May 2020 Q4 a.

Mamavi is a retail business woman with a chain of shops in Ghana. She commenced business on 1 March 2011, with the business name of Unity Enterprise. She sells health foods, fruits, vegetables and juices.

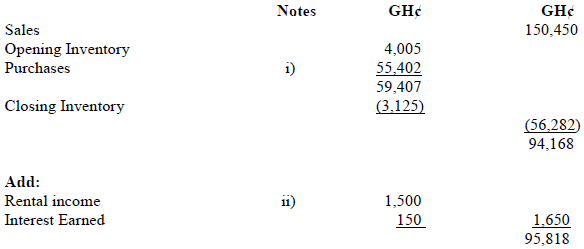

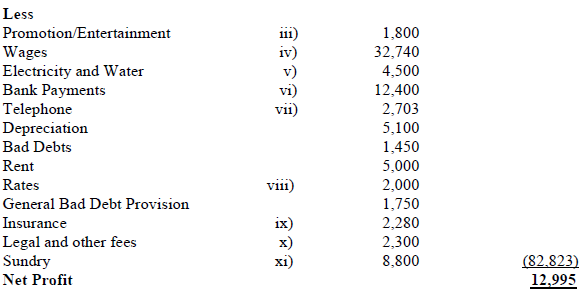

The Enterprise’ profit or loss account for the year ended 31 December 2018 as prepared by the Accountant are reproduced below:

Notes

i) Purchases

The purchases figure includes GH¢2,200 in respect of goods taken by Mamavi for her own use with a mark-up of 25%.

ii) Rental Income

In 2018 Mamavi earned GH¢1,500 for the rent of her holiday home in Ho, Volta Region, for the year.

iii) Promotion/Entertainment GH¢

Golf lessons 600

Christmas party 900

Advertising on Health foods 300

1,800

iv) Wages GH¢

Drawings by Mamavi 12,740

Staff wages 10,000

Paying Baby-Sitter to take care of Mamavi’s daughter 6,500

Tax payment on account for Mamavi 3,500

32,740

v) Electricity and Water

Mamavi pays electricity and water for her home and office, 20% of the cost relates to her

home.

vi) Bank Payments GH¢

Business loan repayments 5,200

Mortgage loan repayments 7,200

12,400

A business loan was taken out to finance the cost of improvements to the store, in particular the juice bars. The interest element included in the loan repayment amounted to GH¢1,750. A mortgage loan was taken out by Mamavi to buy the family a house in Hlefi, Volta Region. The interest element in the loan repayment for the mortgage was GH¢2,670.

vii) Telephone

20% of the telephone costs relate to private use.

viii) Rates

This figure includes GH¢120 in respect of the local property tax for Mamavi’s home. The difference is business rates.

ix) Insurance GH¢

Premises Insurance (Business) 800

General Business Insurance 1,000

Private medical insurance for Mamavi’s children 480

2,280

x) Legal and other fees GH¢

Accountancy Fee 1,200

Court case following a car accident 700

Speeding fines 400

2,300

This court case was as a result of a car hitting Mamavi when she was walking her dog out at night. The car owner claimed Mamavi stepped out in front of him and therefore it was her fault. Mamavi’s Lawyer told her to respond to the allegation because she needed five sessions of physiotherapy to help heal her leg. Mamavi is suing the car owner for her costs.

xi) Sundry GH¢

Painting 1,200

Juicers/Food Processors for shop 5,000

Advertising 600

Lease charges 1,200

Stationery 800

8,800

GH¢700 of the painting cost related to the painting of Mamavi’s private house. The balance related to painting her shop. GH¢1,200 lease charges relate to the leasing of a car for the business.

Required:

Compute Mamavi’s chargeable income for the year ended 31 December 2018. (17 marks)

View Solution

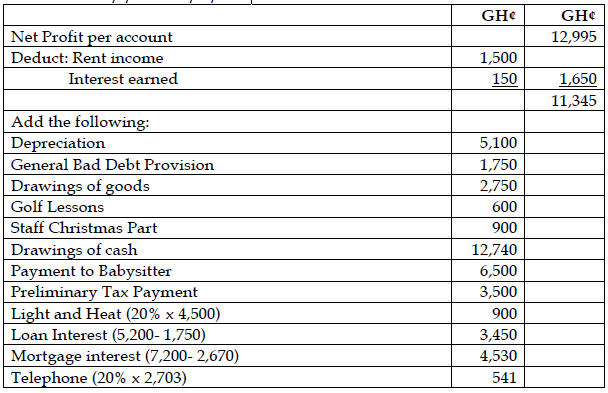

Mamavi

Computation of chargeable Income for the year assessment 2018

Basis Period 1/3/2018 -31/12/2018