Nov 2020 Q5 c.

Plyway Ltd (Plyway) was founded in 2001 and operates in the logistics and supply chain management sector. It prepares financial statements in accordance with International Financial Reporting Standards (IFRSs) up to 31 December each year.

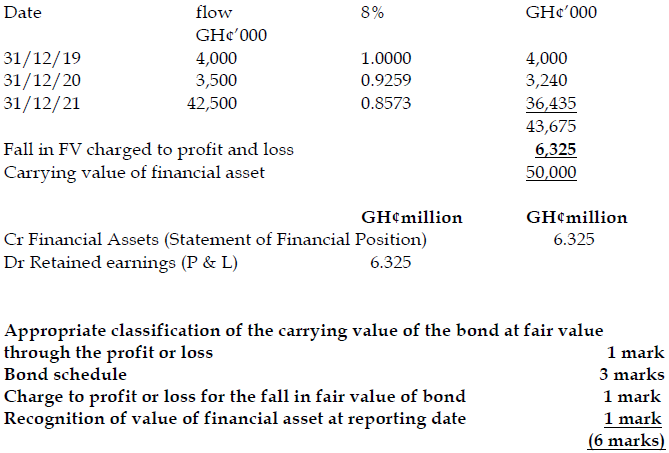

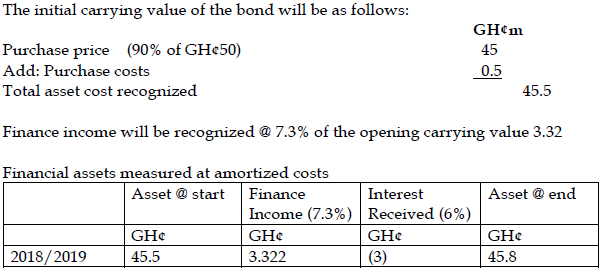

On 1 January 2017, Plyway purchased a GH¢50 million social bond from a renowned finance house. The bond pays a respectable 6% annual interest, which is also the effective rate of interest payable on 31 December. Plyway has classified the bond at fair value through profit or loss.

At 31 December 2019, the carrying value of the bond is GH¢50 million but there are reliable reports within the financial sector that the finance house has financial difficulties. The market interest is now 8%. The cash flows in respect of the bond are as follows:

Year Amount GH¢m

31 December 2019 4

31 December 2020 3.5

31 December 2021 42.5

Interest received for the accounting year ended 31 December 2019 has already been correctly accounted for.

Required:

In accordance with IFRS 9: Financial Instruments, show with appropriate calculations, the accounting entries required to record the transaction above in the financial statements of Plyway for the year ended 31 December 2019. (6 marks)

View Solution

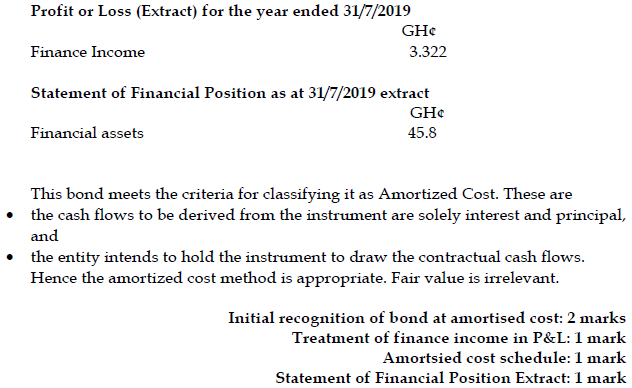

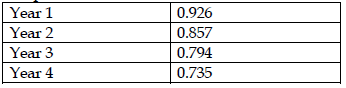

As the bond is classified at fair value through the profit and loss, the fair value can be calculated by discounting expected future cash flows using the current market interest rate. Any change in fair value is taken to the profit and loss accounting for the current year.