SBL board of directors: only draw conclusions that are justified by the evidence and facts contained in the body of the summary report: make recommendations based only on discussion and conclusions: No now line of argument or material in the conclusions and recommendations that is not part of the body of the summary report

- Check conclusions and recommendations against the original objective (summary Bismark work for discussion with the board of SBL)

- Ensure the conclusions and recommendations answer the reader (Bismark) key questions to facilitate his engagement with the board of SBL. (3 marks)