Nov 2020 Q4 a.

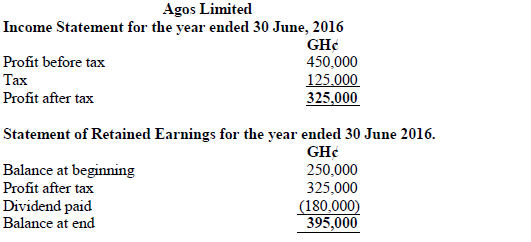

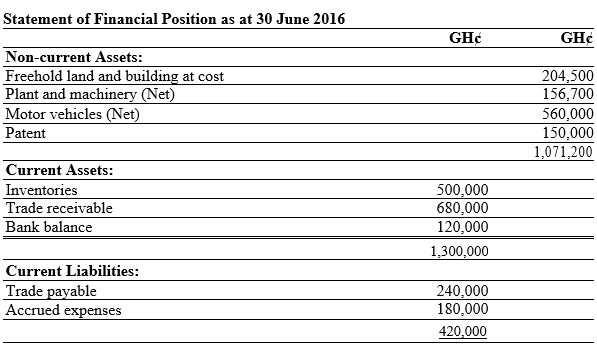

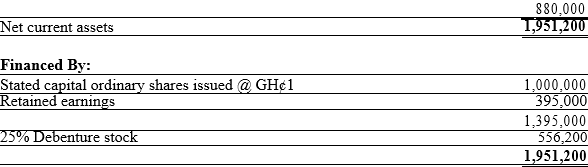

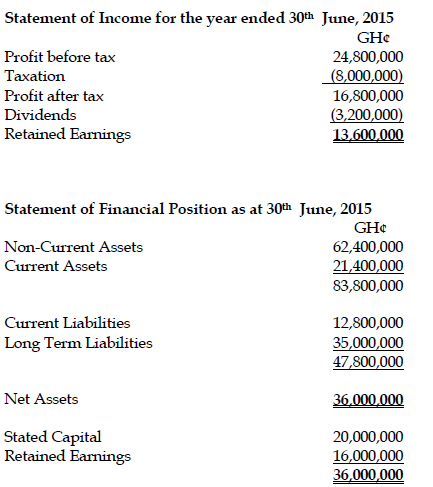

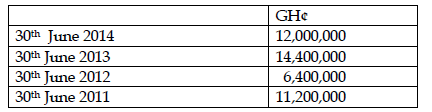

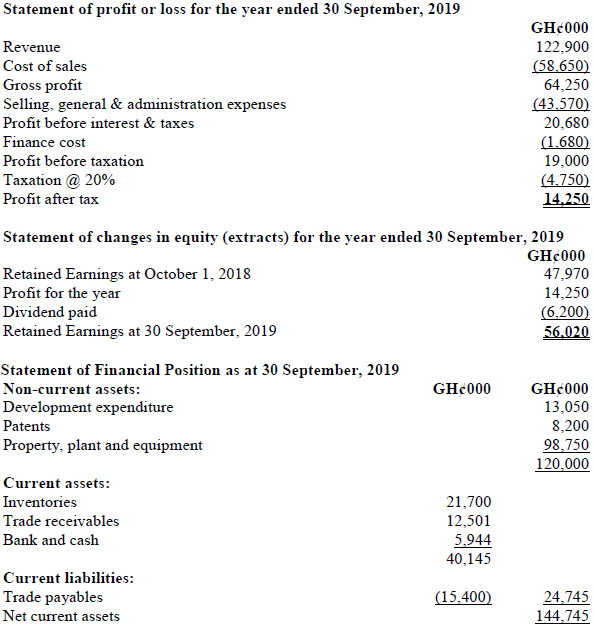

Anidaso Ltd operates in the manufacturing industry in Ghana. The company is in the process of selling some of its shares to the general public in order to raise enough funds to expand its operations. Below are the financial statements of the company:

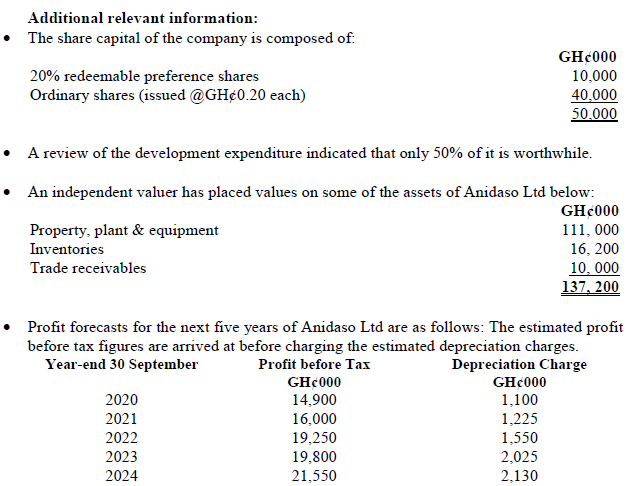

- The patents in the statement of financial position represents a license to produce an improved variety of a product and is expected to generate a pre-tax profit of GH¢10,000 per year for the next five years.

