Nov 2017 Q5 c.

Zealow Ltd has just introduced a new standard marginal costing system to assist in the planning and control of the production activities for the single product which the company manufacturers. “The Stand”, the system became operational on 1 March 2017.

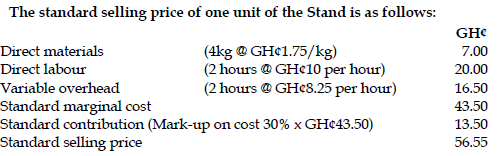

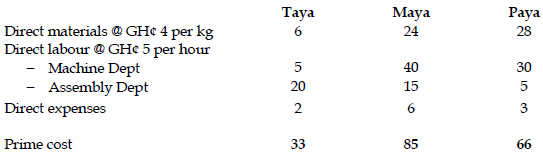

The Management Accountant has consulted with the Senior Engineer and they have agreed the following standard specifications to manufacture one unit of the product known as “The Stand”.

Direct materials 4kg @ GH¢1.75 per kg

Direct labour 2 hours @ GH¢10 per hour

Variable overhead 2 hours @ GH¢8.25 per hour

The Marketing Director has advised that in Zealow Ltd’s industry, the budgeted selling price is normally calculated to achieve a mark up to 30% on cost.

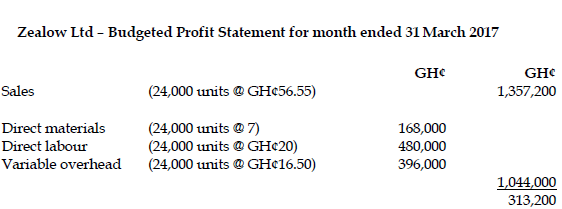

The budgeted level of production and sales activity has been agreed with both production managers and sales staff at 24,000 units per month.

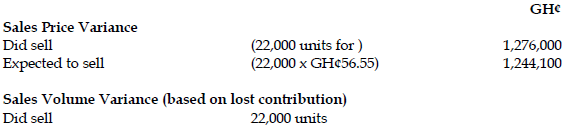

The actual results for the month of March 2017 are as follows:

Sales 22,000 units yielding a total revenue of GH¢1,276,000

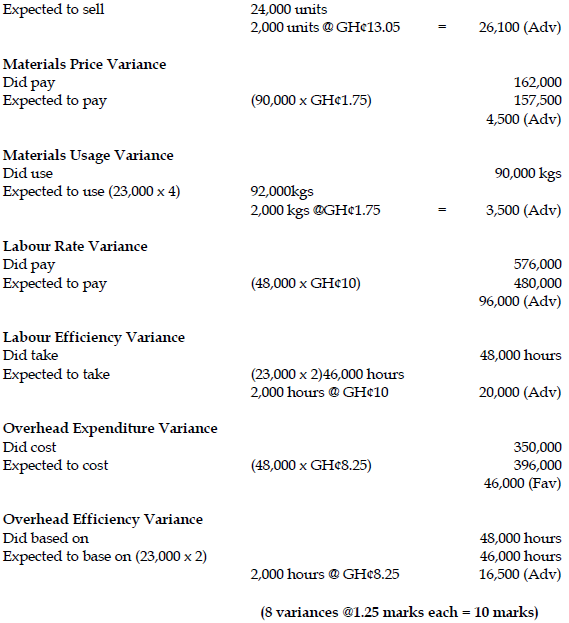

Production 23,000 units

Direct Materials 90,000 kgs at a cost of GH¢162,000

Direct labour 48,000 hours at a cost of GH¢576,000

Variable overhead GH¢350,000

Required:

Zealow Ltd uses a standard marginal costing system and therefore fixed costs have been ignored in the calculations shown above. Assuming that the fixed costs for the company are estimated to be GH¢1,879,200 per annum, calculate the monthly sales in both units and value which will be required to break-even and estimate the margin of safety, based on the current budget levels. (3 marks)

View Solution

[ Refer to Standard Costing Question: Nov 2017 Q5a ]

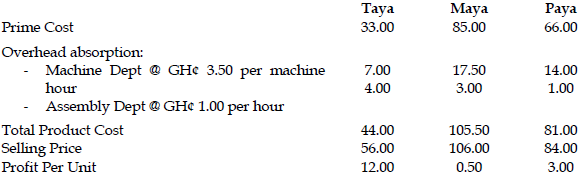

Contribution per unit 13.05

Contribution to sales ratio 13.05/56.55=0.2307.

Breakeven point in units = 156,000/13.05 = 12,000

Breakeven in sales= 12,000×56.55=GH¢ 678,600 or 156,000/.2307.

Margin of safety 24,000-12,000/24,000= 50% or 12,000 units.