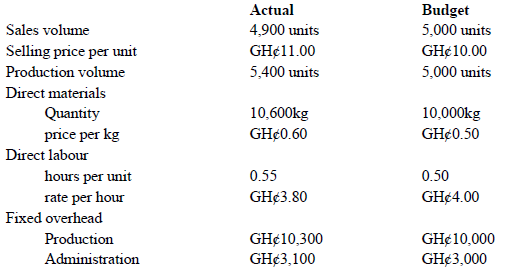

Nov 2017 Q1 a.

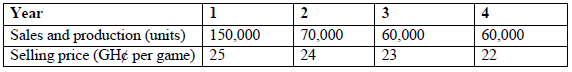

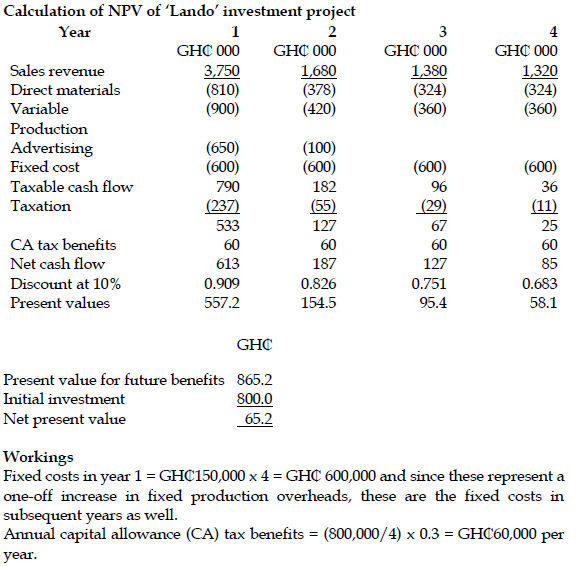

Agyasco Ltd, a software company has developed a new game “Lando” which it plans to launch in the near future. Sales volumes, production volumes and selling prices for “Lando” over its four-year life are expected to be as follows:

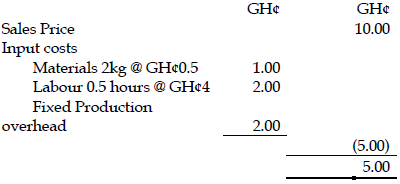

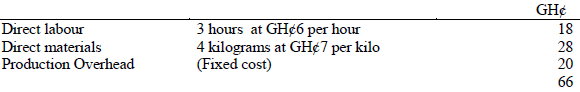

Financial information on “Lando” for the first year of production is as follows:

Direct material cost GH¢5.4 per game

Other variable production cost GH¢6.00 per game

Fixed costs GH¢4.00 per game.

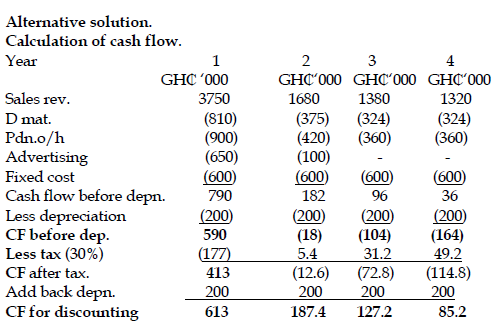

Advertising costs to simulate demand are expected to be GH¢650,000 in the first year of production and GH¢100,000 in the second year of production. No advertising costs are expected in the third and fourth years of production. Fixed costs represent incremental cash fixed production overheads. “Lando” will be produced on a new production machine costing GH¢800,000. Although this production machine is expected to have a useful life of up to 10 years, Government legislation allows Agyasco Ltd to claim the capital cost of the machine against the manufacture of a single product. Capital allowances will therefore be claimed on a straight-line basis over four years.

Agyasco Ltd pays tax on profit at a rate of 30% per annum and tax liabilities are settled in the year in which they arise. Agyasco Ltd uses an after-tax discount rate of 10% when appraising new capital investments. Ignore inflation.

Required:

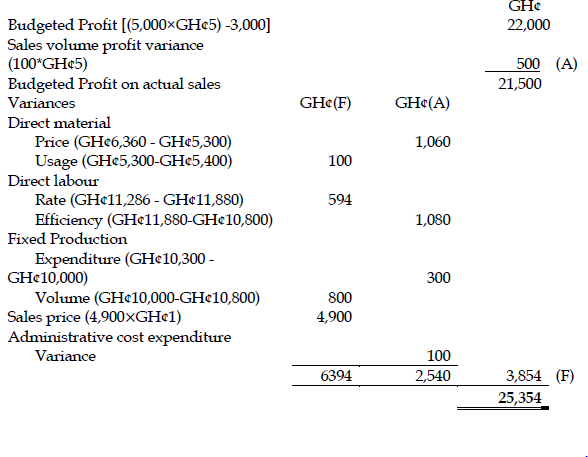

Calculate the net present value of the proposed investment and comment on your findings. (10 marks)

View Solution

(8 marks evenly spread using ticks)

Comment:

The net present value of GH₵65,200 is positive and the investment can therefore be recommended on financial grounds. However, it should be noted that the positive net present value depends heavily on sales in the first year. In fact, sensitivity analysis shows that a decrease of 5% in the first year sales will result in a zero net present value. (Note: you are not expected to conduct a sensitivity analysis) (2 marks)