Nov 2016 Q1

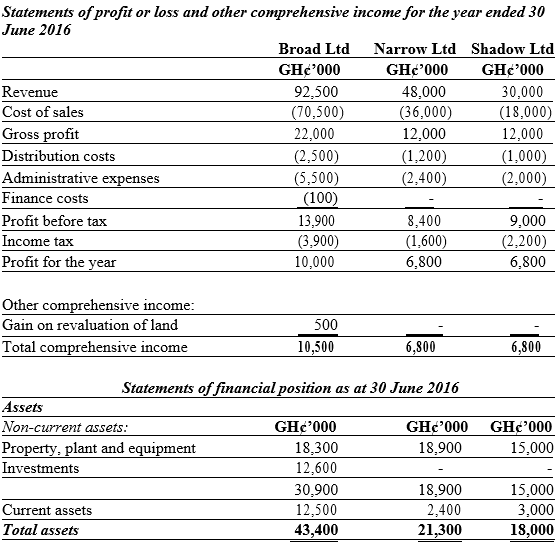

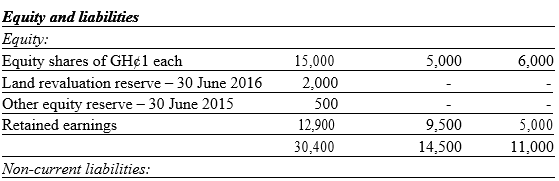

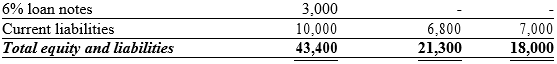

Below are the separate financial statements of Broad Ltd and two investee companies which also operate in the same industry as the investor entity.

The following information is relevant:

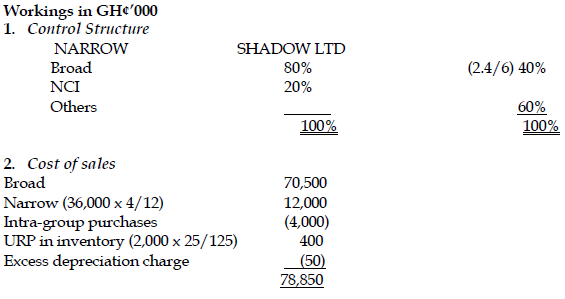

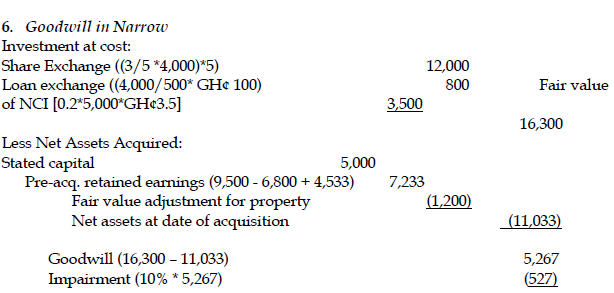

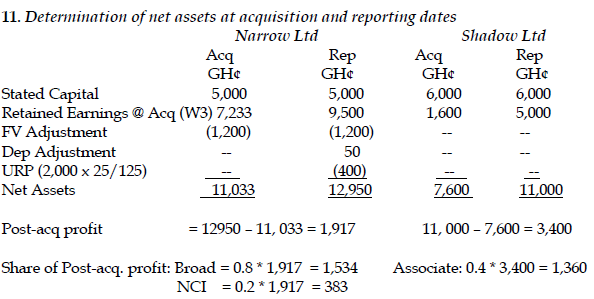

i) On 1 March 2016, Broad Ltd acquired 80% of the equity share capital of Narrow Ltd. The consideration consisted of two elements: a share exchange of three shares in Broad Ltd for every five acquired shares in Narrow Ltd and the issue of a GH¢100 6% loan note for every 500 shares acquired in Narrow Ltd. The share issue has not yet been recorded by Broad Ltd, but the issue of the loan notes has been recorded. At the date of acquisition, shares in Broad Ltd had a market value of GH¢5 each and the shares of Narrow Ltd had a stock market price of GH¢3.50 each.

