Nov 2020 Q3 a.

The following information is relevant to Mandy Ltd (Ghana) a subsidiary of Menkay Incorporated, a company resident in Japan.

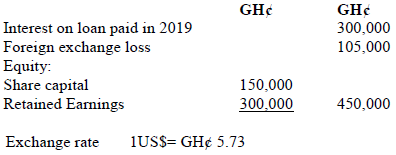

Following Mandy Ltd operational challenges, a loan of US$1,500,000 was secured from its parent company in 2019 year of assessment.

Additional information relevant to Mandy Ltd’s operations:

Required:

Determine the tax implication of the above transaction. (6 marks)

View Solution

Loan Secured: USD 1,500,000

Interest on the loan GH¢300,000

Foreign Exchange loss GH¢105,000

Exchange Rate GH¢5.73 to USD 1

Equity:

Share Capital GH¢ 150,000

Retained Earnings GH¢ 300,000

Total Equity GH¢ 450,000

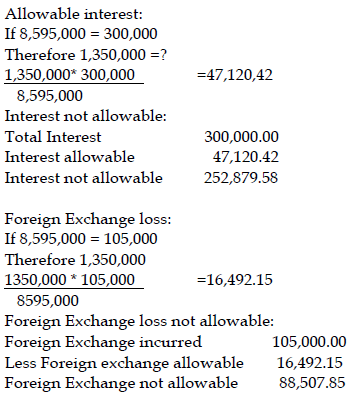

Safe Harbour Rule is Debt: Equity Ratio 3: 1 respectively

Translation of loan into Ghanaian Cedis

USD 1,500,000 x 5.73 =GH¢8,595,000

Allowable debt = 3 times equity

3* 450,000= 1,350,000

Tax implication

- Interest of 8% shall be imposed on 300,000 (8% *300,000) = GH¢ 24,000

- Interest allowable is (300,000-252,879.58) = GH¢ 47120.42

- Foreign Exchange allowable (105,000-88,507.85)= GH¢ 16,492.15

(6 marks evenly spread using ticks)