May 2019 Q5 b.

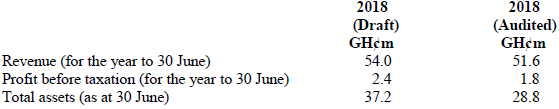

You are the audit manager of Ashiyie Ltd, a private indegenous company that manufactures and retails furniture. Summary draft and audited results show the following:

The following points should be considered in the drafting of the Audit Report.

i) Ashiyie Ltd leases one of its main retail facilities from a partnership controlled by its Chief Executive Officer (CEO). Your review of the lease indicates that it costs Ashiyie about GH¢60,000 more per annum than would normally be expected in an ‘arm’s length’ transaction. Ashiyie refuses to disclose this related-party transaction in the notes to the financial statements for the year ended 30 June 2018.

ii) Ashiyie has one small subsidiary in Rwanda. Restrictions on the repatriation of earnings from this country were introduced in July 2018 and remain in place. As a result, Ashiyie has decided to account for the subsidiary on an equity basis this year. You are satisfied as to the appropriateness of this change and it is fully disclosed in the financial statements.

iii) During the audit, you discovered that inventory valued approximately GH¢1.2 million had been excluded from the financial statements of the company. After discussing this with management, you are satisfied that it was an unintentional oversight. The error was corrected prior to the conclusion of the audit.

Required:

Evaluate the implications of matters (i), (ii) and (iii) for the Audit Report for the year ended 30 June 2018. (10 marks)

View Solution

i) In terms of the amount GH¢60,000 is only 2.5% of the profit before tax and 0.11% of the Revenue so the “Overpayment” can safely be stated to be quantitatively immaterial. However, that is far from the whole story.

Firstly, even if no overpayment arose the entire transaction (of which we are not given the quantum) is a related party transaction and should be disclosed under IAS 24. A matter is considered immaterial under IAS 24 only if it is immaterial to both parties to the transaction. This alone might well be sufficient reason to qualify the audit report on this point.

Secondly, the overpayment could be seen as extra director’s remuneration the consequences of which would be twofold. Firstly, it would need to be disclosed as such under The Companies Acts and secondly it might have tax consequences. Again, these might be quantitatively immaterial but might need to be disclosed because of their nature.

In any case, these transactions and the attitude of the directors towards them bodes ill for our continuing relationship with the client.

ii) This would appear to require no adjustment to the audit report and would appear to have no consequences for our continuing relationship with the client. If this were a very significant subsidiary it might require an emphasis of matter paragraph but since we are told this is a “small subsidiary” this would appear not to be the case.

Depending on how the corresponding figures are shown an “other matter” paragraph might be considered appropriate.

iii) Given that the error was corrected before the financial statements are issued, it clearly has no impact on the audit report in spite of the fact that the issue is clearly material (at 50% of profit before tax and 2.22% of turnover). In terms of our continuing relationship with the client, again there would appear to be no issue but we would want to confirm how the error occurred in the first place and perhaps reassess control risk.