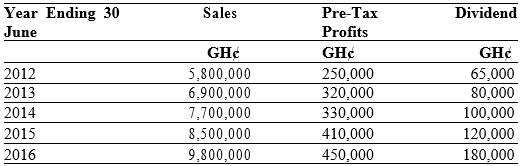

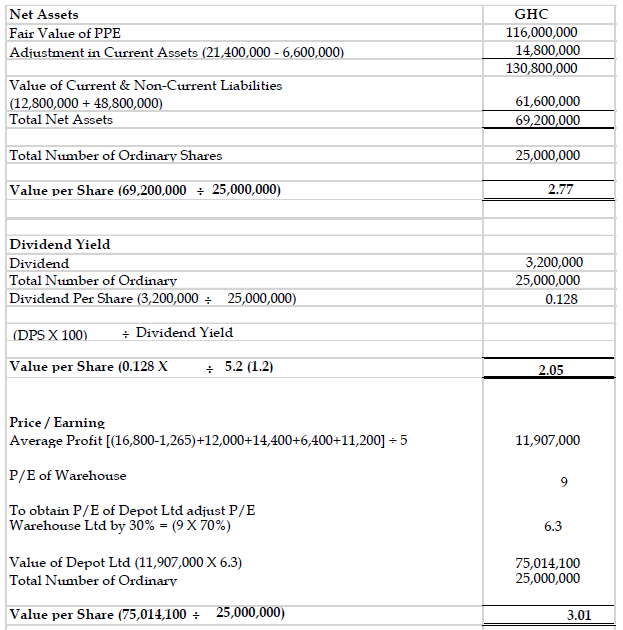

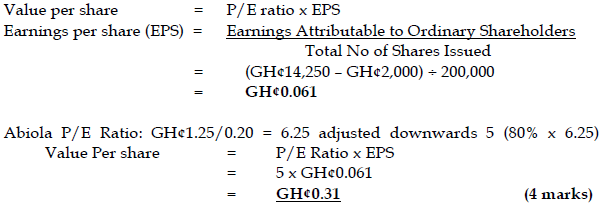

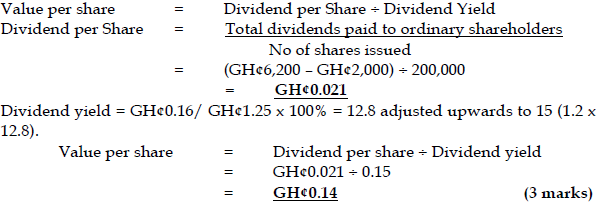

- Abiola Limited is a competitor company listed on the Ghana Stock Exchange and data extracted from its recently published financial statements revealed the following details:

Market capitalisation GH¢1,000,000

Number of ordinary shares 800,000

Earnings per share GH¢0.20

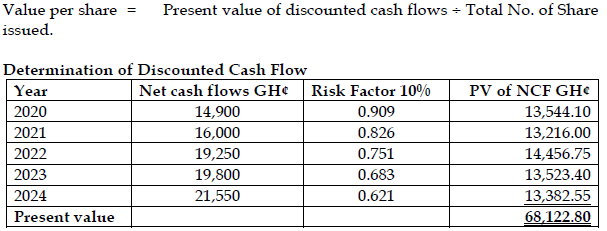

Dividend payout ratio 80% - The cost of capital of Anidaso Ltd is 10%.

Required:

Determine the value to be placed on each share of Anidaso Ltd using the following methods of valuation:

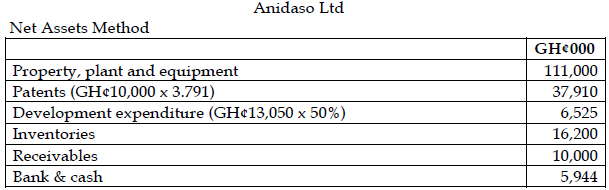

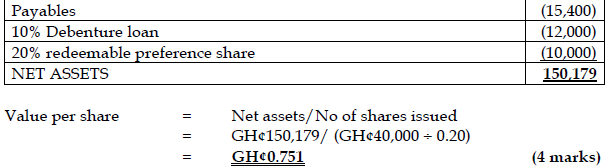

i) Net assets; (4 marks)

View Solution

ii) Price-earnings ratio; (4 marks)

View Solution

iii) Dividend yield; (3 marks)

View Solution

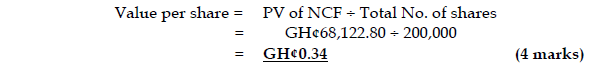

iv) Discounted cash flow. (4 marks)

View Solution