May 2021 Q4 a.

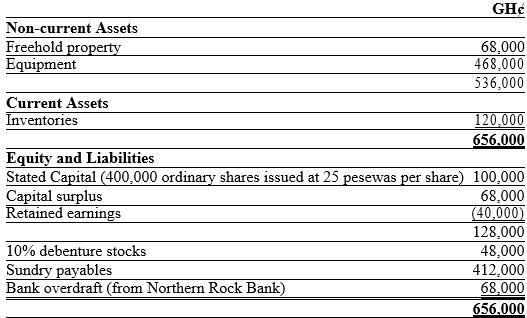

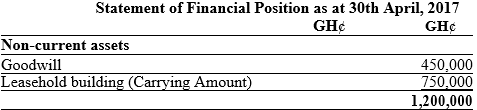

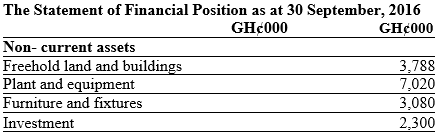

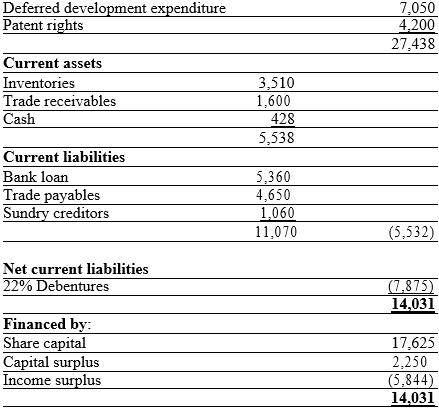

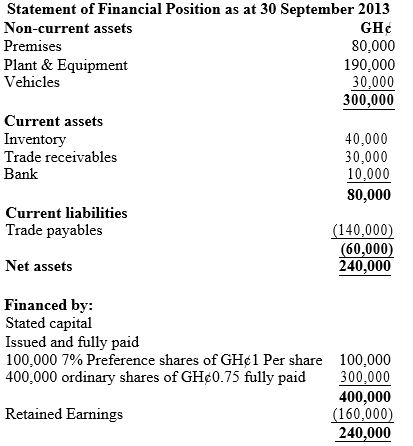

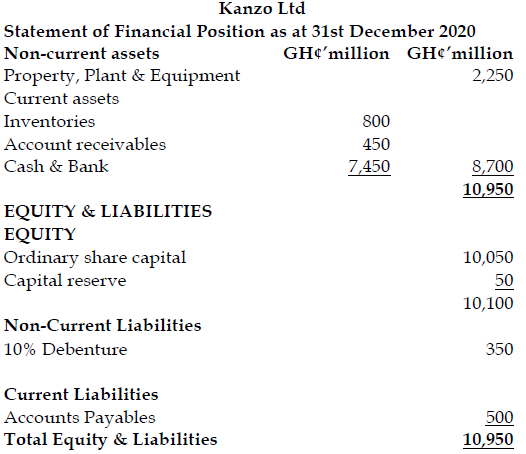

Kanzo Ltd (Kanzo) is a company located in the Savannah Region. The company was strategically located to produce cashew nuts and to take advantage of available tax incentives. However, the company has incurred trading losses for many years now. The Directors are considering the alternatives of liquidation and capital reduction. The company’s Statement of Financial Position as at 31 December 2020 is as follows:

You are provided with the following additional information:

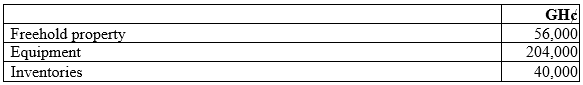

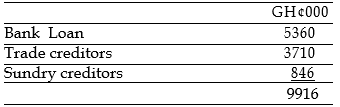

- In the event of a forced sale, the assets would probably raise the following amounts.

. GH¢’million

Property, Plant and Equipment 1,500

Inventories 400

Accounts receivable 450 - The company is developing a new product, which is expected to generate profit before interest and tax of GH¢500 million per annum in anticipation of an immediate capital injection of GH¢2,000 million.

- The Ordinary share capital should be written down to 200 million shares of GH¢1.00 each. In addition, they have agreed to provide the immediate capital injection.

- The 20% preference shares are to be converted into 500 million ordinary shares valued at GH¢1 per share.

- It is proposed for GH¢650 million of the 25% Debentures to be converted into ordinary shares at GH¢1 per share and the remainder to be converted into GH¢350 million 20% Debentures.

- Accounts payables to accept immediate payment of 50% and a moratorium of six (6) months in payment of the remaining balance. New supplies would be paid for on delivery.

- A two-for-one rights issue will be made at a price of GH¢1 per share for cash after the above conversions.

- Property, plant and equipment are to be revalued at GH¢2,250 million, inventories at GH¢800 million and Accounts Receivables at GH¢450 million.

- The accumulated losses and intangible assets are to be written off.

