Nov 2019 Q4 a&b

a) In the recent Auditor General’s Report, your organisation has been indicted for mismanagement of public assets contrary to public financial management rules. The auditors found that three (3) Toyota vehicles which have no service potential to the entity (all exceeding 12 years in age) are left at the mercy of the weather without disposing them. At the Public Accounts Committee hearing, members were unhappy with the development and recommended that the entity disposes of the assets immediately in accordance with the provisions of the Public Procurement Act, 2003 (Act 663) as amended by the Public Procurement Amendment Act, 2016 (Act 914). Unfortunately, the Head of the entity seems not to have any clue of how this should be done.

Required:

Write a memo to the Head of the Entity explaining the procedures involved in disposing of the vehicles under the Public Procurement Act 2003 as amended. (6 marks)

View Solution

The procedures involved are as follows:

- Establish a Board of Survey

The authority to dispose of is vested in a Board of Survey. Head of procurement entity shall convene a board of survey comprising representative of the departments with vehicle, unserviceable, obsolete or surplus stores, plant and equipment which shall report on the items and subject to a technical report from them, recommend the best method of disposal after the officer in charge has completed the board of survey form. - Approval of Board of Survey’s recommendation

The board of survey’s recommendation shall be approved by the head of procurement entity and the items shall be disposed of as approved. Note that for items that become unserviceable for reasons other than wear and tear, disposal guidelines issues by the Board of procurement authority. However in the case of the vehicles, they become unserviceable due to wear and tear so this rule does not apply. - Procedures for disposal

Procedure should be carried out based on the recommendations of the Board of Survey. The procedures approved under the Procurement Act 2016 include:

** Transfer to government department or other public institution with or without financial adjustment.

When this procedure is recommended by the BOS, the entity will enter into agreement with another public sector entity to transfer the vehicle to them for a charge or no charge to the receiving entity. However, in the case in question, this method may not be appropriate since the vehicle is completely out of service and giving it to another entity may cause a financial burden to public purse.

** Sale by public tender to the highest bidder, subject to reserve price

When this option is recommended, the entity has to arrange for a public tender and invite tenders for the sale of the vehicle. Under sale by public tender the services of auctioneer is not required.

** Sale by public auction, subject to reserve price

Here a professional Auctioneer in good standing should be appointed by the entity to carry out the disposal on its behalf.

** Destruction, dumping or burying as appropriate. Only appropriate when the vehicle has no use at all.

b) You are the Head of Accounts of a large public hospital. A major component of a critical X-Ray machine is damaged and requires immediate replacement. However, the Head of the Procurement Entity who doubles as the Director of the Hospital is insisting that the procurement should be carried through competitive tendering so as not to incur the wrath of the Auditor General. He lamented “I hate single sourcing because it has too much issues, I don’t want any problem”. Nevertheless, you feel strongly that single sourcing is the most appropriate method of procurement given that the amount involved falls within the threshold authorised by the Public Procurement Act, 2003 (Act 663) as amended by the Public Procurement Amendment Act, 2016 (Act 914).

Required:

As the Chief Accountant, write a memo to the Head of the Entity, justifying the appropriateness of the use of single source method to procure the component of the X-Ray Machine based on the Public Procurement Act, 2003 (Act 663) as amended by the Public Procurement Amendment Act, 2016 (Act 914). (4 marks)

View Solution

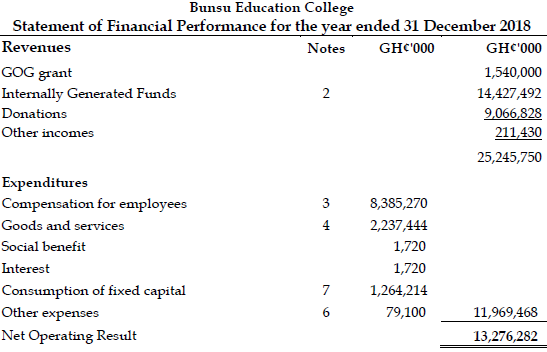

Name of Hospital

Memo

![]()

. Subject: Procurement of X-Ray Component

As we have discussed at the just ended management meeting concerning the above subject matter, I wish to provide you with some information to support our use of single source procurement for the X-Ray equipment, despite your strong reservation for it at the meeting.

I agree that the use of single source procurement raises questions because it is a high-risk method of procurement. However, the Public Procurement Act 2016 (Amendment), Act 914 has permitted the use of single source procurement under certain exceptional circumstances. Under the law single source procurement is allowed when:

i) Goods or services are only available from a single supplier or the supplier has exclusive right.

ii) Urgent need for the GWS not caused by dilatory conduct of the procurement entity, making it impracticable to use competitive methods

iii) Occurrence of catastrophic even making the use of competitive method impracticable.

iv) Contract for research, experiment, study or development not for commercial purpose.

v) Procurement has implications for National security

vi) Where additional supplies need to be procured from a supplier who had made supply in the immediate to ensure standardization and compatibility with existing goods or equipment.

Our use of single source procurement for the procurement of the X-Ray component is justifiable on the ground of circumstance (i) and (ii) above. All that we have to do is to apply to the public procurement authority for approval.

Kindly consider this fact.

Thank you

Johnson