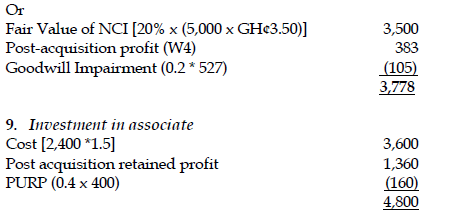

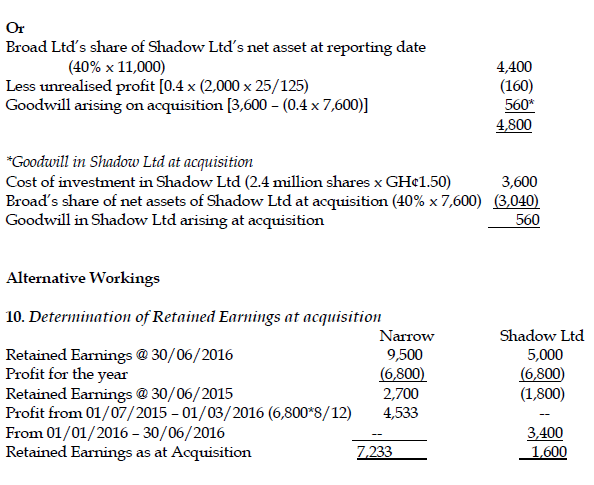

Broad Ltd had earlier on acquired 2.4 million shares in Shadow Ltd on the stock market at a price of GH¢1.50 per share on 1 January 2016.

ii) At the date of acquisition, the fair values of Narrow Ltd.’s assets were equal to their carrying amounts with the exception of its property. This had a fair value of GH¢1.2 million below its carrying amount. This would lead to a reduction of the depreciation charge (in cost of sales) of GH¢50,000 in the post-acquisition period. Narrow Ltd has not incorporated this value change into its separate financial statements.

iii) Broad‘s group policy is to revalue all properties to current value at each year end. On 30 June 2016, the value of Narrow‘s property was unchanged from its value at acquisition, but the land element of Broad Ltd.’s property had increased in value by GH¢500,000 as shown in other comprehensive income.

iv) Sales from Narrow Ltd to Broad Ltd throughout the year ended 30 June 2016 was GH¢12 million. Narrow made a mark-up on cost of 25% on these sales. Broad Ltd had GH¢2 million (at cost to Broad Ltd) of inventory that had been supplied in the post-acquisition period by Narrow Ltd as at 30 June 2016.

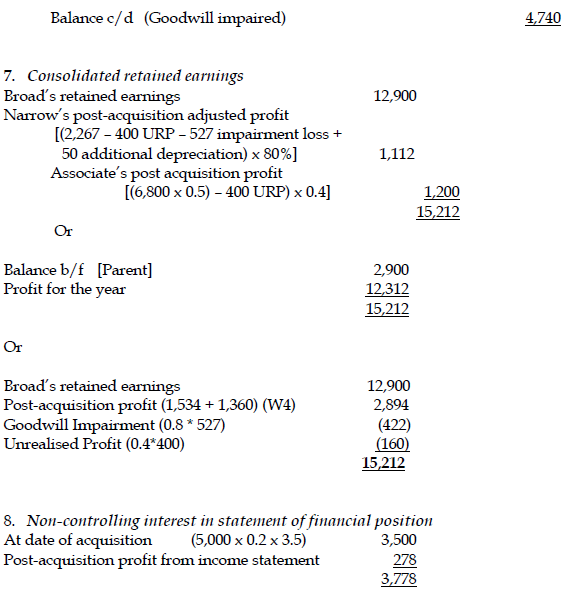

v) In June 2016, Broad Ltd sold goods to Shadow Ltd for GH¢2,000,000, thus achieving a profit mark-up of 25%. The entire consignment remained unsold and was included in the inventory of Shadow Ltd as at 30 June 2016.

vi) Broad’s investments include some available-for-sale investments that have increased in value by GH¢300,000 during the year. The other equity reserve relates to these investments and is based on their value as at 30 June 2015. There were no acquisitions or disposals of any of these investments during the year ended 30 June 2016.

