May 2021 Q4 a & b

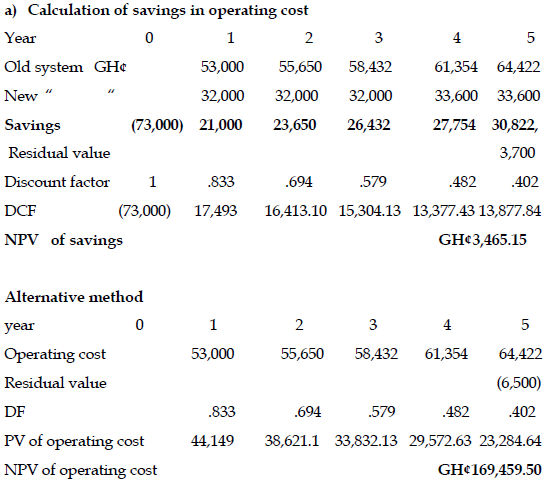

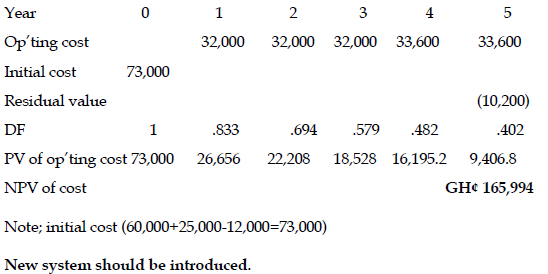

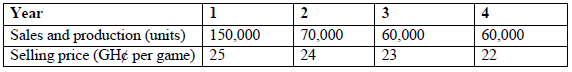

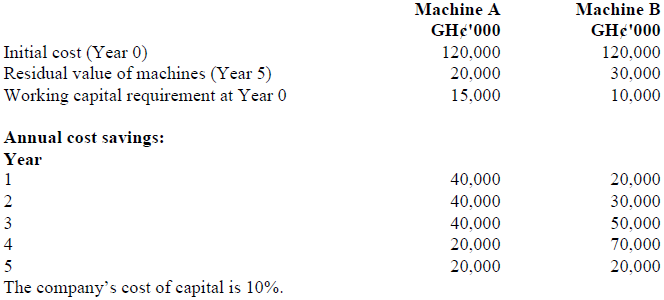

Oseikrom Ventures is considering minimising its production cost through automation of its production system. Two machines are being considered to save cost. The estimated data for the two machines available on the market are as follows:

Required:

a) Using the following methods, which machine should be selected?

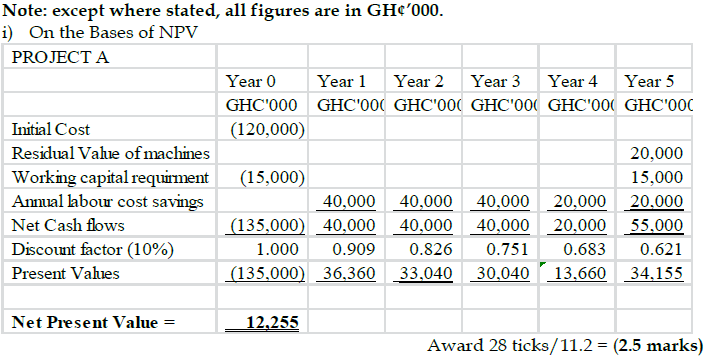

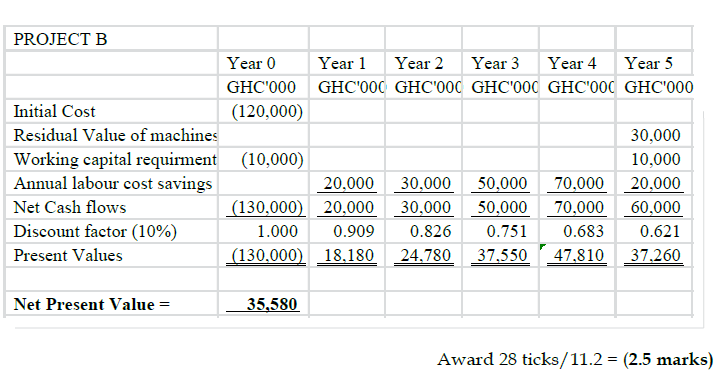

i) Net Present Value (8 marks)

View Solution

Decision: Since both machines have positive NPVs, either would be worthwhile buying. But, Machine B shows itself to be more significantly desirable from an economic viewpoint than Machine A; hence once the two Projects or Machines are mutually exclusive, Project B should be selected. (3 marks)

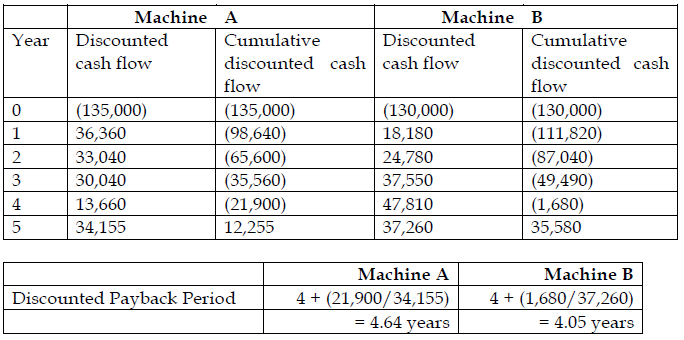

ii) Discounted Payback Period (4 marks)

View Solution

Decision: Since Machine B has a shorter period to pay back the amount invested, Machine B should be selected ahead of Machine A.

b) Identify and explain TWO (2) advantages of the Net Present Value technique. (3 marks)

View Solution

- It uses cash flow rather than profit. Hence it is an objective measure

- Takes account of the time value of money

- Easy to identify the size of the addition to shareholders’ wealth

- Accounts for investment size