Nov 2016 Q2 a.

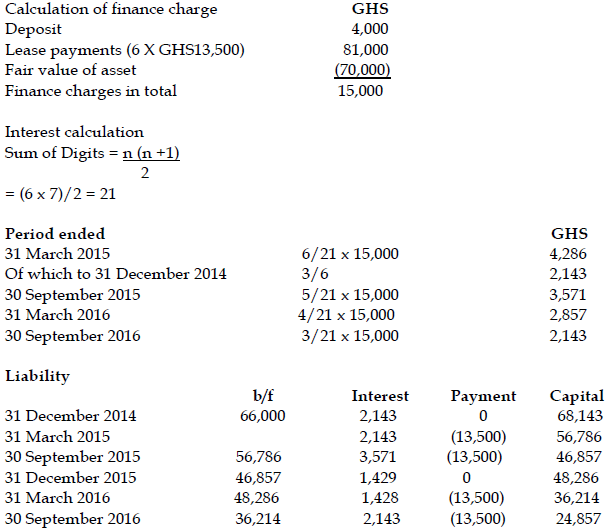

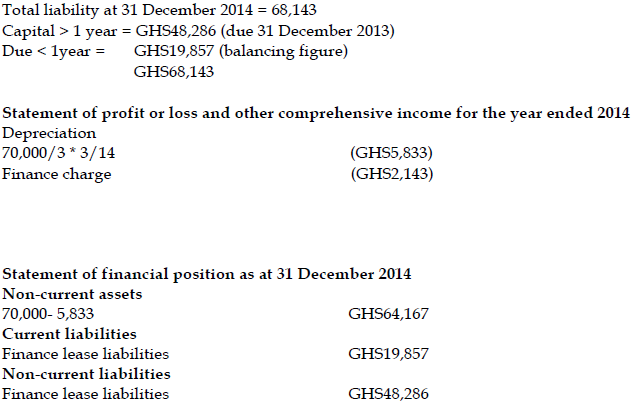

You are employed as the Financial Accountant for Asokwa Ltd. Asokwa Ltd leased a new piece of equipment from Amakom Ltd for three years commencing on 30 September 2014. The fair value of the equipment is GH¢70,000. A deposit of GH¢4,000 was payable on 30 September 2014 followed by six half-yearly payments of GH¢13,500, payable in arrears, and commencing on 31 March 2015. Asokwa Ltd allocates finance charges on a sum of the period digits basis.

Required:

Prepare financial statement extracts showing how the lease transaction of Asokwa Ltd should be treated for the year ended 31 December 2014. (6 marks)

View Solution