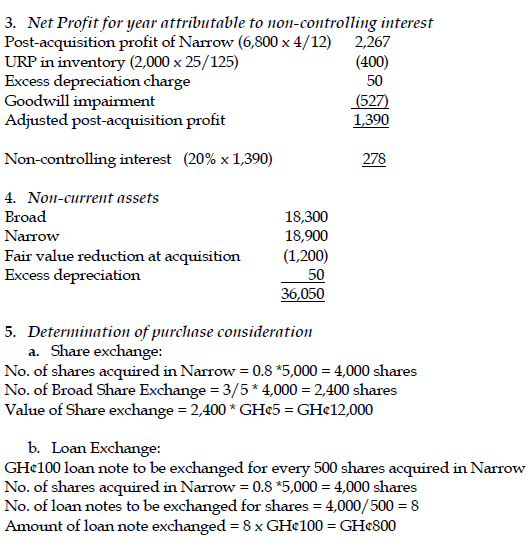

vii) Broad’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, Narrow’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest.

viii) It was determined at the year-end that 10% of the goodwill relating to the acquisition of Narrow was impaired.

Required:

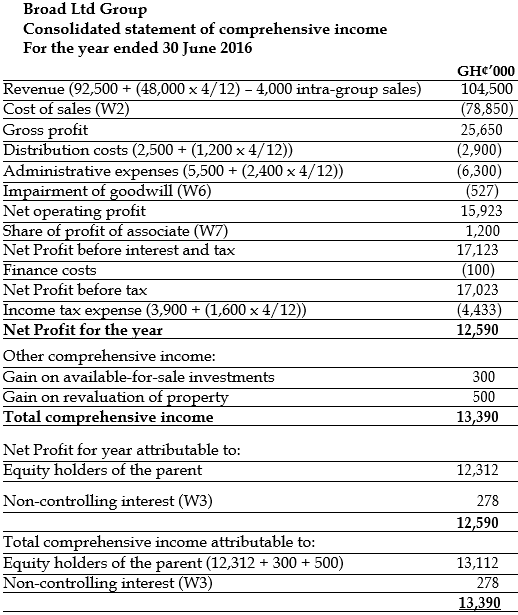

a) Prepare the consolidated statement of profit or loss and other comprehensive income for Broad Ltd. Group for the year ended 30 June 2016. (10 marks)

View Solution

Note: Narrow’s profits for the year ended 31 December 2015 of GH¢6.8 million are GH¢4.533 million (6,800 x 8/12) pre-acquisition and GH¢2.267 million (6,800 x 4/12) post-acquisition.

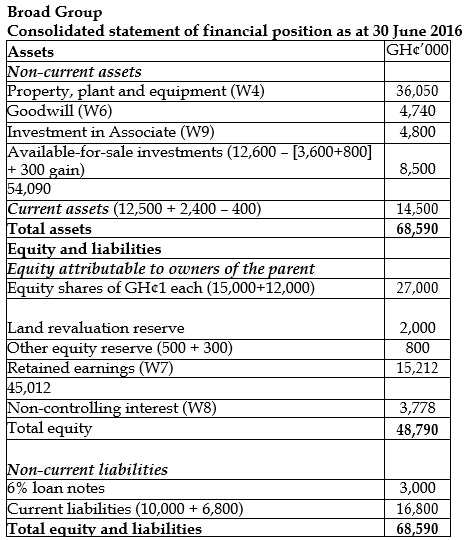

b) Prepare the consolidated statement of financial position for Broad Ltd. Group as at 30 June 2016. (10 marks)

View Solution

View All Workings