- The corporate tax rate is 25%.

- Liquidation expenses will amount to GH¢10 million.

Required:

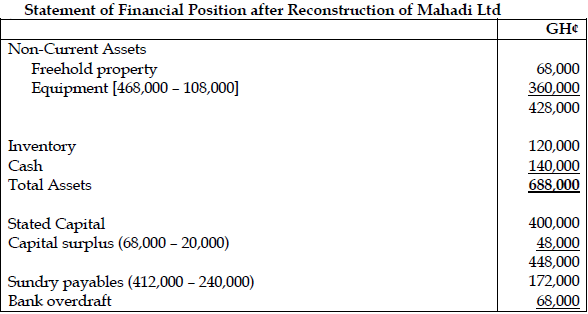

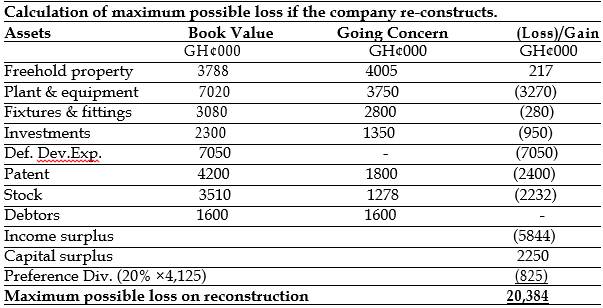

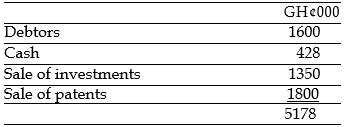

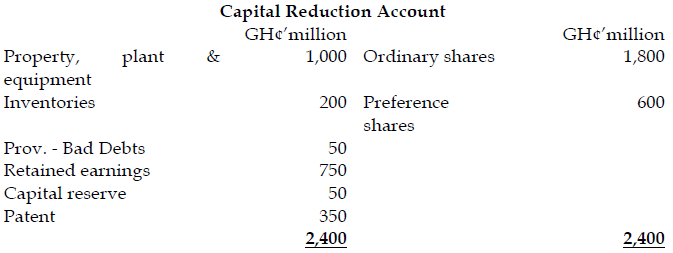

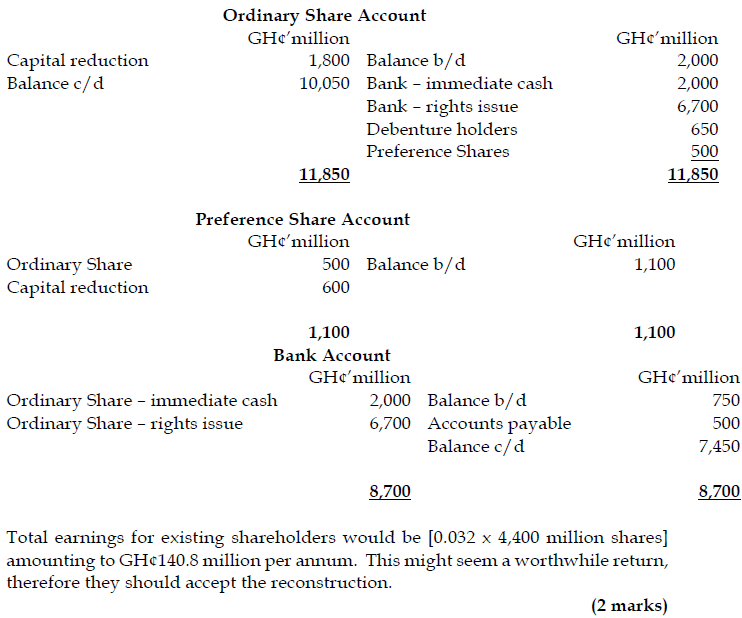

i) Prepare a Statement of Financial Position after reconstruction on the assumption that the capital injection took place. (6 marks)

View Solution

. (6 marks)

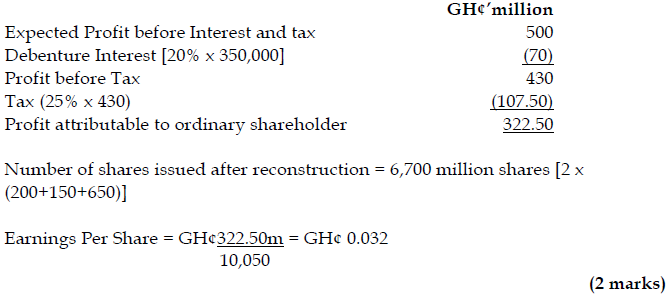

ii) Compute the expected profit after tax and the earnings per share after the reconstruction. (2 marks)

