May 2018 Q2 a.

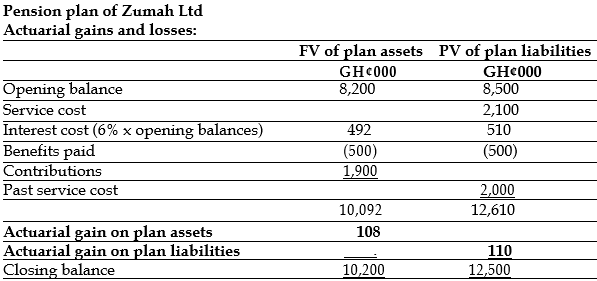

Zumah Ltd operates a defined benefit pension plan for its employees. At 1 April 2015 the fair value of the pension plan assets was GH¢8,200,000 and the present value of the pension plan liabilities was GH¢8,500,000. The Actuary estimated that, the service cost for the year to 31 March 2016 was GH¢2,100,000. The pension plan paid GH¢500,000 to retired members and Zumah Ltd paid GH¢1,900,000 in contributions to the pension plan in the year to 31 March 2016. The Actuary estimated that, the relevant discount rate for the year to 31 March 2016 was 6%.

On 31 March 2016, Zumah Ltd announced improvements to the benefits offered by the pension plan to all of its members. The Actuary estimated that, the past service cost associated with these improvements was GH¢2 million. At 31 March 2016 the fair value of the pension plan assets was GH¢10,200,000 and the present value of the pension plan liabilities (including the past service costs) was GH¢12,500,000.

Required:

In accordance with IAS 19 Employee Benefits:

i) Calculate the net actuarial gain or loss that will be included in Zumah Ltd’s other comprehensive income for the year ended 31 March 2016. (3 marks)

View Solution

The net actuarial gain in OCI is GH¢218,000 for the year.

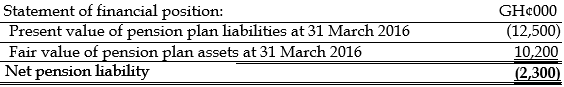

ii) Calculate the net pension asset or liability that will be included in Zumah Ltd’s statement of financial position as at 31 March 2016. (2 marks)

View Solution