May 2019 Q2 c.

IAS 20: Accounting for Government Grants and Disclosure of Government Assistance sets out the requirements for recognising as income any grants received from government agencies, together with any repayments of such grants.

Required:

Detail the requirements of IAS 20 with respect to government grants to aid capital expenditure. (3 marks)

View Solution

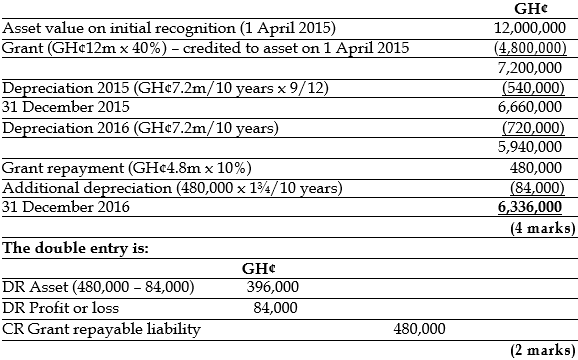

- Grants in respect of capital expenditure are to be recognised within income as the related assets are expensed to income. This normally happens through depreciation or sale. On receipt of a capital grant, there are two options open to an entity under IAS 20 Accounting for Government Grants and Disclosure of Government Assistance.

- First, the grant may be credited to the asset account in respect of which the grant is received. This has the effect of lowering the carrying value of the asset, with a consequential reduction of any depreciation charge. This has the effect of benefiting the profit for the accounting periods in which the asset is used. This method is primarily a legacy of the income-statement driven approach to accounting. The Conceptual Framework currently in issue is financial position driven. Showing an asset at a cost net of grants would conflict with the framework.

- The second allowable method is the deferred income approach. Under this method a capital grant is credited to a separate account on receipt. This account is held as a liability, and amortised over the period expected to benefit from the asset’s use. The asset is kept at its cost less depreciation. The net effect on the profit or loss is the same as under method 1, but the balances in the statement of financial position are more likely to reflect the true asset values. As such, this method is more aligned with the philosophy of current accounting standards.