View Solution

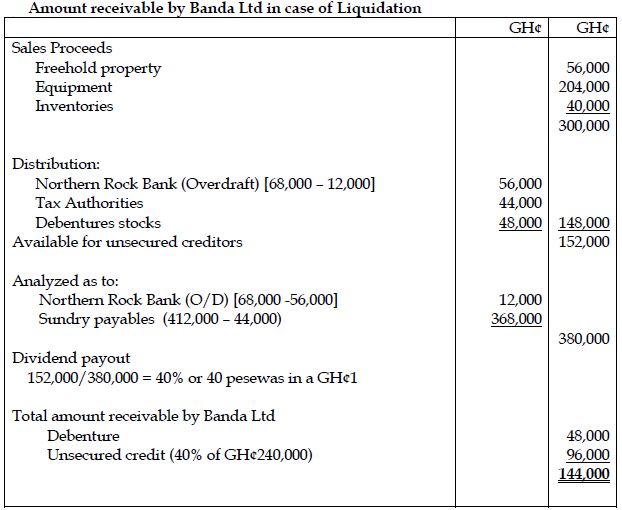

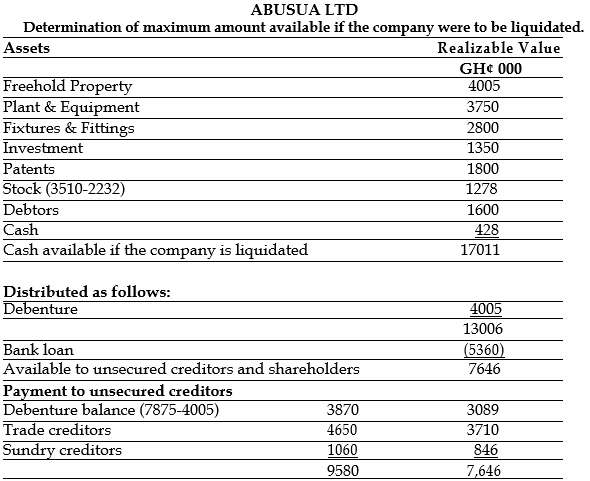

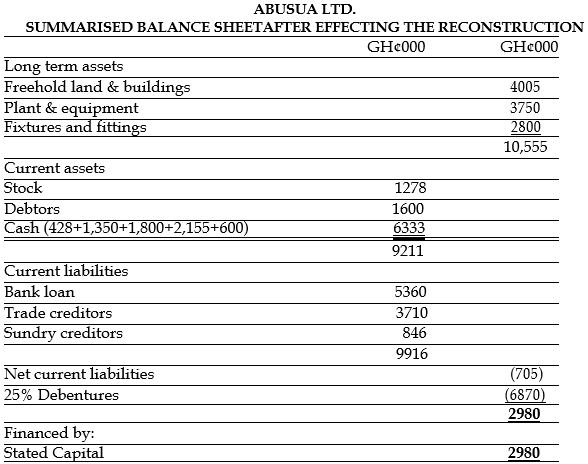

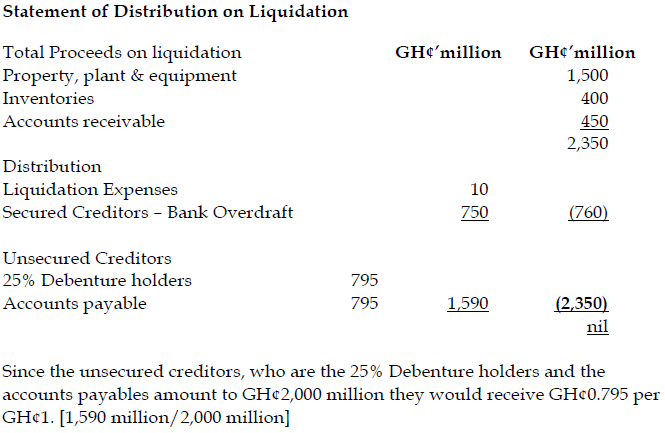

iii) Prepare a statement of distribution if the company were to be liquidated now. (2 marks)

View Solution

iv) Describe the steps the Directors of Kanzo Ltd should follow to appraise the proposed scheme of reconstruction with an emphasis on the interest of shareholders. (5 marks)

View Solution

Steps to follow to appraise a scheme

- A scheme of capital reduction will affect the rights of the various parties who have a financial stake in the business including shareholders.

- The starting point is to construct a working showing how much cash could be raised in the event of liquidation and to whom that cash would be paid. This would provide an indication as to how much shareholders are to gain or lose.

- The scheme is designed to take this information into consideration. The party with the most to gain from the scheme (usually the shareholders) would have to demonstrate their commitment to the scheme by carrying the larger share of its cost.

- The scheme must meet the following criteria:

The scheme must ensure that there is equitable share in allocating losses

The scheme must return to the entity to profitability

The losses to be incurred under liquidation must exceed the losses to be incurred under the capital reduction scheme

The existing control structure must be maintained.

. Present debt or liabilities should be settled under the capital reduction scheme

. The scheme must provide adequate working capital. (Any 4 points @ 1.25 = 5 marks)