May 2018 Q2 a(i)

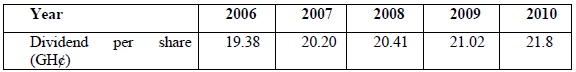

The Finance Director of Vista Hotel has heard that the market value of the company will increase if the weighted average cost of capital of the company is decreased. The company, which is listed on a stock exchange, has 100 million shares in issue and the current ex div ordinary share price is GH¢2·50 per share. Vista Hotel also has in issue bonds with a book value of GH¢60 million and their current ex interest market price is GH¢104 per GH¢100 bond. The current after-tax cost of debt of Vista Hotel is 7% and the tax rate is 30%. The recent dividends per share of the company are as follows:

The Finance Director proposes to decrease the weighted average cost of capital of Vista Hotel and hence increase its market value, by issuing GH¢40 million of bonds at their par value of GH¢100 per bond. These bonds would pay annual interest of 8% before tax and would be redeemed at a 5% premium to par after 10 years.

Required:

i) Determine the cost of equity capital of the company. (4 marks)

View Solution

Geometric average dividend growth rate = (21·8/19·38)0.25 – 1 = 0·0298 or 3%

Using the dividend growth model, ke = 0·03 + ((21·8 x 1·03)/2.5) = 0·03 + 8.9816= 9.0116 x 100% = 901.16%

Market values of equity and debt.

Market value of equity = Ve = 100m x 2·50 = GH¢250 million

Market value of bonds = Vd = 60m x (104/100) = GH¢62·4 million

Total market value = Ve + Vd = 250 + 62·4 = GH¢312·4 million