Nov 2015 Q5 a&b

a) It has been suggested that ratio analysis is not necessarily the best way of assessing a company’s performance.

Required:

i) Describe TWO (2) items of information which should be looked at to make ratio analysis more meaningful. (3 marks)

View Solution

i. The content of any accompanying commentary on the accounts and other statements.

ii. The age and nature of the company’s assets.

iii. Current and future developments of the company’s business interests.

iv. Any other noticeable features of the report and accounts, such as post balance sheet events, contingent liabilities, a qualified auditor’s report, the company’s taxation position, etc.

ii) Explain FOUR (4) limitations of the use of accounting ratios in appraisal of financial performance. (4 marks)

View Solution

1. Inconsistent definitions of ratios

2. Financial statements may have been deliberately manipulated (creative accounting)

3. Different companies may adopt different accounting policies (e.g. use of historical costs compared to current values)

4. Different managerial policies (e.g. different companies offer customers different payment terms)

5. Statement of financial position figures may not be representative of average values throughout the year (this can be caused by seasonal trading or a large acquisition of non-current assets near the year-end)

6. The impact of price changes over time/distortion caused by inflation.

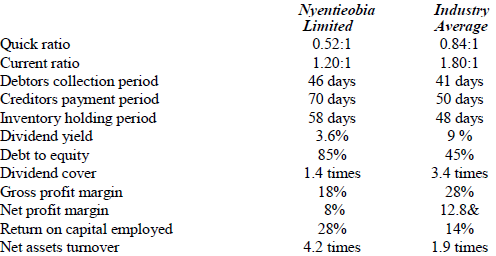

b) Below are the financial ratios for the year 2014 for Nyentieobia Limited, a company engaged in the buying and shipment of shea butter products. The ratios for the industry have also been provided.

Required:

Provide an assessment of Nyentieobia Limited in comparsion with the industry in respect of profitability, liquidity, efficiency and shareholders’ investment. (8 marks)

View Solution

- Profitability:

Both gross profit margin and net profit margin have fallen below the industry average. This may be the result of uncontrolled overhead cost on the presence of large obsolete equipment. Unless steps are taken quickly to improve the income account investors may shift their interest into more profitable companies in the industry. - Liquidity:

Both quick and current ratios fall far below those of the industry as confirmed by the fact that it takes longer to collect its debt than the industry. The problem may have been worsened by the fact that inventory stay longer at Agrimore Ltd than in the industry which is not the best use to which resources should be put. - Efficiency:

Even though Agrimore Ltd takes longer to collect its debts (5 days), this is compensated by an even longer time to settle the debts (20 days). This means that creditors provide free finance for its operations. However, the holding on to inventory for a long time (10 days) cannot be justified. This should be turned over in like manner as that assets turnover far exceeds that of the market. - Shareholders’ Investment:

Both dividend cover and dividend yield fall below that of the industry. Such a situation is not likely to excite investors especially income – oriented investors who are seeking to recoup their investment in the shortest time possible. This poor performance may be due to the fact that high gearing ratio of Agrimore Ltd has effectively put its future in the hands of debenture holders who are reaping the bulk profits in the form of interest charges.